“If you own a small business, and especially if, like me, you have a mindset that you have to bootstrap to be successful, my advice is to get out there and meet with lenders,” says Sergio Reina, the owner of Reina Tire, which operates as Eagle Tire in New Jersey. “There are great small business loans available and if I’d known how much this would help, I’d have applied years ago.”

Learn how Sergio has grown Reina Tire over the nearly two decades they’ve been in business, and how an SBA Microloan through Pursuit is helping his business stay on the road to growth.

Starting small in South River, NJ

Sergio started the business selling tires for commercial vehicles and shortly after, he added other services for commercial vehicles, light trucks and cars, too. The business opened nearly two decades ago and up until he secured an SBA Microloan through Pursuit, Sergio had only used the business’s revenue and his personal savings to make it work.

“I come from a culture that’s debt averse. You pay cash for everything, including business expenses. For years, not taking on debt felt like a win,” Sergio admits. “But eventually, you realize that you can’t stay competitive or grow if you don’t have some liquidity.”

Overcoming immense challenges to keep his business going

When Hurricane Sandy struck in 2012, it nearly put him out of business. Even still, he didn’t apply for funding to help him through it.

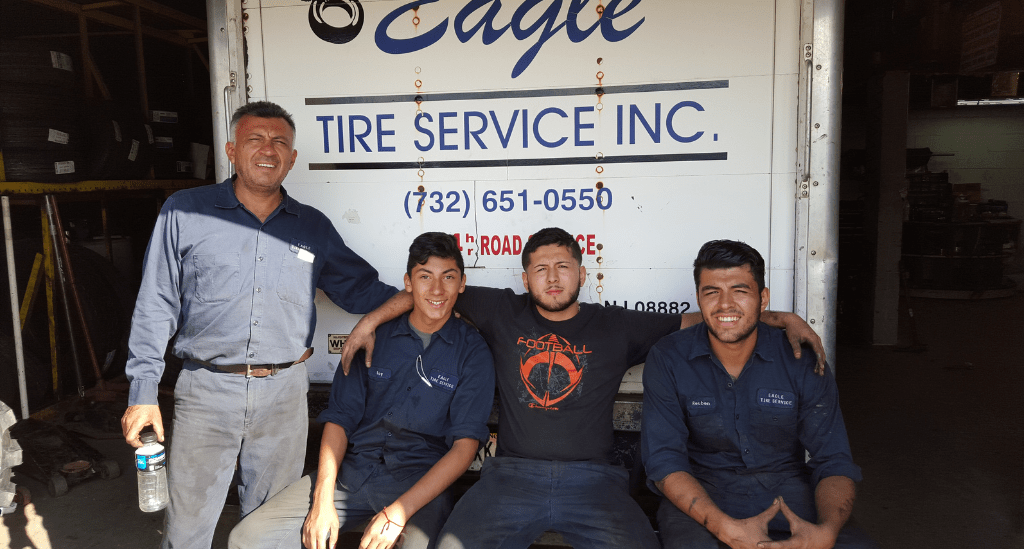

Sergio pulled his family in to help with cleanup, including his sons, most of whom still work with him today. He re-opened the business just two days after the storm, with long days and nights and lots of hard work. He explains, “No one had electricity or water, but we had mechanical compressors, so we could do some services that were in huge demand after the hurricane.”

He eventually decided to focus on the tire business and have a business partner take over the mechanical/repair aspects, now known as H&S Mechanical Center. The two businesses operate in a shared facility that Sergio owns.

Without funding, opportunities can be limited

“I needed equipment and inventory, as well as to make some building improvements, so that was a big reason why I finally considered getting a loan,” Sergio admits. “I also came to realize that although I’d been in business for 16 years, I had very little credit to show for it. I have plans for growth and without a strong credit history and good lender relationships, it would be hard to make my plans a reality. So, that became a motivation, too.”

Another lending officer that he knows recommended Pursuit to Sergio and soon, he was on his way to applying for an SBA Microloan. He was approved quickly, with funds in-hand in Fall 2022.

“My loan officer at Pursuit, Orlando Callegari, is very effective,” he says. “He helped me with the process, which was pretty straightforward, and I got a seven-year loan with a fixed interest rate, which makes it easier to budget. I got great terms and plan to pay the loan off ahead of time, too.”

His SBA Microloan is already having a positive impact

Sergio says that he already used the funding to buy equipment and inventory and to make improvements to his property. He also says that having funds on hand has helped to ease some of the inflationary pressures that have impacted his business. And as a recipient of an SBA Microloan, he’s eligible for expert assistance in areas like marketing and financial management, which will help him further strengthen his business.

“Nearly all of my clients are from repeat and referral business in the commercial-trucking and construction industries, but I think that having an online presence would help strengthen my competitiveness even more,” he admits.

Pursuit has more than 15 loan options for small businesses in NJ, NY, PA and CT

Sergio knows that he’ll need business loans again, and he looks forward to leveraging this experience for the next round. “In fact,” he says, “I’ve already called Orlando about my next project.”

Looking for a funding boost to take on a new project for your business? Take a look at our small business loan options to see how we can help you grow your business, too.