Small Business Loans in Hartford, CT

Boosting Connecticut's Capital with Affordable Financing and Resources

Pursuit brings decades of small business lending expertise to Hartford, CT, with affordable and responsible options for your business needs. While Hartford may be known as the “insurance capital of the world,” it offers a world of opportunity to small businesses in all industries.

With its proximity to major cities like New York City and Boston, Hartford is a great place to start or grow your business. Create your legacy and be a part of Hartford’s rich history!

Pursuit is approved to offer SBA loan products in Hartford, CT under SBA’s Preferred Lenders Program & SBA Express Program.

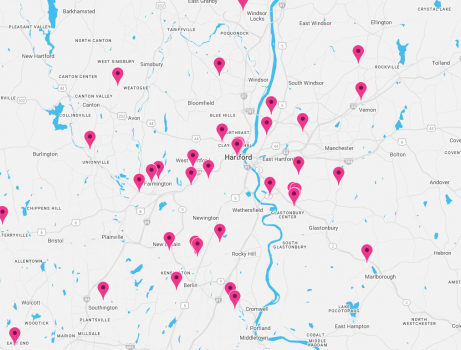

Hartford, CT businesses with funding from Pursuit since FY2023.

Funding Businesses in Hartford, CT and Beyond

Working with Pursuit means working with a lender who understands the heart of starting, running, and growing a business. You can access low-cost financing through the Connecticut Small Business Boost Fund through Pursuit, or the SBA’s most popular loan program, the SBA 7(a), for nearly any business need.

When you work with Pursuit, you’ve got a partner who wants to find the right path to success for you and your business. You’ll find support beyond funding through Pursuit’s Business Advisory Services where you’ll get partnered with expert consultants who can take your business to the next level. We’ve worked with many small businesses throughout Connecticut – will yours be next?

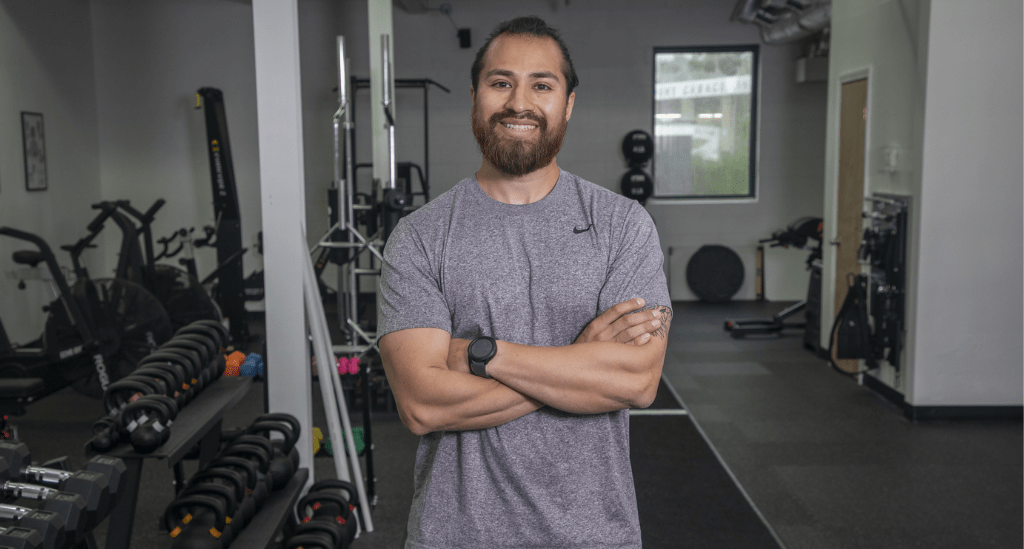

- "The whole experience of working with Anthony and the Pursuit team has been great."

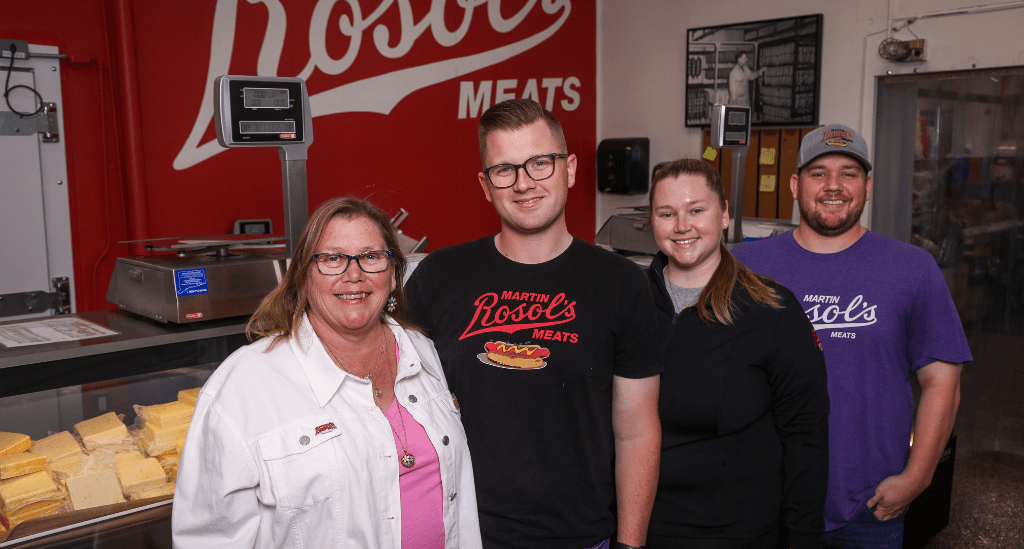

- "We wanted to invest in the business and the Boost Fund offered a loan with a good rate, so we went for it.”

- "The financing terms were great, but it was our Pursuit team that made the experience excellent, from start to finish.”

Business Loan Programs in Hartford, CT

CT Small Business Boost Fund

SBA 504 Refinance

Frequently Asked Questions

You can find small business loans for any business need in Hartford, CT, and the best place to start your search is with your business bank. Talk to a lender at your bank to find out more about what they offer and what you’ll need to qualify. You can also explore alternative lenders like Pursuit who offer SBA loan options as well as other responsible, affordable small business loans.

Yes! The City of Hartford offers a microenterprise microgrant program and a small business investment fund program, among other support programs. One of the most affordable funding programs available in Hartford is the Connecticut Small Business Boost Loan Program, which offers up to $500,000 at a 4.5% fixed interest rate. The program can be used for working capital, equipment purchase, inventory, and so much more!

It depends on your lender’s qualification criteria, but the higher your credit score the more likely you are to get approved for financing. Many programs at Pursuit require at least a 640 credit score, but our underwriting team will review a number of factors to determine if you’re eligible for our loan programs.

Each loan program and lender have their own timelines for approval, so be sure to ask how long the process may take when you’re early in your discussions with your lender. The best practices to keep your application moving forward to approval is to submit a complete application with all required information and to be responsive to any additional questions from your lender.

It depends! Interest rates and terms vary by program, so make sure you’re clear on both of those aspects before you agree to an offer for a loan.