This article is a guest post from Pursuit Consulting Corps member Alek Marfisi (Upwind Strategies).

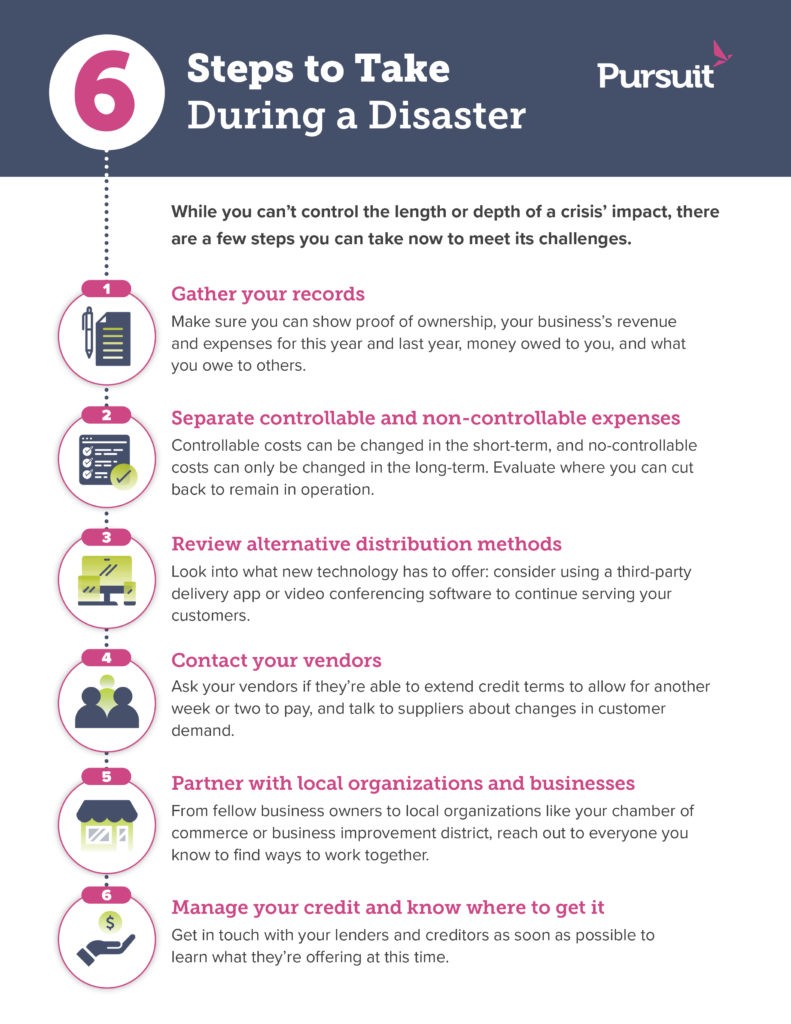

COVID-19 has deeply affected people throughout the world and businesses throughout the United States. While we have no control over the depth and length of this crisis’ impact, as a business owner you can take the following steps to give you and your business the best chance of meeting the present challenges.

1. Gather your records

During our time working on business recovery from Hurricane Sandy, the number one reason businesses were unable to receive assistance was because they couldn’t demonstrate that they were actually affected by the storm.

The government needs to see data in order to evaluate your need for assistance. Apart from seeking outside assistance, it’s important to benchmark your performance early on, so you can tell whether things are getting better or worse, to know how much longer your business can last, and set goals for emerging from the crisis.

These are the must have items for all businesses:

- Proof of ownership and good standing: paperwork that proves the company’s existence, who owns it, and whether it is in good standing with the government.

- Your business’s revenues and expenses this year: make sure that your profit and loss statement is as up to date as possible. If you don’t have a bookkeeping system, gather your point of sale (POS) reports, bank statements, and receipts from your vendors and tally these up.

- Your business’s revenue and expenses last year: you’ll want to compare how you are doing this year to how you are doing for the same period last year. All government programs will need to see this as well.

Here’s a tip: calculate the percentage change in every revenue or expense category and see how much things have moved. - Who owes your company money and what vendors you owe money to.

2. Separate your controllable from your non-controllable costs

Simply put, you need to cut your expenses immediately. Breaking down your costs into controllable and uncontrollable costs is the key to doing this.

It’s all a matter of timing; controllable costs can be changed in the short-term and uncontrollable costs can only be changed in the long-term.

| Controllable Costs | Non-Controllable Costs |

| Raw materials and cost of goods sold (COGS) | Rent |

| Dues and subscriptions | Utilities |

| Office expenses | Key administrative costs |

| Supplies | |

| Labor |

Your non-controllable costs represent the bare minimum costs you need to cover in order to stay open and your controllable costs are the ones that, if necessary, you can cut down to a bare minimum.

Note that while labor is a controllable cost, there are many others that can be cut down before going for employees’ wages. In the past ten years with the rise of software-as-a-service, it might be a good time for you to review your subscriptions and see which ones you absolutely can’t live without.

3. Review alternative distribution methods

Lots of media attention has been given to the growth in delivery business since hospitality and entertainment businesses have shut down during this crisis.

If you have any product business, delivery and takeout need to be integrated into your offering immediately. Check with your delivery service provider – many of them are offering fee reduction and deferment to help their vendors out during this difficult time.

Sensational media coverage has made delivery seem like a goldmine during this crisis, but the reality for most companies is it’s just providing enough opportunity to keep your head above water.

If your business sells services, now is the time to really think through just how much of it can be operated online. Simple person-to-person meetings are the easiest to move online, but a whole range of activities can now be done online ranging from therapy, workouts, sketching, and screensharing of advanced software.

4. Contact your vendors

Often the most overlooked opportunity for no-cost cash flow to businesses is through vendors. Many times, business owners will simply ignore seemingly offerings from vendors like a week or two weeks to pay, but these credit terms can really add up.

A business with a single supplier and 3-times markup will push off over 16% of their expenses every month with just two weeks of payment terms. It might be a gut reaction to reach out and apply for business loans in a time of need, but better terms from suppliers are easier to get and are far less costly.

Also, in this time of crisis it’s important to recognize the ecosystem between you, your suppliers, and your customers. Talk to your suppliers and see how you can better convey rapidly changing customer demand to them so they can make their products more effectively and give you better pricing.

5. Partner with local organizations and businesses

Now is the time to reach out to as many contacts as you can and work together.

Other shops along your commercial corridor, other businesses in your industry, and local organizations can help your business stay afloat. They can help by:

- Enabling your business to be seen by potential customers it’s never interacted with before

- Coupling your products and services with those of other companies – creating new unique offerings, and

- Balancing your inventory load by sharing purchases and trading off unused inventory loads.

Almost all local organizations, like business improvement districts and chambers of commerce, are posting directories of businesses that are open during the crisis, and many organizations have opened up free help lines to direct business owners to resources and aid. In particular, you can turn to your Small Business Development Center (SBDC), or NYC Small Business Services.

6. Manage your credit and know where to get it

Remember that cash is the lifeblood of any business, and you need to be taking action now to ensure that your business will be able to access credit later when you need it.

Every business owner should be in touch with their lenders and creditors as soon as possible. Learn about what kind of programs they’re offering, and any changes to their fee schedules, as many banks are offering these options now.

If you own your business property, get familiar with the mortgage relief program. It’s also worthwhile to apply for a line of credit now, even if your business doesn’t need it yet, while your financial situation isn’t at rock bottom.

Remember, a phone call asking for a deferment is much less uncomfortable than defaulting and ruining your company’s credit potential in the future.

Also, know the signs of a predatory lender, and don’t fall victim to one. While some may offer cash quickly, you need to check the true APR of their loans, the term they offer for repayment, and most importantly, what your rights are to refinance or pay off that loan early. If you get a loan from a predatory lender now, it will significantly impact your cashflow and prevent you from obtaining a loan from one of the many low-interest emergency loan programs that are now available.

We’re here to help

If you need additional help or resources, be sure to visit our COVID-19 resource center. It’s updated in live time to ensure you’re equipped with everything you need to keep moving forward. And as always, reach out to us if you need help with financing. We can outline your options and direct you to the best one for your business.