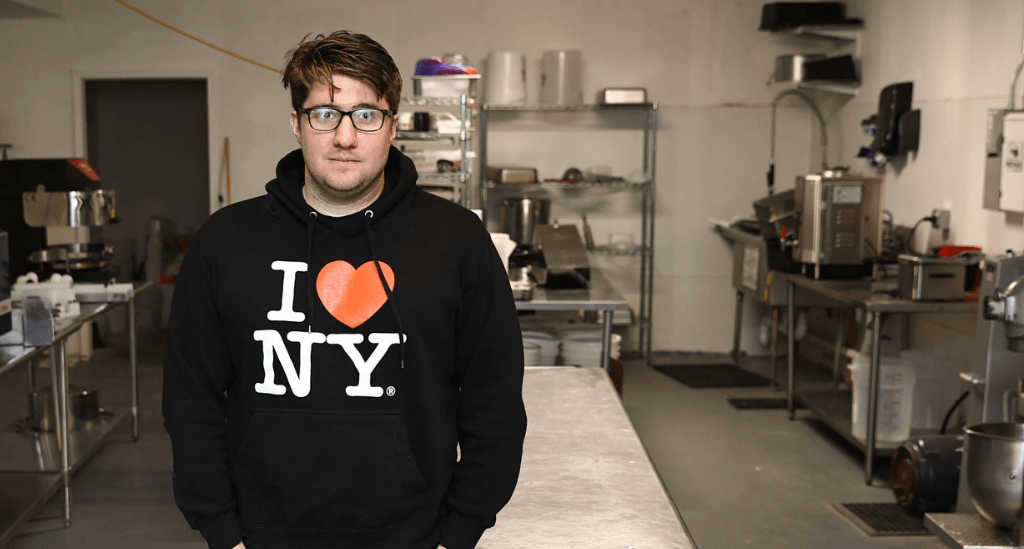

If you identify a need and fill it in a way that exceeds expectations, success will follow: That’s been integral to Ryan Feiner’s business strategy since he launched Imposter Foods – a Troy, NY-based vegan-foods producer – in late 2022. In a short time, Imposter Foods has experienced remarkable growth, including establishing distribution channels with US Foods and Performance Food Group, as well as several additional distributors.

Here’s how Ryan’s idea developed, how an SBA Microloan secured through Pursuit helped bring it to fruition, and his plan for scalable and sustainable growth.

Business strategy: Improve products within an existing niche

Ryan spent years working in natural-food co-ops and on organic farms – experiences that helped him realize the benefits of plant-based foods.

“I also became very familiar with the options that existed for vegan cheese and honestly, they left a lot to be desired. I realized that there was unlimited potential if I could come up with a better product, so I began working on recipes and production strategies,” Ryan says. He also knew that creating an efficient production line that could quickly scale up to meet large orders was essential.

He focused on creating a vegan product that would taste, feel, and melt like mozzarella. With that, he could package it as its own product and use it as the basis for a vegan version of the ever-popular mozzarella sticks. By improving on what was already available and perfecting a limited range of products, he streamlined his business model and launch, too, because the production and packaging equipment he needed already existed for dairy-based products.

Financing strategy: Find a lender that understands your vision

To bring his vision to fruition would take securing the right commercial property and equipment – and to achieve those steps, Ryan needed funding.

He had worked with Thomas Reynolds at the Capital Region Small Business Development Center (SBDC) – and it was Thomas who put Ryan in touch with Wesley Slyke at Pursuit.

“Wes and Pursuit made the loan process really easy,” Ryan says. “If something came up, they dealt with it or helped me with whatever I needed to do to keep the process moving forward.” He says it was about two weeks from the time he started the application until he had funds in hand.

“It’s great to have an SBA option that’s available to new businesses,” Ryan says about the SBA Microloan. He received his loan last summer, providing the funds he needed to lease commercial space and purchase equipment. And after reworking recipes over and over until he was satisfied that he had an outstanding product to bring to market, he was ready to launch.

Ryan tested the products with De Fazio’s, a popular wood-fired pizza restaurant in Albany and Troy.

“We did a soft launch to test products,” he explains, “and now we’re in several restaurants in the Capital Region. We also go to college campuses to give away product samples because if the students love it, then the campus food-service companies want to offer it.”

As an SBA Microloan recipient, Imposter Foods is also eligible for business-consulting services through Pursuit in areas like marketing and financial management.

“I’m working with the Pursuit team on website development now and looking forward to launching that soon,” Ryan says.

Growth strategy: Plan for growth before launching

Ryan says when he developed his business model, he intentionally created a plan that incorporated rapid scalability and growth.

“It’s easy for small business owners to underestimate how quickly products can take off and to overestimate how well we can serve clients as we grow. I wanted to avoid that scenario because large clients are key for our profitability. Thanks to the SBA Microloan, we launched with the equipment and space that we need to grow efficiently and effectively,” he says.

Pursuit can help your business secure the financing you need

“Working with Pursuit made the loan process easy, and with the financing I needed to grow, I can focus on building a strong foundation for the business,” Ryan says.

At Pursuit, we provide loans for New York State businesses, from the Capital Region to the Big Apple. With loan options from $10,000 to $5.5 million, Pursuit can help you get the funding you need to launch and grow, too. Take a look at more than 15 small business loan programs, then contact us to learn more.