New York State Small Business Loans

A Small Business Lender with New York State Roots

Pursuit has worked with thousands of New York State entrepreneurs to find a funding solution custom-fit for their businesses. Founded in New York State in 1955, Pursuit has a deep history serving businesses throughout the Empire State at every stage of their business journey.

Your great idea matched with a New York business loan through Pursuit is the key to achieving your business dreams.

Pursuit is approved to offer SBA loan products in New York State under SBA’s Preferred Lenders Program & SBA Express Program.

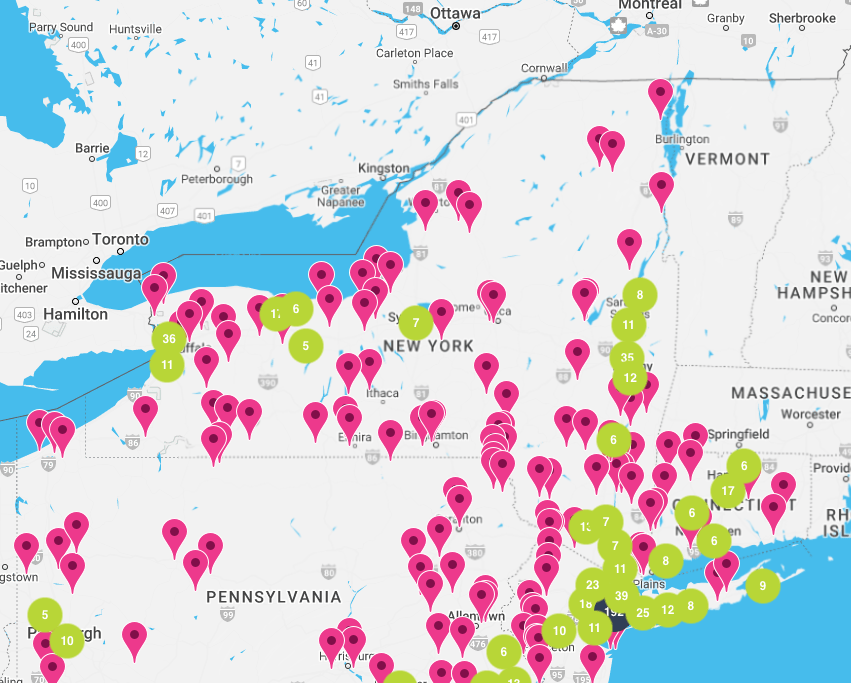

Funding Business Across New York State

As a leading small business lender in New York State, we’re proud to play a small part in your success. You’ll find small business loans in New York for a variety of uses – startups, inventory, working capital, commercial real estate, acquisitions, and more.

From Buffalo to Binghamton, Albany to the Adirondacks, Rochester to Westchester, New York City to Long Island and everywhere in between, if you own a small business in New York State you’ll find opportunities with Pursuit.

- "Thanks to the financing we received from Pursuit, now we’ve got our dream bakeshop and café."

- "The Main Street Capital Loan Fund offers financing for new entrepreneurs and that truly sets it apart."

- “Once again, Pursuit was great,” Dorthy says. “They ensured we understood everything about the loan and the process.”

Business Loan Programs in New York State

Small Business Line of Credit

Small Business Line of Credit

Frequently Asked Questions

Each loan program has its own set of qualification criteria, so the first step is knowing what’s required for the New York State program that best fits your needs. Talk to your lender about what you’ll need to have ready to show that you’re eligible for the program and meet their criteria. Some general areas most lenders will review include your personal credit score, how long you’ve been in business, your annual revenues, and your cashflow, among other criteria.

Yes! New York State has many programs available to specifically to New York-based businesses. Right now, you could apply for the New York Forward Loan Fund 2, which is available to all business owners in the state, or you could check with your local economic development office or chamber of commerce for programs specifically-made for businesses in your area.

Absolutely! While startups might be riskier ventures for more conventional financing, programs like the SBA 7(a) program have helped numerous New York State entrepreneurs launch their businesses.

We’re so glad you asked! Pursuit is one of many alternative small business lenders in New York State. We offer SBA loan programs as well as community lending options with more flexible criteria. You can also find responsible alternative lenders in New York by searching for Community Development Financial institutions (CDFIs), or by getting a referral from your commercial bank.

With any business loan application, you want to start preparing before you actually need the financing and submit a complete application when you’re ready. Include all required documentation and have a plan for how you’ll use the money when you receive it. This shows potential lenders that you’ve done your research and have a plan for the funds that sets your business up for long-term success.