Philadelphia Small Business Loans

Your Reliable Community Lender in the City of Brotherly Love

For nearly 70 years, Pursuit has worked with businesses in Philadelphia to transform, grow, and reach higher. When you work with us, you’re tapping into a team of business lending experts and a wide variety of loan programs and resources to keep you soaring toward your goals.

Philadelphia has been a hub for innovation since its founding, and a center of creative energy that touches every industry. Combine that drive with funding and resources from Pursuit and you’ve got a winning team to fuel your business forward.

Pursuit is approved to offer SBA loan products in Philadelphia under SBA’s Preferred Lenders Program & SBA Express Program.

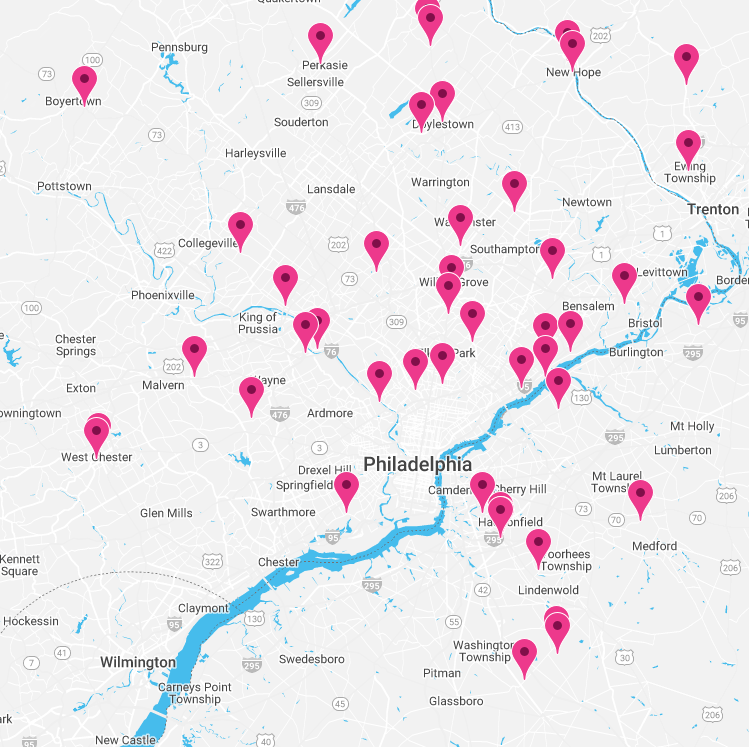

Funding Businesses Across Philadelphia

From Fishtown to Kensington, to South Philly and Germantown, Pursuit has worked Philadelphia-based businesses in a variety of industries and stages.

You can access programs for owner-occupied commercial real estate, working capital, equipment purchase, debt refinance, and so much more. Why not get started today?

- "Financing from Pursuit has given us a solid financial foundation and made our expansion possible."

- "Pursuit and a local bank made the SBA 504 process much easier. Looking back, it’s the best decision I’ve made."

- "The financing, business support, kindness, and thoughtfulness that I've received from Pursuit are life-changing."

Business Loan Programs in Philadelphia

Pennsylvania Small Business Credit Initiative (SSBCI)

Pennsylvania Small Business Credit Initiative

Frequently Asked Questions

You’ll find business loans for everything from working capital to owner-occupied commercial real estate in Philadelphia. Pursuit offers loans from $10,000 to $5.5 million including SBA loan programs, state-run programs like the PA SSBCI loan program, and much more. Many lenders offer term loans but others may also offer lines of credit or business credit cards too. When you talk with a potential lender, be specific on how you’ll use your funding and they can ensure you’re applying for the program that best meets your needs.

Every lender and loan program has its own set of qualification criteria, but there are a few general criteria that are standard. Most lenders want to see a positive or break-even cashflow for your business, and a personal credit score that’s fair-to-good (if not better). Lenders may have specific requirements for number of years in business, annual revenue, and number of employees too. Make sure you fully understand the eligibility criteria before you apply so you can increase your chances of approval!

There are a range of rates and terms available for business loans in Philadelphia depending on the lender and loan program. At Pursuit, you’ll find affordable interest rates and terms to ensure your loan works for you now and in the future. For example, the PA SSBCI program offers up to $500,000 at a fixed rate of 7.75% for a 5 years term. The SBA 504 program offers terms up to 25 years for owner-occupied commercial real estate with below-market fixed rates. Talk to your lender to learn what the best program is for your unique needs.

Have a clear understanding of the qualification criteria and required documents before you apply so you can prepare everything ahead of time. You can increase your approval odds with honest and open communication with your lender and timely responses when they have questions or need additional information. Before you apply, check your personal credit report and address any issues or errors as soon as possible. When you submit a complete and accurate application, you’ll set yourself up for success with your lender.

The best way to compate small business loans is by looking at the Annual Percentage Rate (APR) for each loan option. This gives you the best apples-to-apple comparison between products, taking into account the interest rate, terms, and any applicable fees. The APR will tell you how much each loan will actually cost in the long term.