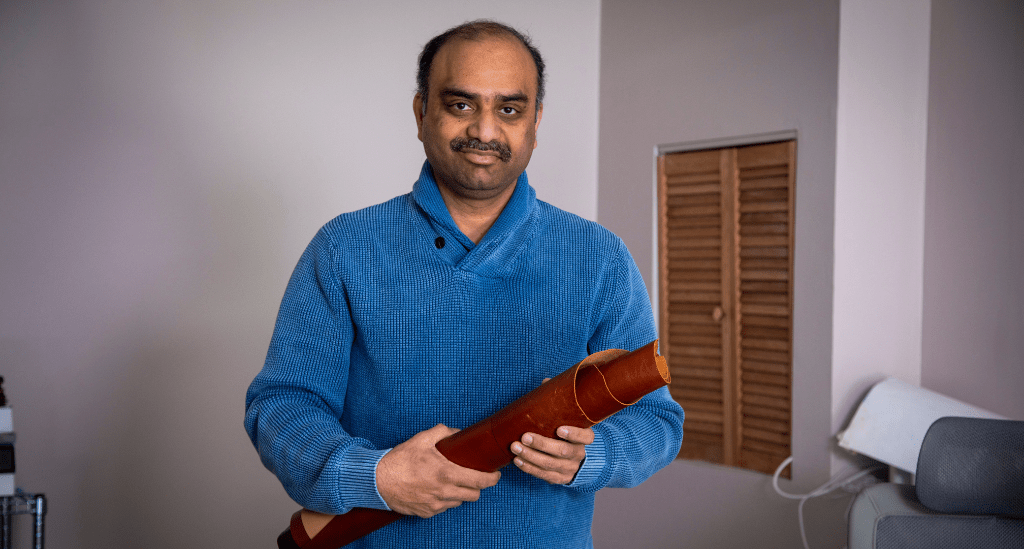

Sri Balan, founder and owner of A Line Leathers, LLC, says, “With financing in hand, I’ve built an inventory of goods that my customers want, which results in meeting the high projections that I set for the business.”

Here’s how he secured two working capital loans through Pursuit and the Connecticut Small Business Boost Fund to leverage opportunities, diversify his business’s revenue, and grow profitable product lines.

Turning lifelong experience into a dream business

Sri’s experience in the textile industry began during his childhood in India, where he learned the trade from family members – notably from his father, who’s still involved with India’s leather goods and textile trades. In 2001, Sri was part of a team that launched a tannery in India that’s still in operation today.

After emigrating to the U.S., he founded A Line Leathers in Hartford, CT, in 2016 with a goal to be the leading leather and fabric import/export wholesale business for fashion and accessory designers and manufacturers in the Northeastern U.S. Nearly all of his leather pelts and finished products – about 99% — are imported from India.

Since launching his business, he’s now diversifying and expanding finished-goods product lines to fulfill consumer demand that he’s identified in the market.

Securing working capital to leverage new opportunities

“When I launched the retail side of the business last year, the response was very good, and I met the high projections that I set,” Sri explains.

But while his business was self-funded for several years while operating in a business-to-business-only model (B2B), adding a business-to-consumer (B2C) component created a need for additional working capital. In B2B, clients typically provide a down payment on orders, which Sri could leverage to purchase wholesale goods. With B2C lines, he doesn’t receive payment until consumers purchase the finished products.

Sri found Pursuit through an online search, and soon after, he was in touch with Business Development Officer Manny Maysonet. Manny suggested that Sri apply for the Connecticut Small Business Boost Fund.

While Sri wasn’t new to business financing – he’d secured funds for his tannery business in India – the process was different in the U.S. He says that the guidance he received from his Pursuit team was invaluable, especially the help he received to get his financial documents ready to apply for the loan, which he did in January 2023. Soon, he received $30,000.

He says, “When I got the financing, it was a tremendous help for the business because it enabled me to get the inventory needed to meet customer demand and to prove my plan.”

A second round of working capital

Sri explains that as the holiday-season purchasing window approached early in the summer, he knew he would need additional funds to rebuild his inventory – and again, he turned to Pursuit and the CT Boost Fund program.

“My second working capital loan was approved for $33,000,” Sri says. This round of financing builds on positive momentum and helps Sri to have the highest-quality products available.

Small business financing that offers additional benefits

As a recipient of the CT Boost Fund program’s financing, Sri was eligible for free business-consulting services to further strengthen his operations and support his success. In partnership with the University at Hartford’s entrepreneurship program and Pursuit team member Irene Dominiguez, a new website has been developed for A Line Leathers. Sri also received help to get his business financials professionally prepared.

“Now I feel confident that this year will be even better,” he says.

Pursuit helps solopreneurs like Sri benefit from the right team

“Although I had prior industry and business-ownership experience, as the sole owner and employee for A Line Leathers, I’ve learned that if you seek help, build relationships, and learn from the process, there’s so much support for small businesses. With funds in-hand, I can move forward with my plans and achieve my goals. I’m working hard to make my company successful, and now the business supports me too, and that makes me so happy,” Sri says.

Pursuit offers more than 15 small business loans and a line of credit for small businesses throughout New York, New Jersey, Pennsylvania, and Connecticut and we can help you, too. Explore our financing options, then contact us to learn more.