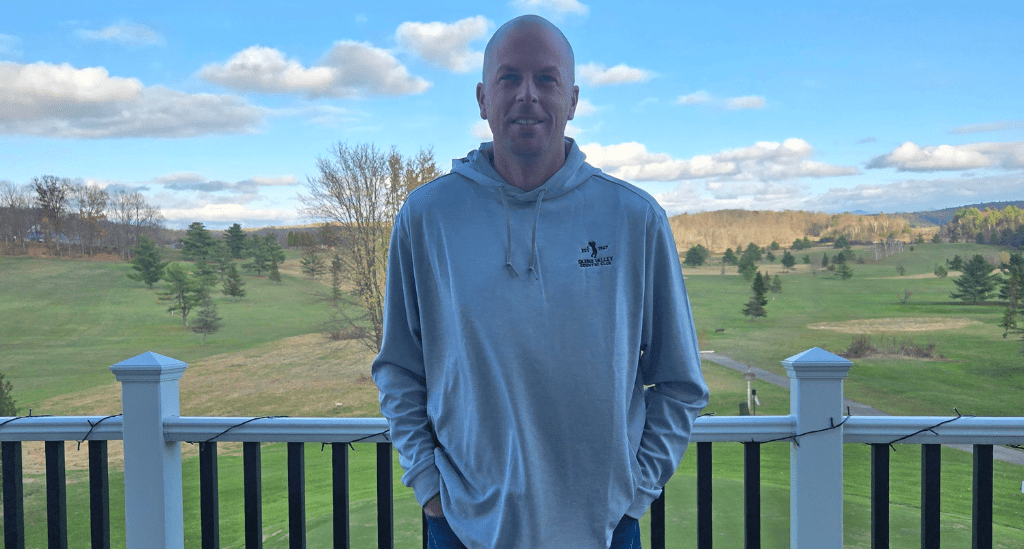

As the legend goes, in 1975, Cliff Sparks – a former farmer in Whitehall, NY, who had converted his farm into Skene Valley Country Club – spotted Bigfoot ambling near the opening fairway. Today, with the help of two SBA loans from Pursuit, the legacies of both the beloved golf course and Bigfoot’s presence are safe and well in the hands of Cliff’s grandson, Grant Sharrow.

Here’s how Grant secured two SBA loans to purchase the property and gain working capital to help him strengthen the business’s foundation and build a more secure future.

Grant brings the course back to the family

Skene Valley opened to the public in 1967, after renowned golf-course designer Mark Cassidy, Sr., created an 18-hole course optimizing the property’s stunning Adirondack scenery. When Cliff passed away in 2012, he left the course to relatives but after several years, they decided to sell to an outside buyer.

Grant grew up playing the course and had long dreamt of running and owning it, too. When the then-current owners decided to sell, he jumped at the chance – but not before creating a business plan, working out the financials, and then looping in his wife.

“It was something that I always envisioned,” he admits. “But I knew it would be a lot of work and a significant financial and time commitment, so I tried to work out the logistics before I proposed the plan to my wife. I wanted her to love the idea as much as I did!”

He met with business brokers and banks to gain a sense of what he’d qualify for in terms of financing because, Grant says, “I had to know whether this was realistic before setting anything else in motion.”

Banks and business brokers recommend Pursuit for SBA loans

With his wife’s support and the security of ongoing income from his work with the New York State Department of Corrections, Grant moved forward. After discussing the project with his bank, one of his earliest contacts was with Pursuit VP Nicole Deyo.

“I had known Nicole outside of this project and when both my bank and my business broker said that Pursuit is the best partner for SBA loans, I was happy to have the opportunity to work with her,” Grant says.

Two SBA loans provide the financing Grant needed

Grant received two SBA loans for the project – an SBA 504 loan and an SBA 7(a) loan.

The SBA 504 loan provides long-term, fixed rate financing of up to $5.5 million for owner-occupied real estate, such as the golf course, and fixed assets and equipment. The program can also be used to refinance debt incurred for these types of purchases.

For a typical SBA 504 loan project, a 10% down payment is required and for special-use properties, like a golf course, the down payment is 15% – significantly less than the 30-40% (or more) that’s required for convention commercial mortgages. In addition, the SBA 504 program offers a fixed interest rate and a longer repayment term, which helps lower the monthly repayment amount.

For many small business owners, the SBA 504 is the best option for commercial real estate purchases. Grant also received an SBA 7(a) loan, which offers financing up to $5 million for a broad range of uses and great terms.

“The SBA 504 loan made it possible to buy the course,” Grant explains, “and the SBA 7(a) gives me the working capital I need for ongoing expenses and to invest in the business. That includes expanding our offerings to engage golfers year-round, such as purchasing two golf simulators that we’ll have here soon. That’s huge for a business like ours that otherwise loses revenue when the course is closed for the winter.”

Over the years, the family converted a barn into a bar and casual dining spot that’s popular with locals and tourists alike, and Skene Valley has about a dozen employees from grounds crew to restaurant staff. Looking ahead, Grant aims to build membership while also expanding outreach to the public to make it a preferred golf course for all.

The right purchase for Grant, with the right loans from Pursuit

Grant admits that a deal this large and complex took time, but he says that his bank and his Pursuit team, led by Nicole, were terrific.

“There’s so much potential here at the club and it’s great to know that Pursuit has confidence in me and the business. Whenever it felt daunting, Nicole would remind me that this was the right purchase for me and the right loan for Pursuit, because it’s their mission to help small businesses like mine,” Grant says.

Pursuit is a leading small business lender serving businesses across New York, New Jersey, Pennsylvania, Connecticut, Nevada, Illinois, and Washington. We offer loans and a line of credit for working capital, commercial real estate, equipment, and much more. We’ve helped thousands of small business owners get the funding they need to achieve their goals and dreams, and we can help you, too.

Contact us today to learn more.