Small Business Loans for Veterans

Reduced-interest rate business loans for veteran entrepreneurs and their family members

With your military experience, you’ve learned to be disciplined, resourceful, bold and determined. These traits brought you success during your military service, and have also served you well as you start and run your own business venture. Learn more about how Pursuit’s veterans business loans can benefit your small business.

When your veteran-owned business needs financing to keep growing, you can count on a Pursuit veteran business loan. You’ll be working with a lender with extensive experience supporting veteran entrepreneurs, and receive one-on-one support throughout the application process and beyond. Pursuit proudly services those who served–unlock your benefits now!

Reduced, fixed interest rate

For active service members, veterans and their immediate family members

Easy to use online platform

About small business loans for veterans

As a veteran, active service member, or an immediate family member of one, you qualify to receive a reduced, fixed interest rate for financing up to $250,000. For loan amounts up to $100,000, you’ll receive a decision within two business days and funding within a week. And with no prepayment penalty, you can borrow now and pay it back as quickly as you’d like. Veterans business loans can be used for nearly any business need, ranging from working capital to technology upgrades.

Program Details

- Loan amount: $10,000 to $250,000*

- Fast turnaround: loans up to $100,000 can be decisioned within 2 business days.

- Interest rate: fixed at 6.75%

- Term: 6 years

- Fees: 2.5% in total closing fees, which will be financed into your loan

*Loans greater than $100,000 may require 2 to 4 weeks to decision and additional collateral.

Is a veteran-owned business loan right for me?

If you’re an active service member, veteran, or immediate family member of one, you can take advantage of our veteran business loans. To be considered for automatic approval, you must meet the following requirements:

- Business must be at least 20% owned by an individual with a veteran status or their family member

- Business has been in operation for two or more years

- Two or more employees

- Break-even or positive cash-flow

- Owner has a personal credit score of 640 or higher

- Business earns more than $120,000 in annual revenue

- No liens or judgments filed within the last 3 years

- No history of bankruptcies for you or your business

If you don’t meet some of these requirements, you can still apply for a loan with Pursuit. Submit your application online and you’ll work with our team to determine which loan option will best fit your needs.

What can this loan be used for?

You can use a veterans business loans for nearly any business need. Veteran entrepreneurs have taken advantage of the program’s low interest rate to support costs for new contracts, refinance high-cost debt, expand their staffing, and more. In particular the program can help you access funding for:

- Working capital

- Purchase equipment

- Technology upgrades

- Debt refinance

- Leasehold improvements

- And more

You and your family members have made sacrifices and tough decisions as you serve your country, and we’re honored to be able to serve you in return. We’ve helped many veteran entrepreneurs and their family members grow their business through financing, and we look forward to helping you reach higher with you business too.

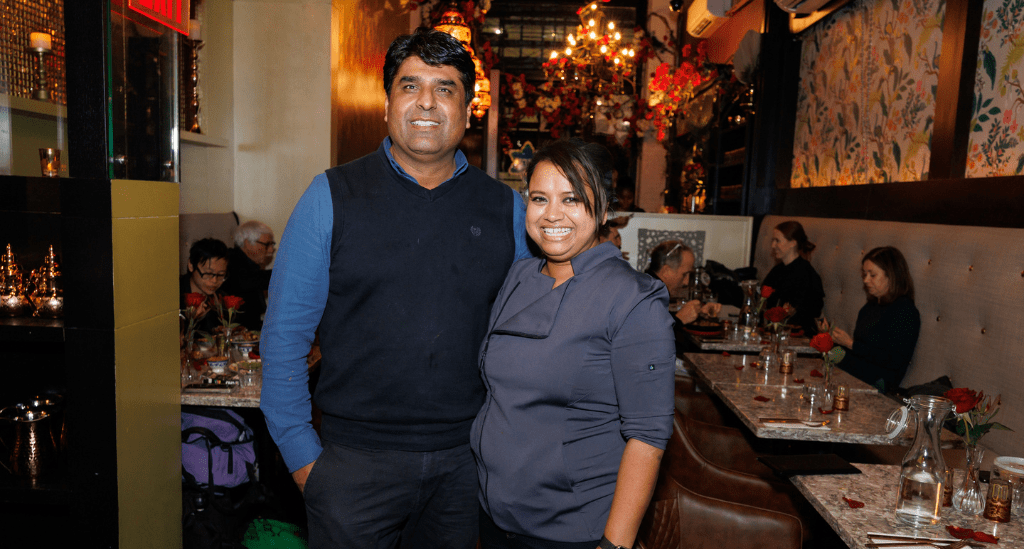

Learn more about how veteran entrepreneurs have met their goals with a loan through Pursuit.

The veteran-owned business loan program is administered by Pursuit Community Finance

Get started

Ready to fund your dream? Learn more about our small business loan application process and get started today.