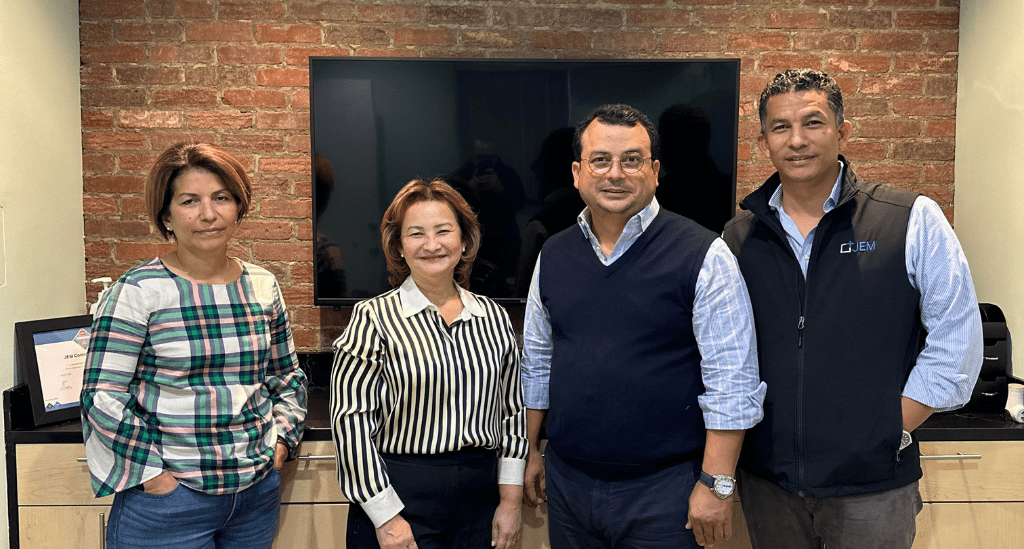

JEM Contracting is a true family business: Brothers and sisters Joseph Jr., Jose, Karla, and Lissette studied different areas of their industry to bring a range of expertise to their growing enterprise. Here’s how they got their start and persevered to secure two SBA 504 loans for their Astoria, Queens-based construction business, realizing a long-held dream.

A family legacy gets new life in New York

It was natural that the Molina siblings became interested in construction and contracting: For several generations, their family included skilled craftsmen and entrepreneurs. Joseph and Jose founded JEM Contracting in 2003, with their contracting and construction company specializing in residential projects; Karla and Lissette joined soon after.

Each of the siblings brings training and expertise in complementary areas that are essential to construction and business management:

- Joseph is trained in architecture and is the lead procurement officer.

- Jose studied business management and he’s responsible for operations.

- Karla studied education with a minor in economics and is the lead for finance and human resources.

- Lissette is trained in real estate development and green-building initiatives and leads branding, site safety, document management, and project management.

Together, the four siblings are leveraging their strengths and expertise to keep the business growing successfully.

Even established businesses find financing challenges

Looking at JEM’s achievements, it’s clear that the business is established in its field and the Molina siblings have worked to deepen its expertise.

The business achieved Minority Business Enterprise (MBE) certifications in New York State, New York City, and New Jersey, which helps this growing business bid competitively on construction contracts. JEM’s skilled team also includes masters in masonry and building core and shell. The team has a growing list of prestigious projects in the Metro New York region that includes, but isn’t limited to, 70 Vestry, The Lantern on 18th Avenue, the Highline, and Hotel Fouquet’s New York. JEM also mentors New York City-area college students training in architecture, engineering, and related fields.

When a new business opportunity became available, the team decided to seek financing

“JEM had been renting different locations since 2005, which is expensive and operationally inefficient,” Joseph explains. “Purchasing our operating yard, where we keep all of our construction-related equipment, had been our dream.”

Despite two decades of industry experience, tremendous credentials, and strong leadership, the JEM team wasn’t able to secure conventional commercial mortgages from banks to move their dream forward.

Everything changed when the JEM team met Rosa Figueroa, Director of the Small Business Development Center at Queens College/CUNY.

“We had tried several times to get loans from banks, but we didn’t meet all of the criteria,” Karla says. “Then we met Rosa and she guided us to Vanus Huang at Pursuit. We’re so grateful for that referral, because Vanus and our Pursuit team helped us achieve our goal of owning our own property.”

With Vanus’s guidance and support, the JEM team pulled together the information needed to secure two SBA 504 loans – a tremendous achievement to move their business forward.

Jose says, “Our first SBA 504 loan was to buy our operating yard, where we store construction materials, equipment, and trucks. The second SBA 504 loan enabled us to relocate and consolidate our offices.”

“Vanus guided us through the entire process and taught us about all the steps in the SBA loan process and why they’re necessary. We came away having learned so much,” Lissette adds.

With the SBA 504 loan for owner-occupied commercial property, the JEM team has better control over their long-term occupancy expenses and is building equity in valuable real estate.

Achieving today’s goals opens the door for tomorrow

“We’ve accomplished so much by consolidating our operations thanks to the SBA 504 loans. Owning our property means growing our team, adding people with new skills, and making our business more competitive for projects,” Jose explains.

Lissette adds, “We’re expanding our bidding department. We can also facilitate jobs at different locations at a faster pace than before because we’re a more efficient company. Eventually, we want to become our own property development company, too. Getting these SBA 504 loans has strengthened our operations and given us the confidence to keep planning for growth.”

Pursuit is here to help small businesses succeed

“One of the most important lessons we learned from this is that, if you need help, reach out to your local Small Business Development Center. They’ll listen to your plans and goals and will put you in touch with the right lender. It really felt like Pursuit came to our rescue and we’re so grateful to Rosa for the referral she gave us for Pursuit—and to Vanus and the Pursuit team for helping us achieve our goals,” says Karla.

“Pursuit has been a guiding light in this growing process,” Lissette adds.

With loan options from $10,000 to $5.5 million, Pursuit has funding options to help you purchase or build commercial real estate for your business, get working capital to help it thrive, and much more.

Take a look, then contact us to learn more.