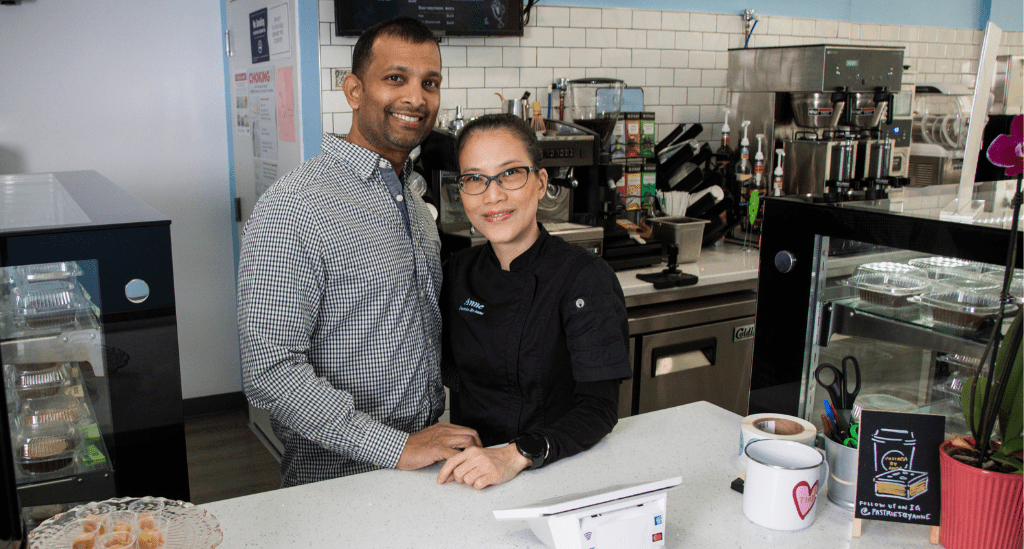

The entrepreneurial journey for Ankhana (Anne) Ward, Pastry Chef and co-owner of Pastries by Anne in Astoria, Queens, includes several great lessons for anyone considering small business ownership: You can always discover a new passion; with hard work, you can leverage it into a business; and with the right support, you can create success. Learn about Anne’s journey so far and how Pursuit helped her get the financing she needed to make her dream a reality with an SBA 7(a) loan.

Discovering a passion for baking

Anne is a native of Bangkok, Thailand and, as she explains, “I didn’t grow up baking because we didn’t have an oven – most of the time, it’s too hot to bake at home there.”

Her family moved to New York City, and after long days at a corporate job, she’d come home and bake. “I started baking from boxed mixes and eventually tried scratch recipes, and the more I baked, the more I loved it, but I didn’t think of it as something that I’d do professionally – my goal at the time was just to get a Kitchen-Aid mixer!”

Dennis Baboolal, co-owner and partner, discovered her baking talent. He signed her up for a cupcake class. It was the first baking class that ignited her love and passion.

When she realized that she might want to pursue baking, she didn’t think anyone would hire her to be a baker simply because she enjoyed it. Although people loved her baked goods, which include classics that often have a Thai twist, she needed credentials that showed she could do the work professionally.

Leveraging an opportunity to learn

“My corporate job caused me a lot of stress, but I had to keep it. I also wanted to find a way to bake professionally,” Anne explains. “Dennis enrolled me in a Sweet Bread Class at the Institute of Culinary Education. With his encouragement, I signed up for the eight-month baking course with ICE. I worked all week at my corporate job, baked at night, and took classes on the weekends.”

To complete her certification, she also had an externship added to her already-busy schedule at Daniel, a Michelin Star Restaurant, working nights in a restaurant after her 9-5 job; after completing her program, she continued to work night shift and weekends as a pastry cook/baker at Locanda Verde.

About the long hours and staying motivated with such a grueling schedule, Anne says, “I learned a trade, and no one can ever take that away from me,” adding that it gave her a new level of confidence and security.

Creating a dream bakery with financing from Pursuit

During the pandemic, Anne made and sold some of her baked goods online; then, with Dennis’s continued encouragement, she decided to open a bakery when Dennis found an ideal storefront in Astoria where he lives.

Anne learned about Pursuit through her bank, TD Bank, when a loan representative there recommended that she contact Dustin Krause. She describes an experience that gave her confidence in Pursuit. “When I was in baking school, everyone said don’t write a business plan because no one reads them, they only read the financial projections,” Anne says. “So, when Dustin read through the entire plan and asked a lot of questions, it showed me that he was engaged and cared about my success. It meant a lot.”

Soon, she applied for an SBA 7(a) loan – an option with great terms, flexible uses, and up to $350,000 in financing. The loan closed in July 2022, and with it, Anne and Dennis had the financing they needed to improve the property and purchase equipment.

They spent nearly six months working on improvements and says that although it was daunting, Anne and Dennis were excited to get the pieces in place so that Anne could focus on what she loves best: baking for others.

Pursuit can help you create the business of your dreams

The brick-and-mortar bakery opened in February 2023 and has been bustling since. It’s open daily and has four employees in addition to Anne – and it has been getting a steady stream of positive press and community support. In fact, Anne says that although she posts updates on social media, she hasn’t done any advertising – business has been brisk simply through word-of-mouth, and customers come from as far as New Jersey to pick up their favorite pastries.

At Pursuit, you provide loans for New York State businesses from the Capital Region to the Big Apple. With loan options from $10,000 to $5.5 million, Pursuit has funding options that can help you get the financing you need to make your business dreams a reality, too. We offer loan options for the purchase or construction of commercial real estate, for working capital, to refinance business-related debt and much more. Take a look at more than 15 small business loan programs, then contact us to learn about how we can help you, too.