New Jersey Small Business Loans

We're Big on Small Businesses in New Jersey

Pursuit works with New Jersey entrepreneurs like you to find the best financing solutions for your business. Although it’s small in square miles, New Jersey offers huge opportunities and numerous incentives that make it a great place to start and grow your business.

With nearly 9 million people calling New Jersey “home,” and the state’s proximity to major East Coast cities, there’s plenty of room to grow with a small business loan.

Pursuit is approved to offer SBA loan products in New Jersey under SBA’s Preferred Lenders Program & SBA Express Program.

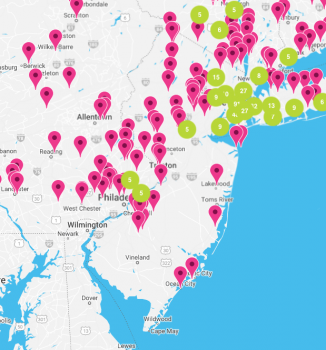

New Jersey businesses with funding from Pursuit since FY2023.

Funding Business Across New Jersey

Whether you’re in healthcare, technology, tourism, or another growing industry, Pursuit has business loan options to keep your business reaching higher. From Hoboken and Jersey City, to Newark, Trenton, and Cape May, businesses throughout New Jersey have found success with financing and resources through Pursuit.

We’ve worked with hundreds of New Jersey businesses to buy commercial real estate, boost their working capital, support startup expenses and so much more. Will your business be next?

- "But without financing from Pursuit, it’s possible that we’d never have gotten it off the ground.”

- “Working with Pursuit was great and the SBA 504 loan program is fantastic for [acquisition] projects like this.”

- "Having funds in-hand has given me peace of mind and the flexibility to make choices that support my goals.”

Business Loan Programs in New Jersey

Frequently Asked Questions

You’ll find loans to support nearly any business need in New Jersey when you work with Pursuit! We offer loans for working capital, equipment, inventory, owner-occupied commercial real estate, and much, much more.

Each loan program has its own interest rate and term and you’ll have full transparency on what’s being offered for your loan should you get approved. SBA 504 loans in New Jersey go up to 25 year terms and have below-market interest rates that are updated each month, while SBA 7(a) loan interest rates are calculated using the prime rate. Rest assured that Pursuit will work with you to find the program with the best rates and terms for your needs.

Yes! While Pursuit does not offer grants at this time, we’re a participating lender in the NJ Capital Access Program. If your NJ-based business has been in operation for at least one year, you can apply for up to $250,000 at a fixed interest rate between 9.5-11.5%, with a 3-5 year term. Funds from this program can be used for working capital, supplies, rent, utilities, marketing and advertising, and other business expenses.

Approval times vary by loan program. The best way to streamline the process is to have all required documentation ready to go before you apply, and to be responsive when additional follow up is needed.

You can start right here on the Pursuit website! Visit our resource center for tips and advice to overcome challenges and grow your business. Eligible Pursuit clients can also access lo- and no-cost advisory services on everything from financial management to marketing and more. If you need more assistance, reach out to you local Small Business Development Center (SBDC) or chamber of commerce!