New York City Small Business Loans

Your Small Business Lender in the Big Apple

For nearly 70 years, Pursuit has worked with NYC-based entrepreneurs like you to get the flexible funding needed to reach higher and grow. No matter what stage your business is in, you’ll find a financing solution with Pursuit to make your vision a reality.

Get started today through an easy online application process to find your path to success.

Pursuit is approved to offer SBA loan products in New York City under SBA’s Preferred Lenders Program & SBA Express Program.

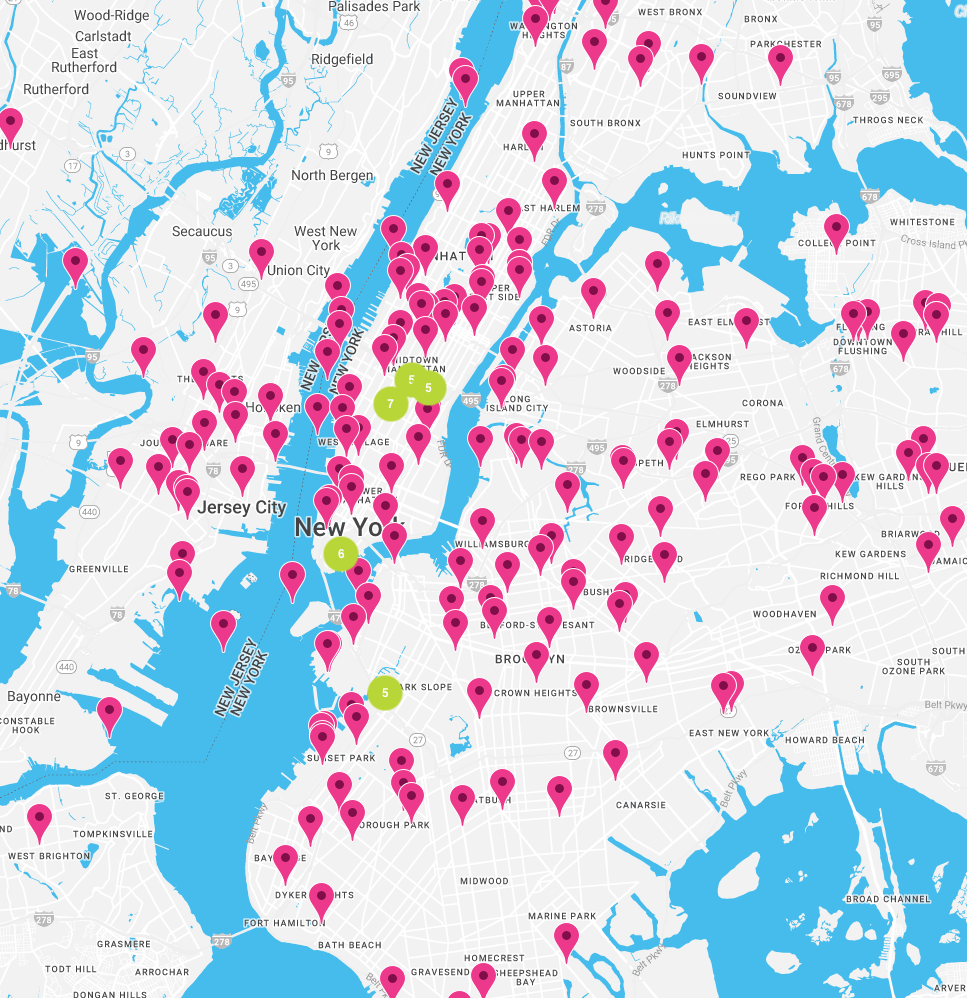

Funding NYC Businesses in All Five Boroughs

When you work with Pursuit, you’re working with a lender that understands the incredible challenges and opportunities of starting and growing an NYC business. You’ll have an ally to celebrate your wins, and an advocate to work with you through the setbacks, and a range of funding available for nearly any business need.

There’s opportunity for almost any industry in New York City, you just need the right financing to make it happen. From working capital, to debt refinance, owner-occupied commercial real estate, and so much more, you’ll find loan options and resources with Pursuit to keep your business growing!

- “I don’t know of any other commercial loan program that would give us the affordability and flexibility that we have with the SBA 504 program."

- "The application was straightforward and I was really impressed that my Pursuit team truly wanted to learn about my business."

- "We’re so grateful for that referral, because Vanus and our Pursuit team helped us achieve our goal of owning our own property.”

Business Loan Programs in New York City

Frequently Asked Questions

You’ll find loans for nearly any business need in New York City. Many small business lenders offer term loans, lines of credit, and even business credit cards. Through Pursuit, you can apply for SBA programs to finance fixed assets, working capital, and more, as well as NYS programs like the New York Forward Loan Fund 2. You’ll also find programs like our small business line of credit and the Pursuit SmartLoan that offer flexible financing at an affordable and competitive fixed interest rate.

There’s a range of interest rates and terms available for NYC business owners depending on your project, your unique situation, and the best fit program. SBA 504 loans offer terms up to 25 years with below-market, fixed rates. The Pursuit SmartLoan is fixed at 11.9% with a 6 year term. When you work with Pursuit, you’ll tap into an expert lending team that will ensure you’ve got the right financing for your business now and in the future.

Approval times vary based on the loan program. No matter what program you’re applying for, you can keep the process streamlined and on track by staying in touch with your lender, and submitting complete and accurate information when it’s requested. Some programs, like the SBA Microloan and Pursuit SmartLoan, can issue approvals within two business days of submitting a complete application. Other programs’ approval timelines are determined on a case-by-case basis depending on the project, the requested amount, and your current business situation.