Aneesa Waheed, owner of Tara Kitchen, says that creating an international conglomerate wasn’t the plan when she opened a weekend food stand in Schenectady, NY, in 2009. “Although I loved to cook, I had no training or restaurant experience, I just took advantage of an opportunity!” she admits.

In 2022, she opened her fifth Tara Kitchen restaurant, located in Manhattan’s Tribeca neighborhood. With financing through Pursuit and the veteran loan program, she overcame an enormous challenge. Now, she’s got her sights set on bringing Tara Kitchen to locations around the world.

Leveraging an opportunity

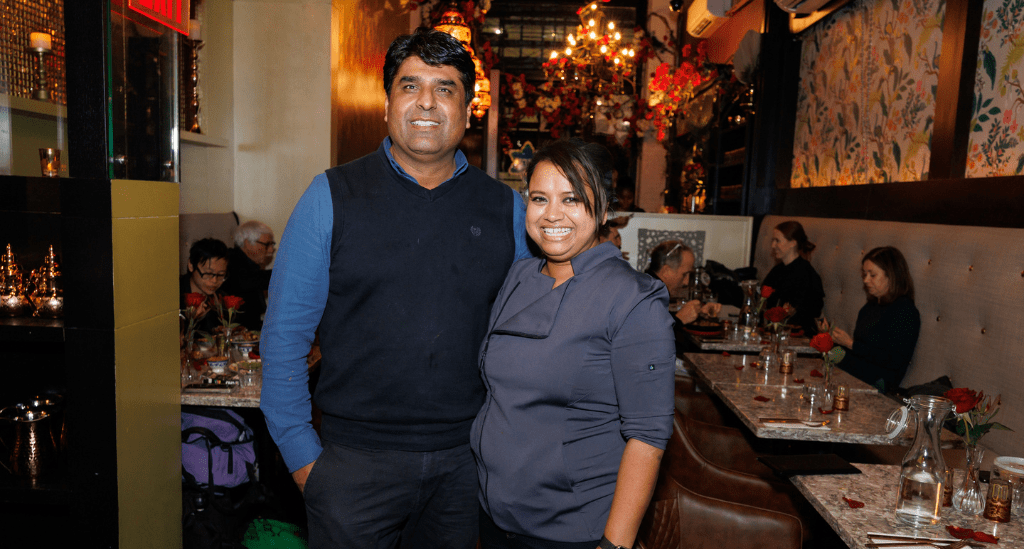

Aneesa and her husband, Muntasim Shoaib, met in Morocco. Soon after, they were married and living in upstate New York, close to Aneesa’s family. Together, they opened a retail shop that sold imported goods.

When the management of a nearby makers’ market approached them about opening a food business there, Aneesa jumped at the chance. “Because it was a makers’ market, we couldn’t offer the imported foods that we sold in our shop. So, we could only sell food if we made it ourselves,” she explains.

Initially, they cooked the Indian and Pakistani foods that they knew best from their family heritages. But over time, they realized that the Moroccan food that they loved and cooked at home would be easier, delicious, and unlike anything else available in the area – particularly tagines, which are stews with spices like cumin, coriander, and paprika, dried fruits, different proteins, lots of vegetables, herbs, and more.

“It’s very hard to find true Moroccan food, so we saw an opportunity to cook what we love,” Aneesa says. Their idea was spot-on, with long lines of hungry and happy customers clamoring for their Moroccan fare each week.

Growing beyond a home base

In 2012, after three years of honing recipes, Aneesa was ready to open a brick-and-mortar restaurant in Schenectady, which was an instant hit. The two continued to learn the restaurant business, including developing processes and recipes that optimized production and quality and reduced the waste that dooms many restaurants. In the process, they realized they’d created a formula for success that they could duplicate at additional locations.

They opened a location in Troy in 2017, Guilderland in 2020, and Wildwood, NJ, in 2021.

About learning to run a restaurant, Aneesa says, “I learned by doing, on the fly, and by reading books and talking to people, searching the internet, and going to lots of small business associations and SCORE meetings. There’s so much incredible information available, as long as you do the work of accessing it.”

She also explains that their first daughter was just eight months old and she had just learned that she was pregnant with their second daughter as they opened their first location. “I think that having a partner who supports your work and goals is so important for success, whether you’re partners in business or life or both. I’m grateful that I do,” she says. “And our whole team is terrific, everyone pitches in and is willing to take on different responsibilities, and that’s key to our success, too.” Today, Tara Kitchen employs about 50 people between five locations.

A financing solution through Pursuit

When Aneesa decided that the next step was to open a Tara Kitchen in Manhattan, she focused on Tribeca and initially self-funded the venture, which opened in 2022. But when an unforeseen and expensive problem arose, she knew she needed a business loan to help. The hood in the restaurant’s commercial kitchen wasn’t just broken – there were internal structural issues that pushed its replacement cost to $100,000.

“It was heartbreaking, but we just had to move forward. Several years ago, when we first opened our shop in Schenectady, I got to know Keri Pratico (senior business development officer at Pursuit),” Aneesa says. “We’d stayed in touch over the years and I didn’t hesitate to contact her, because I really needed help.”

“When I contacted Keri and Pursuit, I learned that I qualified for Pursuit’s veteran loan program because my brother is a veteran. That was a huge help, because the terms for the program are really great for borrowers,” Aneesa explains.

About the process, Aneesa says, “It was a very quick process, not more than two weeks from start to finish.” She continues, saying, “Getting the loan is huge, of course, but what I love about Pursuit is the extra support you get. Pursuit is so invested in small business owners and our success, including connecting us to resources and people who can help. The whole Pursuit team is really true to the mission.”

Gearing up for continued growth

Aneesa has come a long way since the makers’ market, earning “40 Under 40” recognition, several awards, and features on several Food TV Network shows including Beat Bobby Flay, Kitchen Crash and Guy Fieri’s Grocery Games. And plans are in the works for additional locations in New York City and beyond – in fact, Aneesa’s at work on a location in Hyderabad, India, that she’s aiming to open in October 2023.

“Looking back, we were just scraping by for the first five years or so, working 10-14 hours a day, and we didn’t have any breathing room until about eight years in. Now, with the Tribeca location, it’s a whole new learning experience again,” Aneesa says. “And after we conquer New York City, we’ll be ready to take on the world.”

Aneesa says that if she needs financing again, she’ll come back to Pursuit. “The loan and the efficiency of the process are incomparable, and there’s also a huge value-add from the additional support that Pursuit provides. If I need another loan, Pursuit will be my first call.”

Pursuit supports small business success

With more than 15 loan options and a business line of credit for small businesses in Connecticut, New York, New Jersey and Pennsylvania, Pursuit helps entrepreneurs get the funding you need to grow and thrive. To explore SBA loan programs, veteran loan programs and other funding options, visit our website today. Then, contact us to learn more about how we can help you.