SBA 504 Interest Rates

The SBA 504 loan program provides below-market fixed interest rates for owner-occupied commercial real estate and other fixed asset purchases, such as machinery and equipment. Here, you can access the latest information on SBA 504 rates.

To learn more about interest rates for our general business loan programs, visit our loan programs page.

Current SBA 504 interest rates

SBA 504 Interest Rates

10 year term: as low as 5.84%

20 year term: as low as 6.08%

25 year term: as low as 6.01%

SBA 504 Refinance Interest Rates

10 year term: as low as 5.84%

20 year term: as low as 6.08%

25 year term: as low as 6.01%

Historical SBA 504 interest rates

| 2025 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 6.512 | 6.283 | 6.243 | 6.432 | 6.393 | 6.373 | 6.373 | 6.233 | 6.003 | 5.922% | 5.862% | |

| 20 Year SBA 504 | 6.581 | 6.350 | 6.310 | 6.450 | 6.410 | 6.390 | 6.390 | 6.250 | 6.020 | 5.983% | 5.923% | |

| 10 Year SBA 504 | 6.642 | 6.642 | 6.337 | 6.337 | 6.204 | 6.204 | 6.174 | 6.174 | 5.766 | 5.766% | 5.652% | |

| 25 Year Refi SBA 504 | 6.541 | 6.312 | 6.272 | 6.461 | 6.421 | 6.401 | 6.401 | 6.262 | 6.032 | 5.925% | 5.865% | |

| 20 Year Refi SBA 504 | 6.611 | 6.380 | 6.340 | 6.480 | 6.440 | 6.420 | 6.420 | 6.280 | 6.050 | 5.986% | 5.926% |

| 2024 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 6.361 | 6.381 | 6.281 | 6.690 | 6.550 | 6.351 | 6.201 | 6.041 | 5.762 | 6.033 | 6.283 | 6.093 |

| 20 Year SBA 504 | 6.420 | 6.490 | 6.360 | 6.760 | 6.650 | 6.440 | 6.270 | 6.110 | 5.829 | 6.100 | 6.350 | 6.160 |

| 10 Year SBA 504 | 6.526 | 6.526 | 6.587 | 6.587 | 6.892 | 6.892 | 6.476 | 6.476 | 5.865 | 5.865 | 6.459 | 6.459 |

| 25 Year Refi SBA 504 | 6.390 | 6.410 | 6.310 | 6.719 | 6.579 | 6.382 | 6.230 | 6.070 | 5.791 | 6.062 | 6.312 | 6.122 |

| 20 Year Refi SBA 504 | 6.450 | 6.520 | 6.390 | 6.790 | 6.680 | 6.470 | 6.300 | 6.140 | 5.859 | 6.130 | 6.380 | 6.190 |

| 2023 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 6.310 | 6.010 | 6.329 | 5.880 | 6.020 | 6.329 | 6.579 | 6.549 | 6.808 | 7.129 | 7.019 | 6.590 |

| 20 Year SBA 504 | 6.282 | 5.982 | 6.332 | 5.952 | 6.072 | 6.381 | 6.632 | 6.602 | 6.862 | 7.180 | 7.020 | 6.610 |

| 10 Year SBA 504 | 6.433 | 6.433 | 6.768 | 6.768 | 6.036 | 6.036 | 7.063 | 7.063 | 7.052 | 7.052 | 7.207 | 7.207 |

| 25 Year Refi SBA 504 | 6.327 | 6.028 | 6.347 | 5.898 | 6.038 | 6.347 | 6.597 | 6.567 | 6.826 | 7.158 | 7.048 | 6.619 |

| 20 Year Refi SBA 504 | 6.300 | 6.000 | 6.350 | 5.970 | 6.090 | 6.400 | 6.650 | 6.620 | 6.880 | 7.210 | 7.050 | 6.640 |

| 2022 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 3.213 | 3.594 | 3.925 | 4.676 | 5.117 | 5.187 | 4.977 | 5.437 |

6.439 |

6.529 |

6.529 |

6.110 |

| 20 Year SBA 504 | 3.067 | 3.449 | 3.761 | 4.615 | 5.057 | 5.127 | 5.047 | 4.886 | 5.338 | 6.362 |

6.452 |

6.032 |

| 10 Year SBA 504 | 3.070 | 3.070 | 3.807 | 3.807 | 4.922 | 4.922 | 4.962 | 4.962 | 5.320 | 5.598 | 6.534 |

6.534 |

| 25 Year Refi SBA 504 | 3.227 | 3.608 | 3.939 | 4.690 | 5.130 | 5.200 | 5.120 | 4.990 | 5.450 | 6.457 | 6.547 |

6.128 |

| 20 Year Refi SBA 504 | 3.081 | 3.463 | 3.775 | 4.629 | 5.071 | 5.141 | 5.061 | 4.900 | 5.352 | 6.380 | 6.470 |

6.050 |

| 2021 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 2.692 | 2.752 | 3.043 | 3.073 | 2.933 | 2.883 | 2.813 | 2.863 | 2.973 | 2.912 | 2.922 | 3.023 |

| 20 Year SBA 504 | 2.653 | 2.714 | 2.995 | 3.016 | 2.845 | 2.764 | 2.694 | 2.744 | 2.855 | 2.765 | 2.775 | 2.875 |

| 10 Year SBA 504 | 2.438 | 2.438 | 2.684 | 2.684 | 2.612 | 2.612 | 2.591 | 2.591 | 2.673 | 2.372 | 2.793 | 2.793 |

| 25 Year Refi SBA 504 | 2.733 | 2.794 | 3.084 | 3.114 | 2.974 | 2.924 | 2.854 | 2.904 | 3.014 | 2.926 | 2.936 | 3.036 |

| 20 Year Refi SBA 504 | 2.696 | 2.757 | 3.038 | 3.058 | 2.887 | 2.807 | 2.737 | 2.787 | 2.898 | 2.779 | 2.789 | 2.889 |

| 2020 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 3.710 | 3.460 | 2.878 | 3.029 | 2.758 | 2.597 | 2.406 | 2.66 | 2.406 | 2.582 | 2.552 | 2.622 |

| 20 Year SBA 504 | 3.639 | 3.388 | 2.804 | 2.955 | 2.683 | 2.522 | 2.341 | 2.210 | 2.361 | 2.553 | 2.523 | 2.583 |

| 2019 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 4.877 | 4.767 | 4.737 | 4.527 | 4.387 | 4.086 | 4.006 | 3.626 | 3.455 | 3.480 | 3.740 | 3.640 |

| 20 Year SBA 504 | 4.751 | 4.641 | 4.581 | 4.360 | 4.260 | 3.978 | 3.908 | 3.526 | 3.355 | 3.398 | 3.679 | 3.579 |

| 2018 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 25 Year SBA 504 | 5.316 | 5.346 | 5.286 | 5.207 | 5.317 | 4.987 | ||||||

| 20 Year SBA 504 | 4.64 | 4.94 | 4.92 | 5.024 | 5.214 | 5.314 | 5.254 | 5.294 | 5.244 | 5.153 | 5.253 | 4.922 |

| 2017 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 4.58 | 4.60 | 4.83 | 4.62 | 4.66 | 4.59 | 4.76 | 4.53 | 4.37 | 4.57 | 4.51 | 4.50 |

| 2016 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 4.82 | 4.31 | 4.54 | 4.30 | 4.31 | 4.22 | 4.08 | 4.08 | 4.09 | 3.99 | 4.35 | 4.59 |

| 2015 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 4.59 | 4.53 | 4.79 | 4.58 | 4.84 | 5.05 | 4.95 | 4.89 | 4.89 | 4.76 | 4.74 | 4.86 |

| 2014 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 5.53 | 5.30 | 5.28 | 5.18 | 5.07 | 5.06 | 4.94 | 4.95 | 4.99 | 4.81 | 4.87 | 4.77 |

| 2013 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 4.20 | 4.28 | 4.29 | 4.15 | 4.14 | 4.52 | 5.22 | 5.23 | 5.69 | 5.44 | 5.45 | 5.45 |

| 2012 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 4.83 | 4.70 | 4.79 | 4.74 | 4.45 | 4.49 | 4.45 | 4.44 | 4.27 | 4.25 | 4.16 | 4.00 |

| 2011 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 5.73 | 6.06 | 5.93 | 5.89 | 5.63 | 5.51 | 5.58 | 5.13 | 4.69 | 4.83 | 4.94 | 4.94 |

| 2010 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 5.79 | 5.55 | 5.6 | 5.77 | 5.52 | 5.29 | 5.21 | 4.93 | 4.62 | 4.95 | 5.09 | 5.56 |

| 2009 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 6.66 | 5.70 | 5.6 | 5.25 | 5.37 | 5.89 | 5.24 | 5.39 | 5.14 | 5.33 | 5.5 | 5.46 |

| 2008 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 6.14 | 6.13 | 6.46 | 6.34 | 6.46 | 6.65 | 6.84 | 6.99 | 6.57 | 6.57 | 7.72 | 7.17 |

| 2007 | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 Year SBA 504 | 6.29 | 6.26 | 6.2 | 6.29 | 6.28 | 6.28 | 6.79 | 6.75 | 6.53 | 6.54 | 6.48 | 6.26 |

Looking for interest rates for another loan program? View our full list of loan options.

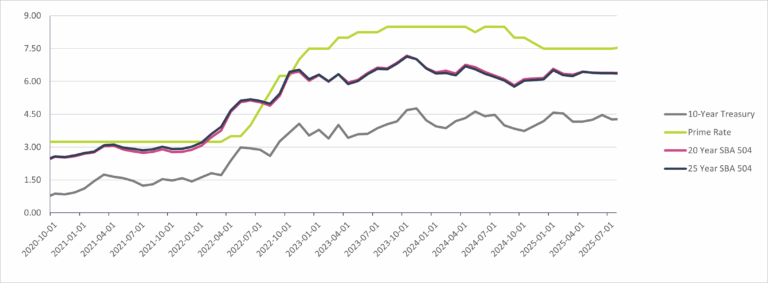

Comparative SBA 504 interest rates

What can the SBA 504 loan program be used for?

The SBA 504 loan program is a versatile program that you can use to fund expenses associated with the purchase of owner-occupied commercial real estate, property renovations, and/or heavy equipment purchases.

You can also use the SBA 504 loan program to refinance loans that you previously took out to finance fixed asset projects, or to cash out on the value of your property to fund working capital needs.

The SBA 504 loan program is designed to help businesses of all shapes and sizes grow and create jobs and opportunity in their communities. Whether you’re a start-up or a well-established business, you can take advantage of affordable SBA 504 loan rates and terms.

What are the other benefits of the SBA 504 loan program?

- Long terms: Terms of 10-, 20- and 25 years are available. Longer terms make the monthly payment on your loan more affordable.

- Low down payments: Typically, a 504 loan will require the owner to put 10% down. This makes larger property purchases and renovations a reality for growing businesses.

- Convert equity to working capital: If your business is eligible for an SBA 504 refinance, you can recoup existing equity as working capital at a low-interest rate with longer repayment terms, making it a very affordable option.

What will my SBA 504 loan rate be?

Your final interest rate will be set when your SBA 504 loan is fully funded. Rates are subject to change monthly.

How do SBA 504 loans work?

SBA 504 loans are unique because they are always made in conjunction with a first mortgage provided by your bank. For a typical 504 loan, your bank will lend you 50% of the total project cost, Pursuit will lend you 40% of the total project cost, and you will be required to put 10% down. The interest rate for the first mortgage will be determined by your bank.

If you are interested in the SBA 504 loan program, but are not yet working with a bank, contact us and we will put you in touch with a partner familiar with the SBA 504 loan program.

See the SBA 504 loan program in action

See the SBA 504 refinance program in action with our story on Butch Grimm and his family-owned promotional goods company, Grimm Industries. Through the 504 refinance program, Butch reduced his business’s monthly payments by $30,000, and gained access to $1 million in working capital from the equity in his real estate.

Crepini is a great example of how a specialty business can grow exponentially when the business responds to consumer demand. Together with the company’s pivot to e-commerce and the SBA 504 loan program, which allowed Crepini to relocate to a larger production facility, Crepini significantly scaled their business.

When twin brothers and former firefighters Karl and Kurt Hughes opened Bucket Brigade Brewery, they knew that their brand would have widespread appeal and they had confidence that they’d make a great product. With the SBA 504 loan program, these two brothers sealed the deal on their brewery’s historic location, and are well prepared for future success.

When Jennifer Burns was ready to refinance her commercial real estate mortgage for her massage and wellness center, Healing Hands, she was referred to Pursuit and the SBA 504 refinance program to lower her monthly payments.

Let's get started

You can start an application for an SBA 504 loan online in about 10 minutes. Once we have your basic information, you’ll speak with a loan officer who will walk you through the specifics and start your full application if you qualify.