Pennsylvania Small Business Loans

Your Key to Success in the Keystone State

Pursuit works with Pennsylvania small business owners in every stage to get the financing and resources to reach higher and grow.

With an entrepreneurial legacy as solid as America, today, Pennsylvania is emerging as a leader in education, innovation, healthcare, technology, and advanced agriculture and manufacturing. There are endless opportunities for entrepreneurs here, given PA’s prime location between the Great Lakes and the Atlantic seaboard, along with its affordability.

Whether you’re launching your business, expanding an existing operation, or relocating your venture to Pennsylvania, Pursuit has loan options that support every aspect of your success.

Pursuit is approved to offer SBA loan products in Pennsylvania under SBA’s Preferred Lenders Program & SBA Express Program.

Pennsylvania businesses with funding from Pursuit since FY2023.

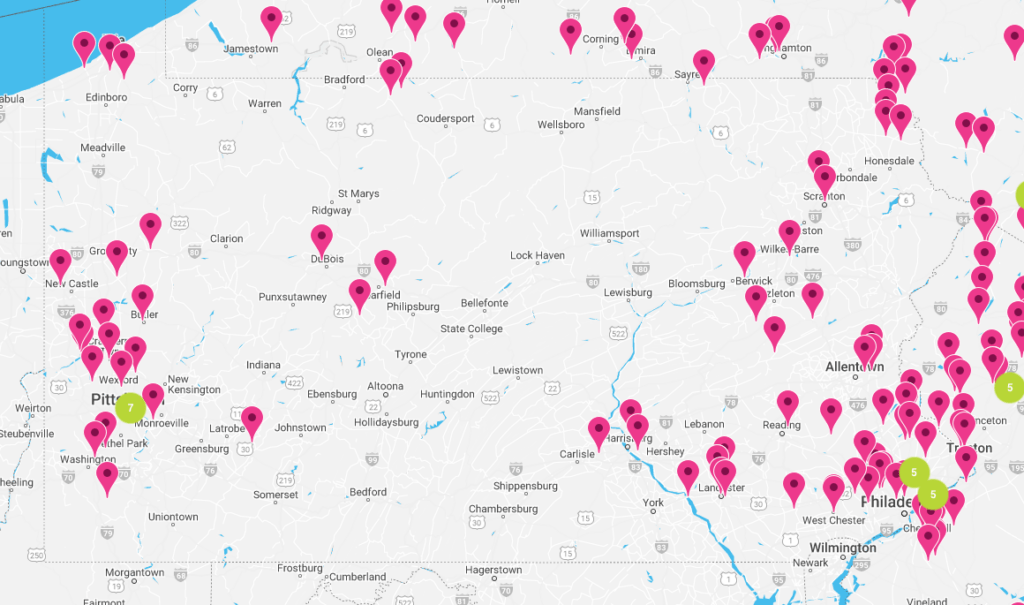

Funding Business Across Pennsylvania

Pursuit is proud to work with business owners throughout Pennsylvania as they chase their dreams. We offer small business loans in PA for nearly any use – you can work with us to start your business, purchase owner-occupied commercial real estate, boost your working capital, and so much more.

From Pittsburgh to State College, and Philadelphia to the Lehigh Valley, Pursuit has Pennsylvania small business loans to keep you moving forward.

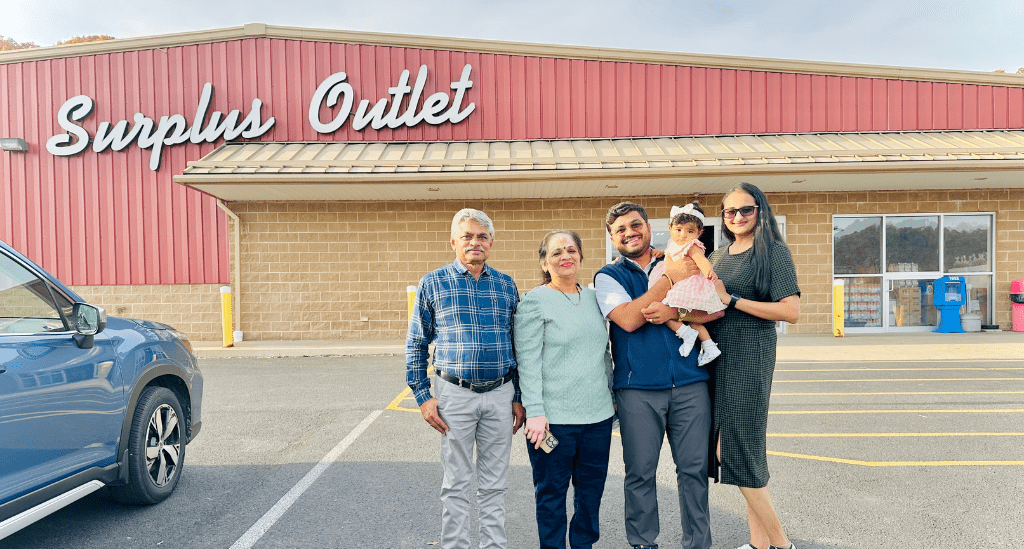

- “Pursuit’s help was essential not only for the loan, but also because my team was determined to make it work.”

- "Our Pursuit team and bank were responsive and great to work with on our SBA 504 loan."

- "Financing from Pursuit has given us a solid financial foundation and made our expansion possible."