Are you a small business owner looking to grow your business? Are you trying to figure out how much money you’ll need to put a growth plan into action? One of the key questions you should ask yourself is, “how much additional working capital do I need to grow my business?” This article will help answer that question.

What is working capital?

Let’s first be clear on what the term working capital means. From an accounting standpoint, working capital = current assets – current liabilities. Current assets are short-term and can be converted quickly to cash. This includes your accounts receivable and inventory. Current liabilities are obligations that come due within one year, which are primarily your accounts payable and short-term debt

The term “working capital” is often used incorrectly when talking about the financing needs of a business, especially for startups. For example, if your business is looking to get funding for an advertising budget and salaries for new employees, what you need is “long-term capital” or equity. If your business is unable to support the expenses for advertising and salaries, then most likely it is under-capitalized. If your business is projecting losses in your first year, then you most likely need equity, and not working capital.

Money used to fund short-term assets like your business’s inventory and accounts receivables is correctly considered working capital financing.

How much working capital is needed to grow your small business?

To answer this question, you need to understand how money flows through your business. In other words, you need to understand your “working capital cycle.” The cycle consists of (1) how quickly current assets (accounts receivables & inventory) are turned into cash and (2) how quickly that cash is used to pay current liabilities (accounts payable). The working capital cycle is also referred to as your turnover rates for accounts receivables, inventory, and accounts payable.

Turnover Rates

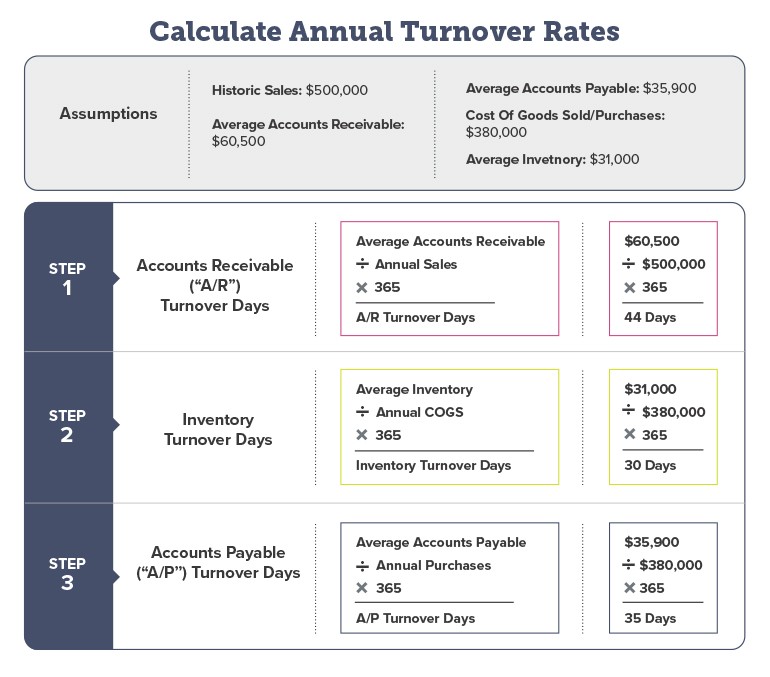

Your business’s historical turnover rates are the first step in forecasting your growing working capital needs. You need to analyze your actual income statement and balance sheet to find out the following information: How many days of inventory do you keep on hand (inventory turnover)? How many days does it take for customers to pay you (accounts receivable turnover)? How many days do you take to pay your vendors (accounts payable turnover)?

The chart below shows how to calculate your annual turnover ratios.

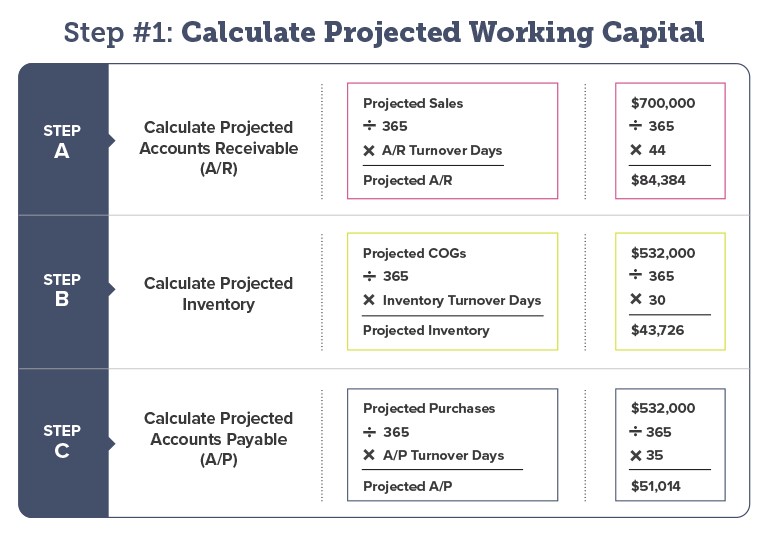

Now that you have calculated your turnover rates, you are ready to forecast your working capital needs based on your plan for growth. This growth will require carrying higher levels of inventory and accounts receivable, which will require additional working capital financing. But “How Much?” is the question.

To do that calculation, you need to have a projected income statement, which includes both projected sales and cost of goods sold. Using these figures and the working capital turnover ratios shown above, you can get an estimate of how much additional working capital is needed to grow your business. See the example below.

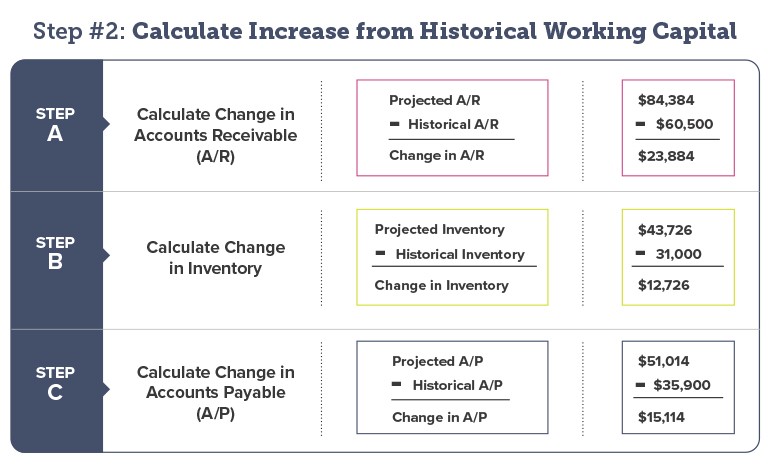

Using these projected balances, you can figure out the changes to working capital by calculating the difference between your projected and historical balances for accounts receivable, inventory, and accounts payable.

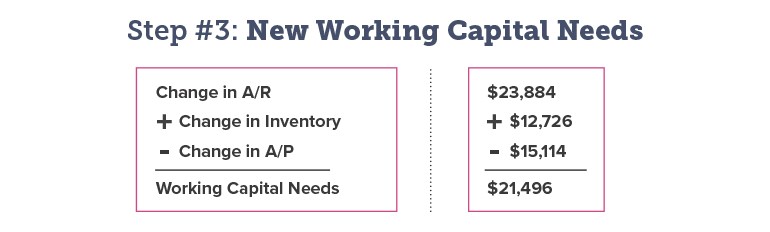

So what does this all mean? Your new working capital needs equals the change in Accounts Receivable plus Inventory minus Accounts Payable.

For our example, if you project to grow your sales from $500,000 to $700,000, you will need additional working capital of $21,496.

How to fund additional working capital needs

For small businesses that have been in operation and generating profits, you will most likely have reinvested some of the profits back into the business (retained earnings). You reinvest your profits into your inventory, use the profits to carry increased levels of receivables or you use the profits to pay down your trade suppliers. In essence, the retention of these profits increases the working capital that enables you to grow.

If you did not earn or retain sufficient profits to finance your own growth, however, you need to turn to borrowings for your increased working capital needs. Generally speaking, small businesses find it difficult to obtain working capital financing from traditional banking sources.

As a result, you might be tempted to turn to non-bank lending sources such as factoring, merchant cash advance, and online lenders. You should know that these sources of working capital financing charge annual percentage rates (APR) of 50% or more! We encourage you to calculate the APR of factoring, merchant cash advance, and a typical online loan to uncover the true cost of each loan type.

What are alternative sources of working capital financing?

Small business owners needing to finance inventory and accounts receivables may be eligible for financing from community lenders, such as Community Development Financial Institutions (CDFIs). CDFIs are nonprofit, private financial institutions that provide affordable lending to small business owners who are not being served by the banking community.

In addition to their own loan programs, many CDFIs also participate in U.S. Small Business Administration (SBA) loan programs. The annual percentage rates on CDFI and SBA financing is significantly lower than for other non-banking sources of financing such as factoring, merchant cash advance, and online lenders!

Talk to Pursuit about your working capital needs

When growing your small business, you will need to make an additional investment in inventory and accounts receivable. How much working capital you need can be estimated by creating projections that use your historical turnover rates for inventory, accounts receivable, and accounts payable as shown in the example above.

If you are a small business owner in need of working capital financing, avoid the high cost associated with financing products such as factoring, merchant cash advance, and peer-to-peer online lending by exploring alternative, lower-cost financing options available through your local CDFI. You can start by learning more about Pursuit’s SmartLoan, which offers loans up to $100,000 with affordable monthly payments.