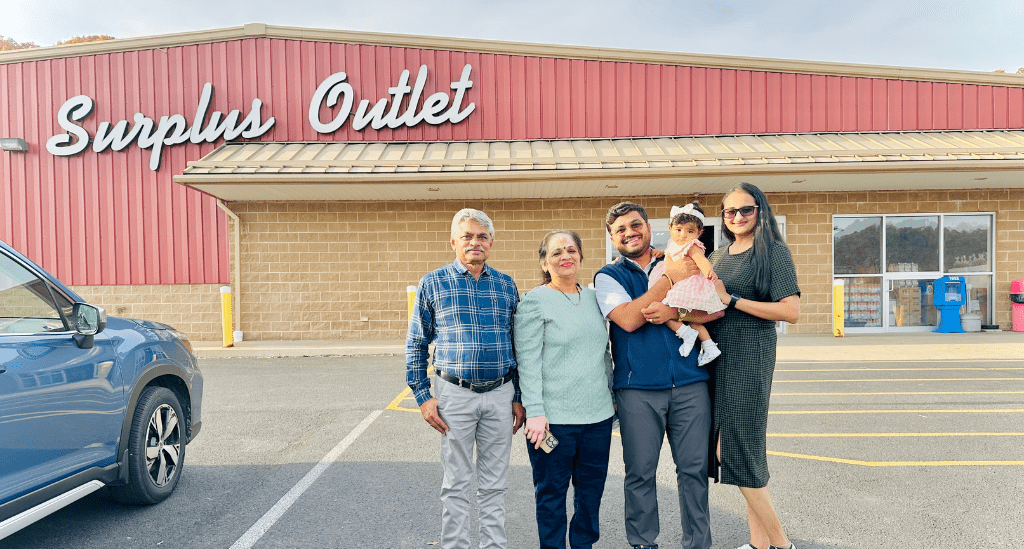

At 26 years old, Akash Patel already had years of business-management experience when he purchased two Surplus Outlet grocery stores in Pennsylvania. “I found the right opportunity, but I needed financing,” Akash says. “Pursuit’s help was essential not only for the loan, but also because my team was determined to make it work, even when we ran into a significant challenge.”

Here’s how his deal came through with an SBA 504 loan from Pursuit.

Leveraging experience and achieving a dream

Akash had managed several Dunkin’® locations in Indiana and Michigan. The experience he gained as an employee in the shops and managing staff and retail outlets made him determined to find his own opportunity to own a business.

“I’m grateful for those years because I learned about running a successful business,” Akash says. “And it made me realize that I want to spend my time and energy building something of my own. I looked for businesses aligned with my experiences and with growth potential.”

He found his ideal opportunity in Surplus Outlet – two discount grocery stores located in Northumberland and Montgomery, PA. Surplus Outlet offers name brands at discounts that Akash and his team achieve through purchasing goods when other retailers are overstocked or items are nearing sell-by dates. Surplus Outlet customers benefit from significant discounts on their favorite products (such as bottled water or baked-goods mixes) that are shelf-stable for years.

Major deals, major challenges

Akash’s deal included buying the businesses and commercial real estate. Each store is about 40,000 square feet, along with land, parking areas, equipment, and brand assets.

“I knew that the right financing would be key,” Akash explains. “I talked with a commercial banker I know in Michigan about SBA loans for a business acquisition in Pennsylvania – and he got in touch with Pursuit.”

Akash reached out to Pursuit SVP Ashley Heaton who explained more about SBA 504 loans. With the SBA 504 program, small business owners can purchase property with a 10% down payment (for most properties). It includes a fixed, below-market interest rate over the life of the loan and a longer repayment term, which makes monthly payments easier to budget. They’re also made in partnership with a commercial bank, which holds the first mortgage on the property.

From their first conversation, Akash says, “I knew that Ashley wanted to help and make this happen.”

When challenges arise, Pursuit stands by small business owners

It’s not unusual for large and complex commercial-property and business-acquisition deals to run into challenges – but when the first partnering bank fell through for Akash’s deal, that could have been the end.

Instead, Akash says, “Ashley and her team were even more determined to find another financing partner. It was clear that they cared about helping me, and Ashley never let me think that this wouldn’t get done.”

Akash says that thanks to Pursuit’s persistence and experience, the deal closed in just 83 days, with Akash taking on full ownership in July 2024. It was a smooth transition, including 100% employee retention for more than 117 team members.

Akash set to work creating the business and brand of his dreams and looking ahead, he sees opportunities to expand Surplus Outlet’s reach even further.

Pursuit: When experience matters

Akash says, “As small business owners, we get used to hearing ‘NO,’ but when the first bank fell through, that could’ve derailed the whole deal. Instead, Ashley and Pursuit found another partnering bank and made it work. I’m so grateful for that – and I’m so happy with my stores!”

Whether you’re launching or growing the business of your dreams or seeking the right opportunity to acquire one, Pursuit has the financing you need. With loan options from $10,000 to $5.5 million, Pursuit can help you get the financing for working capital, the purchase or construction of commercial real estate, to refinance business debt and more for businesses in New York, New Jersey, Pennsylvania, Connecticut, Nevada, Illinois, and Washington.

Contact us to learn more.