Westchester, NY Small Business Loans

Westchester, NY: A Beautiful Place for Business

The Hudson Valley is defined by beautiful geographic features, the mighty Hudson River, and its proximity to more than 23 million people in metro New York and the Capital Region. It’s also home to the State University of New York (SUNY) campuses in New Paltz and Purchase, as well as prestigious liberal arts colleges including Bard, Vassar, and Marist.

Many county and New York state organizations support local business development in the area, such as the Hudson Valley Economic Development Corporation, Empire State Development, and Hudson Valley Gateway Chamber of Commerce. With highly coveted residential real estate and excellent public schools, the Hudson Valley and Westchester County offer incredible opportunities for entrepreneurs.

Pursuit is approved to offer SBA loan products in Westchester, NY under SBA’s Preferred Lenders Program & SBA Express Program.

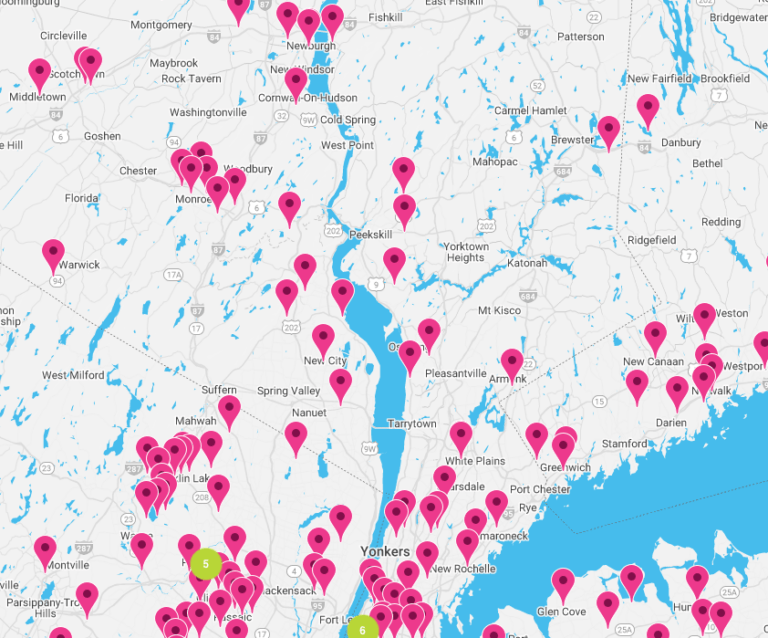

Businesses funded in Westchester, NY since FY2023

Funding Businesses in Westchester, NY and Beyond

No matter what stage your Westchester, NY business is in, you’ll find financing options with Pursuit. From startup funding to owner-occupied commercial real estate loans, and everything in between, Pursuit offers more than 15 different business loan programs to meet your needs.

Business owners from Kingston to Yonkers, and Newburgh to Woodbury and beyond have found a path to success with Pursuit. It’s easy to get started – simply complete an online application and Pursuit’s lending experts will match you with the best-fit financing solution.

- "Carol made it so easy. Honestly, if she hadn’t reached out, I’m not sure our business would exist today.”

- "Working with Pursuit for our small business loan was such a great experience."

- "Working with Pursuit has been great. They made the process really easy for us and they've stayed in touch."

Business Loan Programs in Westchester, NY

New York Forward Loan Fund 2

SBA 504 Refinance

Frequently Asked Questions

You’ll find a wide variety of small business loan options in Westchester, and the best place to start is with your business bank. Reach out to you bank to find out more about what they offer and if you qualify for their products. You can also reach out to Pursuit! You can apply for loans for working capital, startup expenses, fixed assets and so much more while tapping into our team’s decades of expertise.

Eligibility requirements vary depending on the loan program that best fits your needs. However, before you apply, it’s a good idea to request your free credit report and review it for any errors. The sooner you identify errors, the sooner you can fix them before you apply. You may need to meet certain requirements for how long you’ve been in business, your location, and your industry, so be sure to review those before you apply as well.

You may need different documents depending on the loan program that fits your situation, but most programs will require your personal and business taxes, recent business bank statements, a debt schedule, and your interim financial statements (like a profit & loss statement and balance sheet).

Yes! Pursuit offers the Main Street Capital Loan Fund for startups and early-stage businesses in Westchester, NY and beyond, and the SBA 7(a) is also a great fit for startups!

Interest rates for loans depend on many variables and Pursuit offers a range of rates among our loan programs. When you apply, you’ll have clear communication on the best program for you and the interest rate that comes with it.