Connecticut Small Business Loans

A Small State with Big Opportunities

They say that Connecticut has eight distinct regions, but we say that it’s simply one great state for small businesses. Pursuit is a leading small business lender in Connecticut and we’re ready to help you get the funding you need to succeed.

According to the U.S. Small Business Administration (SBA), 97% of Connecticut’s businesses have fewer than 500 employees, which shows how important the small business community is to the Constitution State. Whether you’re a lifelong Connecticut resident launching or expanding your business, or you want to relocate your business to CT, Pursuit has loan options for you!

Pursuit is approved to offer SBA loan products in Connecticut under SBA’s Preferred Lenders Program & SBA Express Program.

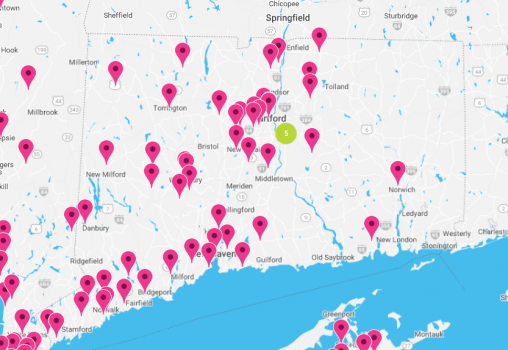

Connecticut businesses with funding from Pursuit since FY2023.

Funding Business Across Connecticut

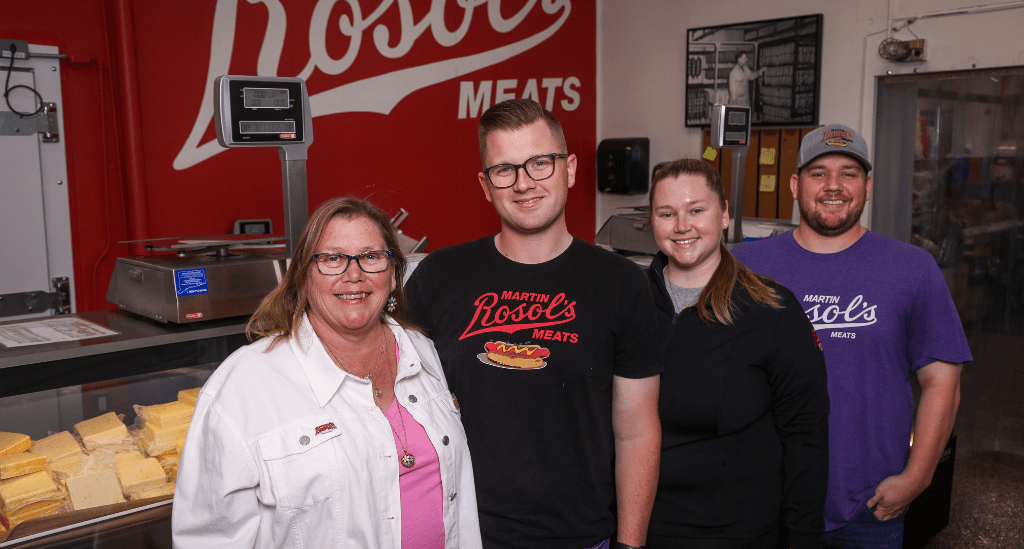

From Bridgeport to Hartford, and the famed pizzerias of New Haven, Pursuit has worked with Connecticut small businesses in a variety of industries and stages.

You’ll find small business loan options for working capital, inventory, equipment, and so much more, plus advisory services that can take your business higher. How will you use your Pursuit loan?

- "The loan process was seamless and easy, and my Pursuit team was great."

- "We wanted to invest in the business and the Boost Fund offered a loan with a good rate, so we went for it.”

- "The financing terms were great, but it was our Pursuit team that made the experience excellent, from start to finish.”

Business Loan Programs in Connecticut

CT Small Business Boost Fund

SBA 504 Refinance

Small Business Line of Credit

Small Business Line of Credit

Frequently Asked Questions

You’ll find loan programs for nearly any need in Connecticut, from SBA loans to more traditional financing options. One of the most attractive loan programs in the state is the CT Small Business Boost Fund, which offers up to $500,000 in financing at a fixed rate of 4.5%. If your CT-based business has been in operation for at least one year, with annual gross revenues of less than $8 million and 100 or fewer full-time employees, you could be a good fit for this program!

Document requirements vary by loan program, you’ll need the following for most programs:

- Your most recent two years of filed personal and business tax returns

- Interim year-to-date income statement for the current year – Schedule of ownership or beneficial ownership forms for all owners

- Copy of your driver’s license or other photo ID for all owners

- A valid Connecticut operating license

Other documents may be requested as needed, so be sure to check with your lender throughout the application process to confirm you’ve submitted everything needed.

It depends. There are varying requirements for each program and some can make exceptions to credit score requirements. That being said, you’ll want to work on improving your credit score before you applying for a small business loan to improve your approval odds and get the best terms possible. Be wary of loan offers for low credit scores that seem too good to be true. That could be a sign of a predatory lender who could cost you more money in the long term.

Yes! While Pursuit can offer support and advice while you’re seeking a loan, there are many organizations that can also offer this support. You can reach out to your local Small Business Development Center (SBDC), the Women’s Business Development Council, or the Minority Construction Council for advice and support. You can also contact your local chamber of commerce or industry association for more resources.