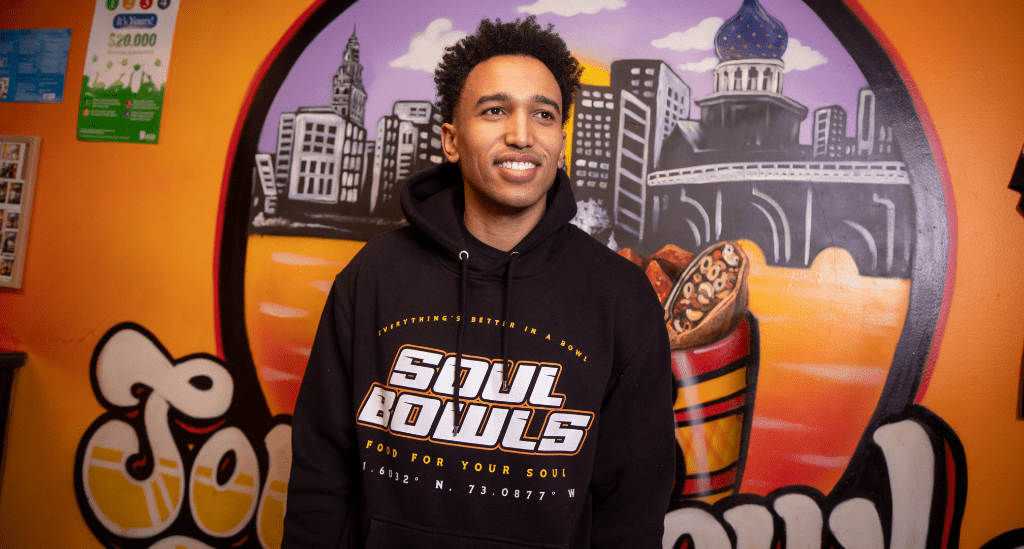

“Start small to test your business model, but don’t be afraid to dream big if that’s what you want. And know that there are funders, like Pursuit, who can help you achieve your dreams,” says entrepreneur Willie Fair. He co-owns Hartford, CT-based Soul Bowls with Malik Golden and Chef Hughann Thomas. The talented and ambitious team is on the cusp of launching their second location with Connecticut Small Business Boost Fund financing through Pursuit.

With a goal to be “the Chipotle of soul food,” here’s how they leverage their different experiences and how they knew the time was right to move from self-funding their venture to taking on a small business loan to invest in growth.

Soul Bowls brings the fast-casual model to soul food

There’s a level of fate and faith, as Willie describes it, to the synergy that brought the Soul Bowls team together with the right experiences at just the right time to launch their restaurant.

Hughann – or Chef Poppa, as he’s affectionately known – has extensive experience as a chef and caterer and takes the lead on recipes, including several that he perfected while developing the core concept of Soul Bowls.

“It’s his love of cooking and his amazing food that inspired Soul Bowls,” Willie says.

Malik brings the discipline and focus that he cultivated through years as a collegiate and pro football player – and he also had the family recipe for Soul Bowl’s secret sauce, which has become an essential factor in their success. Willie studied business at the University of Connecticut and was co-creator of The Lost Breed, a successful venture integrating workouts, athletic wear, and wellness. His experience is vital to day-to-day management and growth strategy.

When their paths crossed and brought them together as a team, they spent nearly a year planning and opened in March 2022 as a takeout-only business. From the first day, it was a resounding success.

Self-funding their startup and perfecting their model

The team self-funded the first location because, as Willie says, “We felt it was important to test our business model before we went all-in. You have to know what works, what you need to pivot or let go, and then find the right opportunities for growth.”

For the Soul Bowls team, that includes discovering a new revenue line with tremendous potential: Bottling and selling their secret sauce, which will launch soon.

Growth creates a need for financing

Willie admits that his team could have self-funded the second location, “But that meant waiting years to save what we’d need.” That strategy didn’t align with their growth goals.

In addition, “With self-funding, you’re going to run into challenges because you have to watch every dollar,” Willie says. “When we opened the first location, we had to constantly replace kitchen equipment because we went with what was already in the space or what we could afford to purchase. Eventually, it just wasn’t sufficient or cost-effective.” With the second location in the works, the team wanted new, top-of-the-line equipment.

They approached their bank for a loan but although their early success and future potential were clear, Soul Bowls was still too new to meet all the criteria for conventional loans. However, the bank recommended the Connecticut (CT) Small Business Boost Fund program – low-interest loans from $25,000 to $500,000 that support a range of financing needs.

Soon, the Soul Bowls team connected with Business Development Officer Anna Sinatro at Pursuit.

“Anna’s really responsive and knowledgeable and we’re grateful that we were connected with her and with Pursuit. They made the entire loan process much better,” Willie says. “It wasn’t easy, but we felt supported at every step. In a lot of ways, it was the most helpful process we’ve been through because we knew that Pursuit was there for us.”

Now, as they prepare to open the second location, the team is also planning future corporate and franchise opportunities. For Soul Bowls, that means an ambitious-but-achievable goal of 1,000 locations across the U.S.

Starting small with big goals for growth and help from Pursuit

Pursuit helps entrepreneurs get the funding needed to grow and thrive, with more than 15 loan options and a business line of credit for small businesses in Connecticut, New York, New Jersey and Pennsylvania. Visit our website today to explore funding options, then, contact us to learn more about how we can help you.