Bridge to Success MWBE Contract Financing Program

Access to affordable, short term bridge loans for MWBE contractors bidding or executing on a contract with the State of New York

You’re a business owner who’s won a big contract, or is in the running for one. You have a great service and a strong plan, but need funding in order to deliver. If you’re looking for short term capital or a line of credit to fund the early stages of a contract or need to show that you have the financial backing to perform the job, the Bridge to Success loan program through Pursuit can help.

Bridge to Success is made possible through Empire State Development. Access this contract financing program through Pursuit and you’ll work with an experienced lender and benefit from efficient loan processing.

Line of credit

Affordable interest rates

Flexible terms

What is the Bridge to Success loan program?

Simply put, the program offers contract financing for small businesses. If you are a certified Minority- and Women- Owned Business Enterprises (MWBE), you can use funds from the Bridge to Success program as working capital when bidding or executing on a contract with the State of New York. Bridge to Success offers revolving lines of credit for contract financing that can be left open–meaning you have access to funding when you need it and can easily pay down the line when you don’t.

Bridge to Success loan program details

- Loan amounts: Lines of credit up to $200,000

- Interest rate: Prime + 4.0% (currently 8.75%)

- Time to funding: 4-6 weeks after your complete application is submitted

- Term: 12-18 months

Is the Bridge to Success loan program right for me?

MWBEs undergo an extensive certification process with New York State. In turn, they receive increased access to certain government contracts for minorities and women, and have access to networking and other benefits.

Certified MWBEs of all shapes and sizes can benefit from Bridge to Success. Perhaps you self-funded previous smaller contracts and are looking to move to the next level. Or, you have a track record of performing on large contracts and can take on more work, but have maxed out your line of credit with your bank. Bridge to Success can provide access to contract financing when other sources might not be available.

What can you use a Bridge to Success loan for?

You can use your Bridge to Success loan for working capital when bidding or executing on a contract with the State of New York. Having working capital on hand means that you can more easily hire staff, purchase materials or equipment, and more. You’ll also be able to demonstrate that your business has the funding to successfully complete the job and better position yourself to win the contract bid.

If you are looking for contract financing as a contractor for an entity other than the State of New York or are not a certified MWBE, please start an application or contact us. You can access other contract financing loan programs that may be a fit.

Jumpstart business growth with a Bridge to Success Loan

Bridge to Success loans can help position you to successfully compete for government contracts.

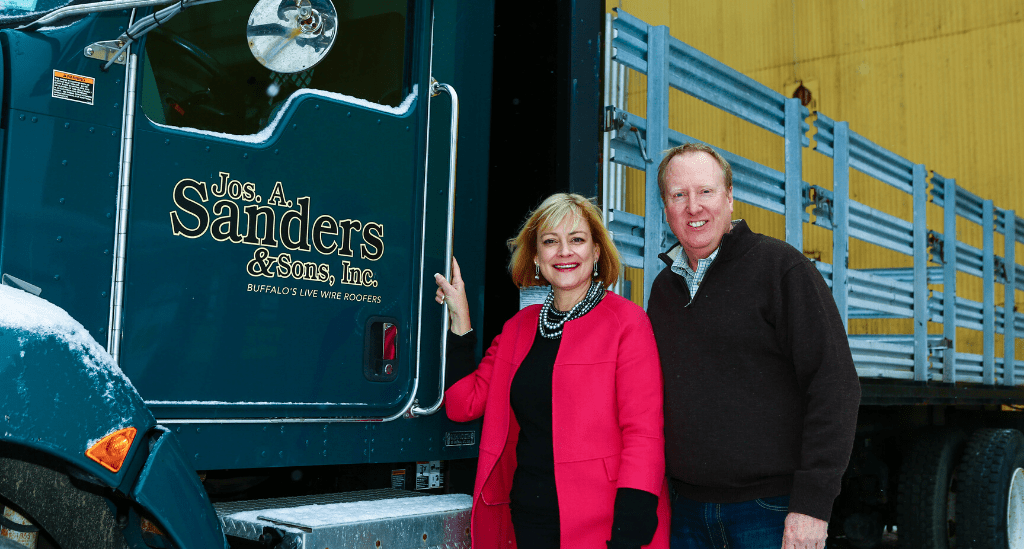

Learn how other businesses have used the program to grow:

Get started

Ready to fund your dream? Learn more about our small business loan application process and get started today.