“When I realized the benefits for people of all ages and abilities, I saw that the opportunities were huge, but I needed financing to bring my vision to fruition,” says John Crossman, founder and owner of VDO Gaming & eSports Education, LLC, in Menands, NY.

Here’s how John launched VDO Gaming & eSports Education and how Pursuit is helping him realize his business’s potential with two loans to support growth.

An idea evolves into a business plan

“My sons tried to convince me to invest in their business idea, which involved offering video game- and multi-player eSport events around the Albany County area,” John explains about how his niche business evolved. “Like most people, I just assumed it meant kids playing video games for hours on end.” That was in 2017.

He continues, saying, “Then I read studies that show how video games and eSports help veterans physically and emotionally and, as a service-disabled veteran myself, I found that interesting. And I learned that there were huge benefits for youth, from developing logistical and mathematical awareness to creativity and social skills and how colleges were starting to integrate these into their programs. And I read about how seniors who play show decreased physical and cognitive decline.”

“I realized that this was a forward-looking business opportunity with a lot of potential for positive impact and long-term growth. So, first I became a partner in my sons’ business. Then, I started my own,” he says.

That’s in part because the earlier business model had many limitations – constantly moving equipment from site-to-site, for example, and running into problems due to a location’s inability to offer sufficient internet service to power the games.

“To really achieve its full potential meant securing my own space and equipment,” John says.

Networking and business assistance lead to beneficial connections

John has a tremendous drive to take on challenges and learn things for himself, but he also values the insight gained through networking in the industry. Even though there are relatively few businesses like this – not just locally, but across New York State and around the country – John learned a great deal from visiting other locations and learning from their experiences.

He also got a lot of help from his local SBA Veterans Business Outreach Center (VBOC) team.

“I completed the Entrepreneur Bootcamp program and several other classes through the VBOC and the director, Amy Amoroso, was a tremendous help,” John explains. “She and the team gave me pointers to develop my business plan and financials and helped me get it ready for financing. Then I attended an SBA-sponsored event and that’s how I learned about Pursuit.”

Soon, John was in touch with Pursuit Business Development Officer Louis Carroll, who helped John review loan options and encouraged him to apply for multiple loan opportunities for which John and VDO were eligible.

“Although the SBA loan process was complex, the Pursuit team was great and kept things moving forward,” John says. “And getting two loans was tremendous.” John secured an SBA 7(a)/Community Advantage loan and an SBA Microloan. The financing helped him secure and renovate VDO’s space, purchase equipment, and gain working capital as the business gets established in its new, 2,500-square-foot home, with the capacity for up to 34 guests at a time.

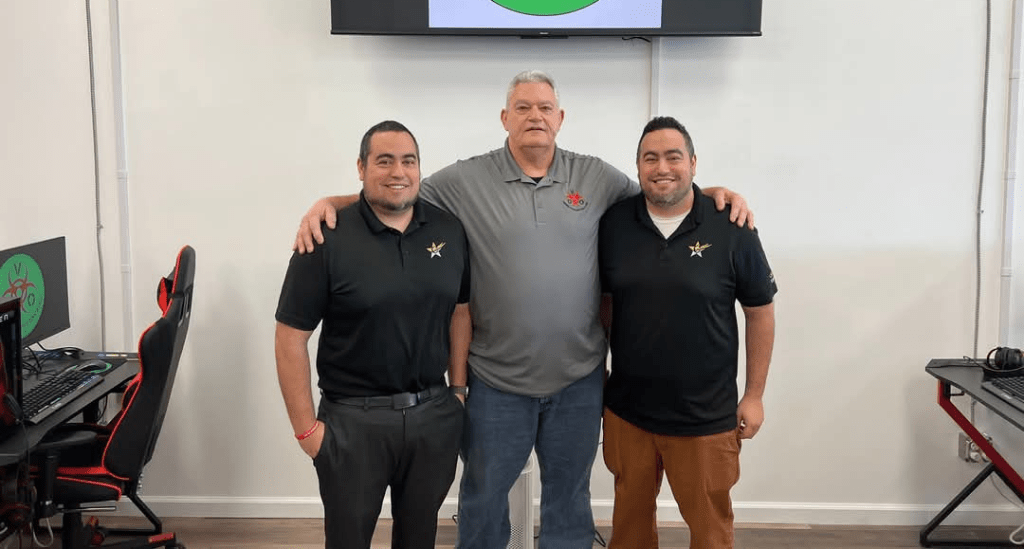

VDO hosts birthday parties, summer camps, tournaments, and much more. And John and his team – his sons’ business, Claim to Fame Entertainment, runs marketing, outreach, and event management – are engaging middle and high schools and college scouts are noticing, too.

“What we offer is so much more than simply playing games,” John says. “For example, the kids are learning how to create tournaments and brackets, which takes math and logistical skills and creativity. College scouts recognize this and want to get our kids into their tech programs.” They also have special offerings for seniors and for veterans in the community and new opportunities are growing by the day.

Pursuit can connect you to small business financing

“I’ve learned so much over the years, but the most important lesson was to keep making connections to strengthen my business network, including the VBOC and Pursuit. Now, I’ve got the financing I need to build this business and the potential is really unlimited,” John says.

Whether to launch a new business or expand, Pursuit can help you achieve your vision.

With loans from $10,000 to $5.5 million, we can help you secure financing for working capital, equipment, the purchase or construction of commercial real estate, to refinance business debt and more for businesses in New York, New Jersey, Pennsylvania, Connecticut, and Illinois. And our Business Advisory Services are available to you as a Pursuit borrower to help you succeed.

Contact us to learn more.