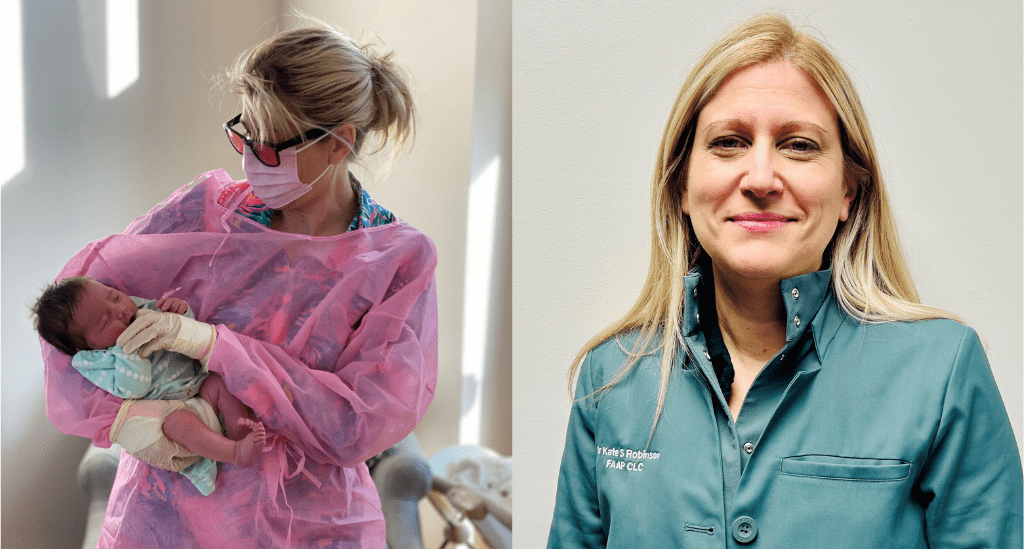

“As healthcare practitioners, we put patient care above everything and that’s how it should be,” says Dr. Kate Robinson, a pediatrician and owner of Lyndon Pediatrics LLP, “but sometimes, that means we forget to take care of ourselves.” As Dr. Robinson realized, one way to overcome that – while also benefiting her clients – was to own the commercial property in which her patients are served, bringing stability to her clientele while building long-term equity.

Here’s how she purchased the Fayetteville, NY-based home of Lyndon Pediatrics with financing from an SBA 504 loan in partnership with Tompkins Community Bank and Pursuit.

Caring for people, creating solutions

Inspired by generations of family members who put service at the forefront of their careers, Dr. Robinson decided at a young age that helping others was going to be her priority, too. A career as a pediatrician was a great fit for her, she says, because it enabled her to help children and families while also handling challenges that ignite her innate, high-level problem-solving skills.

Lyndon Pediatrics has a long history in the community, serving the Syracuse area since the 1970s. Dr. Robinson joined in 2011 and became a partner in 2014, working with the practice’s existing senior physicians until, in 2016, the last of them retired. With that, Dr. Robinson bought the practice and became its sole owner.

Building on a thriving practice

Despite immense challenges that include a changing healthcare environment and the COVID-19 pandemic, Lyndon Pediatrics is thriving with more than 4,000 clients. One of the biggest challenges, Dr. Robinson admits, is an industry-wide staffing shortage. Fortunately, Lyndon Pediatrics has an excellent staff and she works hard to find ways to make the work environment supportive and engaging for all.

“We have a great team,” she says about the staff of 10, which includes some employees who have been with the practice for decades. “Together, it’s our goal to bring hope and joy to as many families as we can. I feel so fortunate to be in this position, taking care of kids and their families and working with such a talented team. I love it all.”

Creating security for all

Among healthcare providers, it’s not uncommon for their own well-being to take a back-burner. That was the case for Dr. Robinson, too, until she had a great opportunity.

“As providers, we sometimes forget that we’re business owners, too,” Dr. Robinson explains. “One piece of wisdom that’s discussed among doctors is that if you have the opportunity to buy your commercial property, do it, because it builds security and stability for the practice and the practitioners. The most successful doctors and practices I know own theirs.”

That’s because property ownership comes with significant short- and long-term financial benefits, including helping business owners build equity and gain tax benefits while stabilizing long-term occupancy costs.

A program to stabilize commercial property provides a great opportunity

Dr. Robinson learned about a special opportunity in 2021 for Syracuse-area small businesses to buy their commercial properties. It included financing through the SBA 504 program, with additional benefits to help businesses that were dealing with the financial impacts of the COVID-19 pandemic. It also aimed to mitigate some of the fallout that the pandemic caused to commercial real estate as many businesses downsized or closed altogether.

With the SBA 504 program, small business owners can purchase property with a 10% down payment (for most properties). Small business owners also benefit from a fixed, below-market interest rate over the life of the loan and a longer repayment term, which makes monthly payments easier.

“The pandemic reverberated throughout our community in so many ways and business and government leaders really wanted to help. That’s when I learned about the SBA 504 loan opportunity and it was too good to pass up,” Dr. Robinson says. She was connected with Pursuit through Tompkins Community Bank, which partnered on her SBA 504 loan.

“The loan process was actually pretty easy,” Dr. Robinson says. “There’s a lot involved when you’re purchasing real estate and with the SBA 504 loan there’s some additional paperwork, but our financing team was great and kept everything moving forward.”

The loan closed in 2021 and Lyndon Pediatrics has gained the stability of a payment that won’t fluctuate for the life of the loan and, Dr. Robinson says, her monthly payments are actually a little less than leasing. She adds that commercial real estate in her geographic area is strong and her property has already increased in value, providing additional proof that this was the right move for her and her practice.

“And I never need to worry about losing a lease and having to move the practice, which is so important to the families we serve and for our team,” Dr. Robinson adds.

Property ownership can benefit any small business – and Pursuit can help

“Buying the property was such a good move. Our practice has been in this location since the 1980s and before this, we had been leasing the whole time,” Dr. Robinson explains. “Now, our clients and staff know that we’ll be here for the long run. And I have peace of mind because I’m looking out for my well-being, too. I couldn’t be happier about how this has worked out.”

Pursuit is a leading small business lender serving businesses across New York, New Jersey, Pennsylvania, Connecticut, Nevada, Illinois, and Washington. We offer loans and a line of credit for working capital, commercial real estate, equipment, and much more. We’ve helped thousands of small business owners get the funding they need to achieve their goals and dreams, and we can help you, too.

Contact us today to learn more.