Risk assessment isn’t something you’re likely to think about as you launch and grow your business, but recent events have shown how essential it is. In this article, you’ll learn the steps you need to take to ensure that your business is better prepared to weather a range of risks and emerge financially and operationally strong.

How to assess and address risks for your business

Here are the steps to take to identify and address challenges and opportunities:

Step 1: Examine your business operations

Look at all key internal and external business operations and ask yourself, “What would happen if this were suddenly unavailable, temporarily or permanently?” Make notes as you go through this list, as you’ll apply your findings to a SWOT analysis in the next step.

- Management:

Who runs your business? If yours is a solo operation, make notes on what would happen if you weren’t available. Make sure you have a succession plan to pass the business on to a family member or to sell it. If you have partners, decide on what would happen if one (or more) decide to leave the business and how that will impact operations. What about financials, including any outstanding debt on the business? Work with your business’s legal advisor and accountant on succession and contingency plans. - Staff:

The pandemic forced many business owners to examine which staff roles are essential to business operations. If you haven’t taken that step yet, do so now. Also, figure out why those roles are essential, so that you can identify the key skills and qualities you’d need if you had to replace an essential employee. Spend some time gauging the morale of your staff. Nothing drags down productivity like unhappy employees. Get their input on ways to improve or accommodate their preferences. - Vendors and suppliers:

List out where and how you get the supplies that are essential to running your business. What would you do if key suppliers couldn’t get the materials or products you needed? Consider the following question:- If your business is a priority to them, and if not, how can you improve your standing? There are several ways, such as ordering in line with their manufacturing schedules or renegotiating payment terms.

- Are your vendors financially stable, so that they can weather challenges?

- Do you have backup suppliers available? If not, what would it take to establish those inventory lifelines?

- Could you pivot your products or services to generate income, independent of vendor issues?

- IT infrastructure and cybersecurity:

Small businesses have expanded online services and are increasingly targeted by ransomware and hacking schemes. Make sure that your IT infrastructure is protected and that your customer information is secure. If you’re not sure, it’s a worthwhile investment to have an expert review your IT programs. - Real estate and equipment:

Whether you own or lease, ensure that you have ample insurance coverage for a range of potential natural and manmade disasters. Review your policies with your insurer for coverage if something happens to an adjacent property. And while it’s essential that the tangible items are covered — like real estate, equipment and furnishings — find out if disaster coverage is available for financial losses from business disruptions. - Finances:

Stress-test your budget — run your numbers as if you had a 10% increase in revenue and expenses and as much as a 25% decrease in revenue and expenses. Determine what changes would you have to make to leverage opportunities or kick into survival mode. If you haven’t already, check to see if you have an effective business budget.

Always have sufficient working capital and know your financial safety nets. Get a loan if you’re operating too close for comfort and get a line of credit to enable you to survive through disasters or leverage new opportunities that arise, such as when a competitor decides to close or sell.

Step 2: Create a SWOT analysis for risk management

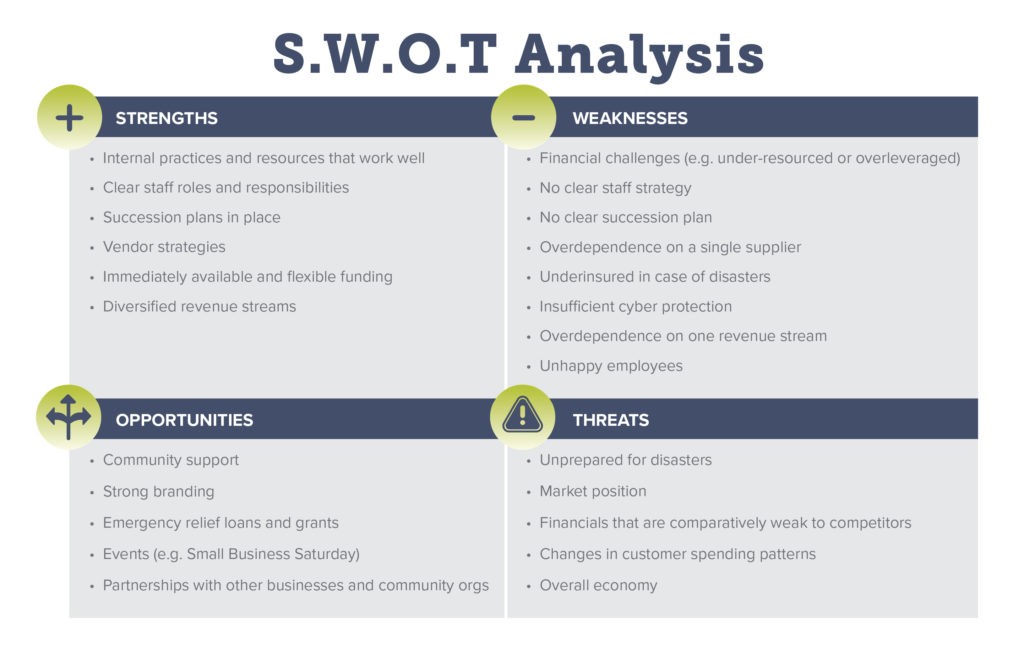

A SWOT analysis is a commonly used business tool that helps you identify strengths (S), weaknesses (W), opportunities (O) and threats (T). The strengths and weaknesses are usually internal assets and challenges, while the opportunities and threats are externally driven.

You can use the sample layout below as a template, download your own S.W.O.T. analysis template here. With the notes you made in Step 1, fill in the assets and challenges that you identified.

Step 3: Take action to mitigate risks

Highlight the major challenges and identify the actions needed to reduce the risks you’ve identified. For example, if your SWOT analysis shows that your business isn’t sufficiently insured, contact your insurance agent immediately. If you don’t have sufficient working capital to get you through another round of closures (or to leverage new opportunities), get those in place now.

If you need working capital or other funding, Pursuit can help

If your risk assessment indicates that you need more working capital, contact us today.

Pursuit offers access to more than 15 loan programs and a range of additional services and we’re committed to helping your small business get stronger today and thrive tomorrow.