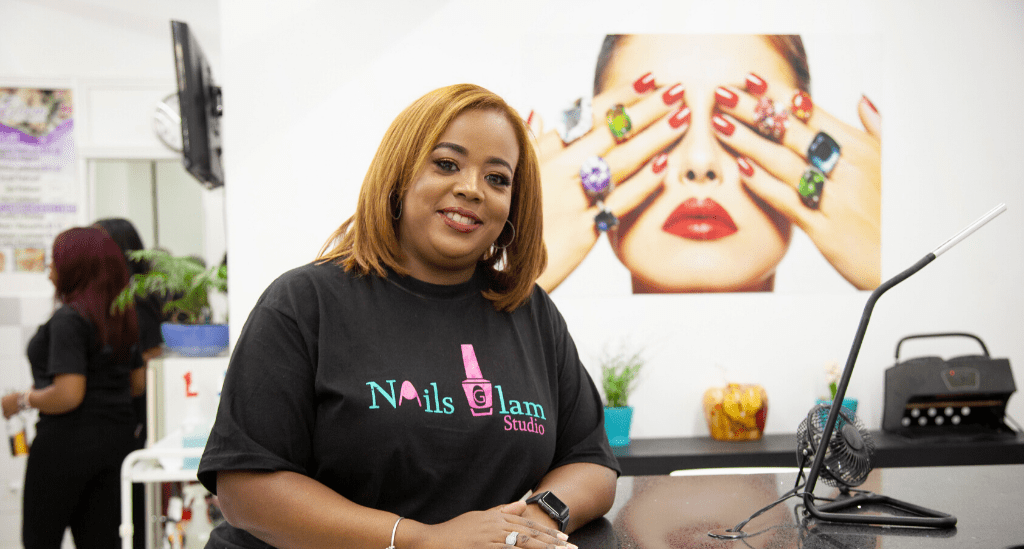

Just steps away from “the Hub” in the heart of the South Bronx, you’ll find Nail Glam Studio – a nail salon that offers everything from simple manicures and pedicures to extravagant nail art. Inspired by her sister’s talent for nails and her lifelong dream of owning her own business, Yahaira Caraballo opened Nail Glam Studios in 2013. With the help of an SBA Microloan through Pursuit and her Pursuit business advisor Aissatou Bah, Yahaira is now fulfilling her entrepreneurial dreams.

We sat down with Yahaira to learn more about her business, inspirations, and journey, which took her from the Dominican Republic to the Bronx.

Did you have any women role models or mentors that helped and supported you in starting your own business?

Actually, I decided to open Nail Glam Salon because of my sister. She moved to the United States in 2003 without speaking any English. But she had a talent for doing nails and used to practice on me. Shortly after moving to the US, she started working at a nail salon. After seeing her work for other people, I came up with the idea for Nail Glam Studio. In many ways she is the body of the business and I am the brains because she is in the store everyday doing nails while I’m in behind the scenes managing and coordinating everything else.

So in many ways, your sister was the inspiration behind Nail Glam Studio?

Yes! Many people thought I was crazy when I first told them that my sister and I were opening our own nail salon. But I believe that was because nobody saw the potential that I saw in my sister and in this business. In fact, I think I saw potential in my sister that she couldn’t even see in herself. I knew how talented she was at doing nails and I knew that her talent could grow in a different setting.

Did you always want to be an entrepreneur?

I’ve wanted to start my own business for as long as I can remember; I was just looking for something I was really passionate about. Before I came up with my idea for Nail Glam Studio, I was always on the lookout for potential business ideas. There were a couple ideas that I was interested in but ultimately I liked the nail salon idea the best because it allowed me to work with my sister.

What are some of the challenges you encountered when opening your business?

When I first started Nail Glam Studio, I wasn’t aware of alternative lenders, so I opened the business with my savings. This is part of the reason why many people were telling me it was not a good time to start a business. No matter what they said I was very committed to the idea and I remember thinking that sometimes, in order to be successful, you have to put everything you have into your dream.

The first couple months were hard, not just because I used my savings, but also because those months were a learning process. When I first opened the salon, I knew very little about business and I didn’t have anybody to coach me on how to run a business. My husband has some business knowledge, so of course he helped me when he could, but for the most part the process was a learning experience and somewhat of an experiment.

How did you find out about Pursuit?

I bank with JP Morgan Chase, so when I first thought about getting a loan I applied through them. Unfortunately, I didn’t qualify for a loan through Chase and instead I was referred to My Way to Credit through a Chase representative. After filling out a couple of applications through My Way to Credit, I was connected to Aissatou Bah at Pursuit.

How has Pursuit helped your business?

One of the reasons I didn’t qualify for a loan through Chase was because I didn’t have a lot of the necessary paperwork. I had never created a balance sheet or interim financials before. Aissatou worked with me throughout the whole experience to help me create these documents. There was a lot of back and forth between me, my business advisory services, and my accountant. I was very determined to get a loan, and Aissatou helped make that happen.

Aissatou is also going to connect me with a consultant to help me learn QuickBooks, so I can learn how to better organize and track my financials.

How do you plan to use your Pursuit loan?

I am planning to use my loan to upgrade my business. When I first started my business, I paid for all the equipment with my savings. This will be my first time upgrading that equipment, and I want to make sure all my equipment is in compliance with the new state rules and regulations. Actually, the reason why I was so determined to get a loan was because I wanted to make sure I didn’t have to fall back on my savings when updating these appliances.

I would also like to use my loan to hire more employees. There is so much potential in the South Bronx, and I would really like to create more jobs and more areas of work for people in the community.

Do you have any advice for entrepreneurs in the South Bronx?

As a matter of fact, I have actually been helping one of my sister’s friends start her own business. I helped her find a venue near me and have been guiding her in the best way I can. Even though her business is different than mine, I have been helping her in the way that I wish someone had helped me when I first started. I think it is important for entrepreneurs everywhere and in the South Bronx to try to find other small business owners who can help support them through the experience.

Also, I told this to my sister’s friend but I would also like to tell it to all entrepreneurs, especially those in the South Bronx: Continue to pursue your dreams because even though they are not always easy, they are not impossible.

What are your upcoming goals for your business?

In the next couple of years I would really like to expand my business and open up another salon in my community. I don’t want too many stores but I think at least two would be nice.

We look forward to seeing continuous success and growth for Yahaira and Nail Glam Studio.