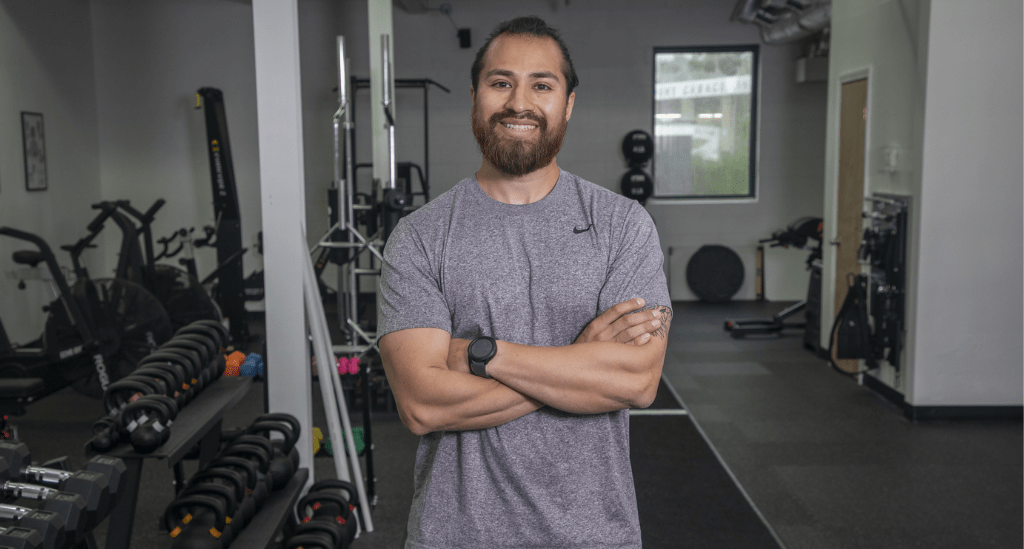

“Starting “I learned about Pursuit through a small business owner who recommended them,” says Jon Camacho, owner of The Lift Effect in West Hartford, CT. “I got in touch and the rest was easy.” Here’s how financing from Pursuit helped Jon launch The Lift Effect, while Pursuit’s Business Advisory Services team helps him build a solid foundation for growth.

An interest in health and longevity leads to a fitness business

“I studied biology in college and then enrolled in a program for training as a physical therapist, but I realized that wasn’t the right path for me,” Jon explains about pivoting to bring longevity-focused fitness programs to people of all ages and abilities.

“I worked in several gyms and studios over the past 15+ years to learn more about strength training, which was also something that had helped me on my own journey to improve my health. But I also learned that there’s a limit to what that, alone, can help people achieve,” Jon explains. “At The Lift Effect, I focus on meeting people where they are, physically and emotionally, and putting together individualized programs that provide real results to help people achieve their goals.”

Jon launched The Lift Effect in May to offer small-group personal training for 4-6 clients at a time, as well as one-on-one-training. “I’ve seen a lot of people lose strength over time, but it doesn’t have to be like that. I want them to feel and know that they can be strong, confident, and active throughout their lives with the right conditioning and strength exercises, no matter what their current age or fitness level is. My clients range from current and former competitive athletes to people who have very limited to no previous gym experience. Everyone can benefit.”

An opportunity leads to a need for financing and Pursuit

Jon’s father is involved in real estate in Connecticut and showed him an available location in West Hartford – and Jon knew it was exactly the space he wanted.

“Even with my savings and some funds from a small investor, though, to get the location and fully equip it would take more money than I had available. It was clear that I’d need a loan to get this off the ground,” Jon says. “I wanted to make sure my equipment was new and modern to offer my clients a more high-end experience.”

“One of my clients is a baker who used the Connecticut Small Business Boost Fund to finance their business and they recommended it. I submitted the eligibility form online and was connected with Pursuit, which has been a great experience in every way,” Jon says.

He worked with Pursuit AVP Anthony Booth, Jr. for the Connecticut Small Business Boost Fund financing and within six weeks, he had the funds in the bank to move forward with his dream business.

“I had the funds I needed to secure the location and equip the studio and also to get the business off the ground and further build my clientele,” Jon says. “The whole experience of working with Anthony and the Pursuit team has been great. Anthony made the loan process easy and connected me with additional services from Pursuit to help me get my business off to an even stronger start.”

Anthony says, “I felt the Lift Effect right away working with Jon. His passion for his work and active engagement in learning more about the financing process made my job easy. I’m excited to see the impact Jon’s business will have on the community.”

Pursuit’s Business Advisory Services (BAS) help small businesses thrive

Anthony connected Jon with Pursuit VP and Business Advisor Irene Dominguez. With her help, Jon is receiving a range of consulting services, at no cost to him, for key areas that include financial management.

“Irene has been terrific,” Jon says. “She’s gotten to know me and my business goals and has been responsive and kind when I have questions. She connected me with Alek Marfisi, CEO of Upwind Strategies, who is an expert in financial management for small businesses. He’s helping me get my business’s financials set up correctly from the start and now, I have a much clearer picture of where I need to focus to grow the business.” Jon also has access to expert consultants in marketing, human resources, and more.

“Jon has the drive and focus needed to work on the business itself, including dedicating time to accounting and work on financial analyses with the support of our expert from Upwind Strategies,” Irene says. “Jon has also been thoughtful and strategic about refining his business model – and all this work happens in addition to his fitness coaching. Not all business owners have the patience or ability to make time for these things, but Jon does. I look forward to seeing The Lift Effect grow further!”

With the financing he needs to support building his business, Jon can also keep his longer-term goals in mind. “Right now, I’m the only trainer and my focus is on growing my clientele and providing an outstanding experience for each of them. Longer term, I’m looking at hiring additional trainers and opening a second location.”

Financing from Pursuit supports a launch today and long-term growth, too

For entrepreneurs like him, Jon says, “If you’re thinking about financing, having a vision that you’re passionate about is really important. Then, just take action. There was no guarantee that I’d get a loan, for example, but I had no way of knowing that until I applied. Keep trying, stay excited, and you will make it happen.”

If you’re looking to launch a new business or expand, Pursuit can help you, too. With loans from $10,000 to $5.5 million, we have financing for working capital, equipment, the purchase or construction of commercial real estate, to refinance business debt, and more for businesses in New York, New Jersey, Pennsylvania, Connecticut, and Illinois.

Contact us to learn more.