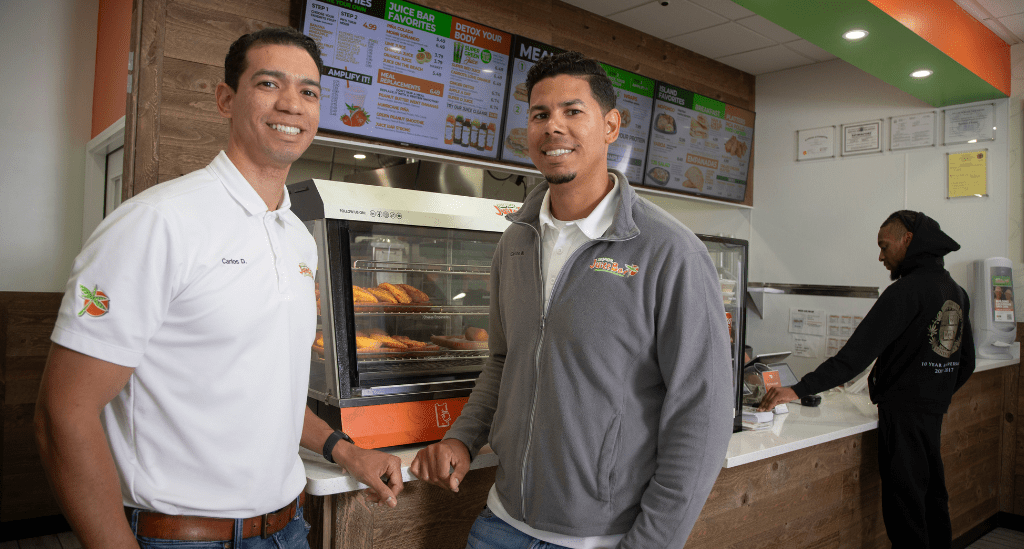

Seeing a need for healthier foods in urban New Jersey, the Lopez brothers started Tropical Juice Bar in 2010. Now, The Lopez brothers – Carlos M., Carlos D., and Luis – have seven locations, including their first franchise opening soon in Hackensack.

Here’s how they’re growing their business – including achieving an important goal by purchasing their first commercial property with an SBA 504 loan from Pursuit.

Identifying an opportunity in urban New Jersey communities

The Lopez brothers emigrated to the U.S. from the Dominican Republic as children and have always loved Caribbean foods and flavors. After gaining experience in fields that range from restaurant work to physical education, they saw an opportunity to bring the fresh flavors and health benefits of the tropics to New Jersey, opening the first Tropical Juice Bar in Passaic.

CEO and co-founder Carlos M. explains, “The decision to go into business together was easy because we share the same vision. The key is that we have defined roles and responsibilities, and we talk through everything.” Along with his brothers and cofounders Carlos D. (COO) and Luis (Facilities Director), the team now includes about 75 full- and part-time employees.

The community responds with tremendous support

Carlos M. says, “Pretty soon after opening our first location, we realized we needed to expand our offerings to attract our target customers. We added traditional Caribbean comfort foods, like empanadas, mofongos, and stuffed yuca to our signature sandwiches and wraps, adding balance while staying true to our goal of offering healthy options along with our juices.”

Today, the most popular item on the menu is the Super Green Juice – a mix of kale, celery, orange, and cucumber juices, all of which are delivered twice a week from their local vendor – which shows that their vision of introducing their customers to healthier options is working.

The business formula that the brothers developed has led to steady growth, largely through word-of-mouth and marketing through social media and other digital channels. During their first years in business, they also created a strong brand identity that reflects their childhood neighborhood in the Dominican Republic, with bright colors and warm woods.

An SBA 504 loan from Pursuit helps them leverage a key location in Newark

Up to this point, the brothers had entirely self-funded the growth of Tropical Juice Bar. They admire the business model of successful fast-food restaurants like McDonalds and Dunkin’, whose expansion plans include owning commercial real estate along with operating corporate locations and offering franchises. So, when an opportunity to buy an ideal location in Newark arose, the Lopez brothers decided to take advantage of it.

Carlos M. says, “We realized that to make this work, we’d need financing because it involved the acquisition and complete renovation of the property. It is our most expensive and extensive expansion to date. We were ready for the challenge, knowing it would be worth the investment in terms of revenue generation, brand recognition, and business equity.”

“A friend who had been in commercial banking recommended the SBA 504 loan program and Pursuit,” Carlos M. says. Soon, they were working with Pursuit Senior Vice President and Loan Officer Hector DaCosta to apply for an SBA 504 loan, which gave them funding to acquire and renovate the property, as well as gain working capital to support a strong launch.

“Working with Hector and the Pursuit team was great,” Carlos M. says. “Considering this was our first business loan, it felt pretty complex and daunting. Hector and the entire Pursuit team were a tremendous help and guided us every step of the way, always ready to answer questions that arose along the way. It was a long process, but they got us through. Now, we own this incredible location have developed a strong relationship with a lender who can help us continue to grow.”

Carlos M. admits that self-funding for so long likely held back the business’s growth potential and made their lives more stressful, too.

“We realize now that we went through a lot of unnecessary financial stress with the current business and trying to grow, making many sacrifices in our business and personal lives. This time around, we applied for and received financing that includes working capital as well as funds for property acquisition and renovation. It makes our business stronger and creates a path to achieving the long-term goals for growth that we envision,” he says.

Helping communities grow through entrepreneurship

The Lopez brothers have identified several ways to grow their business, including offering franchise opportunities to help others become successful business owners, too.

“We work with family and friends every day, which makes it fun, and we’ve developed a business model that works financially and serves communities in ways that we can feel good about,” he says. “So, now, our goal is to share what we’ve learned with others so that they can enjoy the same kinds of opportunities and success that we’ve experienced.”

Financing from Pursuit supports small business growth

For other business owners, including potential franchisees, Carlos M. says it’s important to know there are lenders out there who can help. “You don’t realize how essential the right financing is and how much easier everything is until you have it. Even if you’ve been denied in the past, keep pushing – soon, you’ll find the right lender to have on your side. Listen to their advice and pursue it. It will open doors you never thought possible. That’s what happened to us with Pursuit.”

With loan options from $10,000 to $5.5 million, Pursuit has funding options that can help you get the financing you need, including loans for commercial property, equipment, working capital, to acquire a franchise or refinance high-cost business-related debt, and much more.

Take a look at more than 15 small business loan programs, and contact us to learn about how we can help you, too.