Long Island Small Business Loans

From Nassau to Suffolk, Pursuit has worked with hundreds of Long Island small businesses to fund their dreams. Is yours next?

Long Island: A business powerhouse that feels like home

With easy access to New York City and the tri-state area, a population of nearly three million people, and its range of industries, Long Island is a great place to start and grow your business. From advanced manufacturing to fishing charters, and everything in between, there’s a wide array of industries to explore and join.

Pursuit has a long track record of funding Long Island businesses for owner-occupied commercial real estate, equipment, inventory, working capital, debt refinance, and so much more. How can we help your business grow?

Pursuit is approved to offer SBA loan products in Long Island under SBA’s Preferred Lenders Program & SBA Express Program.

Businesses funded on Long Island since FY2023

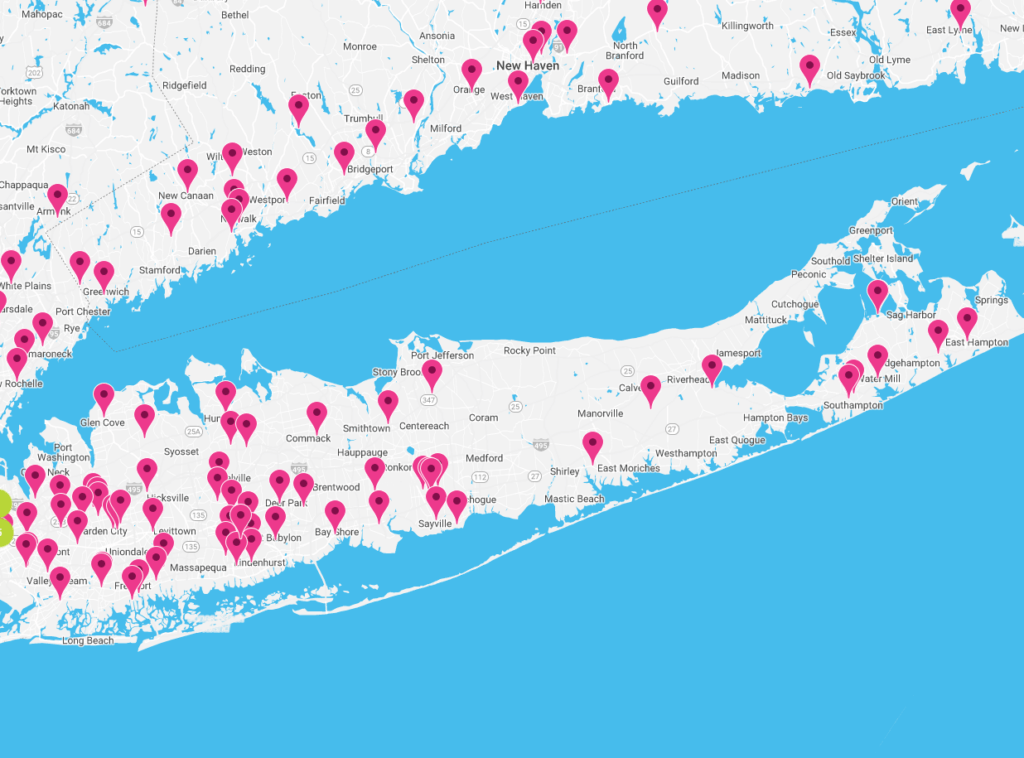

Funding Businesses All Over Long Island

From fixed asset funding to fast funding, Pursuit has Long Island businesses covered with loan options. Whether you’re in tourism, hospitality, retail, professional services, or science and engineering, you can find a path to success with Pursuit.

You’ll find Pursuit clients in the North Fork and the South Fork and throughout Nassau and Suffolk counties. We’re proud to fund and support small businesses that are making a positive impact on Long Island!

- “As long as you have your business documents together, it’s straightforward, and the Pursuit team was there for me throughout.”

- "When we received the SBA Microloan from Pursuit, it was immensely helpful for our financial needs."

- "The experience was very positive. With Pursuit and my bank partnering, we substantially lowered the interest rate."

Business Loan Programs on Long Island

Frequently Asked Questions

You’ll find a wide variety of business loan options for your Long Island business, from SBA loans to conventional bank financing and more. With Pursuit, you can access the SBA 504, 7(a), and Microloan programs, as well as programs in partnership with New York State. You’ll find a solution for nearly any business need. Simply apply through our online application and we’ll find the best options for your needs.

Interest rates vary by program so be sure to confirm with your lender during the application process. At Pursuit, you’ll find programs in a range of rates up to 12.5%. When you’re applying, you’ll have full clarity on the rates available and we’ll confirm your rate when you’re approved.

Yes! You can search for local funding opportunities through your county, town, chamber of commerce, local development agency (IDA), and business improvement district (BID). You can also visit your local Small Business Development Center (SBDC) to learn what’s available and get support in gathering what’s needed for your application.

It depends. Some lenders have strict criteria for credit scores and aren’t able to make exceptions, while others may want to learn more about why your credit score is lower before making a decision. The best course of action is to do what you can to improve your credit score before you apply. Order your free credit report and review it for any errors. If you find any, clear those up as soon as you can. If you’re behind on payments to a creditor, contact them to develop a payment plan. Improving your credit score will take time but it’s worth the investment.

Approval and funding times are different for each loan program. Loans for commercial real estate and fixed assets can take longer to approve and fund, while other programs for things like working capital and inventory may have a shorter approval timeline. You can ask your lender about the timeline before you apply. One thing to keep in mind is that being responsive and submitting all required documentation will keep the process moving forward efficiently!