Pittsburgh Small Business Loans

and take your business to new heights!

Building Strong Businesses in the City of Bridges

The Pittsburgh metro area is ripe for business, so it’s no surprise that entrepreneurs and innovators are flocking to the area to launch and grow their ventures. Whether you’re strating your business in Pittsburgh, or you’ve long called the Steel City “home,” you’ll find financing solutions through Pursuit to make it even stronger.

From the city’s rich history in steel and manufacturing, to its future in tech investment, Pittsburgh has so many opportunities for entrepreneurs.When you’re ready to take a new opportunity, Pursuit is here with the right financing to make it a success.

Pursuit is approved to offer SBA loan products in Pittsburgh under SBA’s Preferred Lenders Program & SBA Express Program.

Businesses funded in the Pittsburgh area since FY2023

Funding Businesses in Pittsburgh

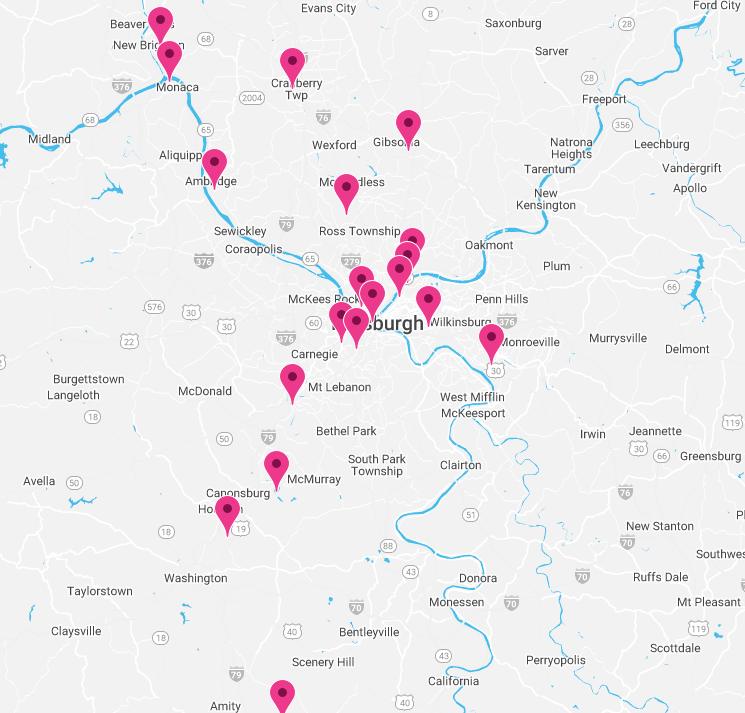

From Lawrenceville to Squirrel Hill, to the neighboring suburbs of Cranberry Township and Monroeville,, Pursuit has worked with hundreds of Pittsburgh area entrepreneurs to reach higher and grow. You’ll find funding options for working capital, equipment, debt refinance, owner-occupied commercial real estate, and so much more when you apply with Pursuit.

Breweries, salons, healthcare centers, manufacturers, and a whole host of industries have found financing with Pursuit. Will your Pittsburgh business be next?

- "I can’t stress enough how easy my Pursuit team made the loan process."

- "Our Pursuit team and bank were responsive and great to work with on our SBA 504 loan."

- "If I didn't have this option, I couldn't have moved forward on this location. It's that simple."

Business Loan Programs in Pittsburgh

Pennsylvania Small Business Credit Initiative (SSBCI)

Pennsylvania Small Business Credit Initiative

Frequently Asked Questions

In addition to the conventional financing options you’ll find at your bank, there are numerous alternative small business loan options available to your Pittsburgh business. Pursuit offers SBA financing through programs like the SBA 504, SBA 7(a), and SBA Microloan programs, as well as our own loan programs like the Pursuit Smartloan and small business line of credit. Reach out to our team today to find the best fit for your business.

Interest rates vary by product and can change with the market. Given the wide range of rates available, it’s difficult to present an accurate average rate for the area. When you’re searching for financing, do some research to find out what rates might be available to you from a variety of lenders. That will give you a better sense of what’s possible for your specific business needs and situation.

Yes! You can apply for the Small Business Advantage Grant that’s available throughout Pennsylvania, or explore opportunities through the City of Pittsburgh. You can also check in with the local Small Business Development Center (SBDC) to see if there are opportunities for your neighborhood or your industry.

Your documentation requirement may vary by program, but most require:

- your government-issued photo ID

- the last two years of your personal and business tax returns

- interim financial statements

- information on your existing debts

Depending on what’s required for the program that best meets your needs, you may be asked to submit additional information. You can always ask your lender what’s required before you start your application so everything is ready to go ahead of time.

Yes! The SBA 7(a) loan program is a great option for startup businesses. It can be used for working capital, to purchase furniture, fixtures, and equipment, leasehold improvements, and so much more. You can also combine multiple startup business expenses into one loan through the program.