As a small business owner, you might be wondering, “what is working capital?” Working capital is the lifeblood of your business. It’s what keeps your business running and enables it to take on new growth opportunities.

No matter what stage your business is in, working capital is a crucial piece of your business’s health. This is because change is the only constant in the business world. The emergence of new competitors, new trends, and new consumer tastes likely make success in your industry a moving target. Even the top brands need to be receptive to a constantly changing market.

In this in-depth guide, you’ll learn what working capital is, why it’s important, and how much you need to start or keep a business running.

What is working capital and why do I need it?

Working capital is the total amount of capital you’ve invested in running your business. This is the money your business has available to meet your short-term (and sometimes long-term) obligations, typically within the next 12 months.

Your business can have either positive or negative working capital. Having positive working capital means your business can cover its day-to-day expenses and still have funds set aside for the unexpected. On the opposite side, having negative working capital means your business may not be able to cover key expenses like inventory, payroll, suppliers, and more.

Here’s another way to think of working capital: it’s the money that’s leftover if you paid off all your current liabilities with your current assets. The basic working capital formula is:

Working Capital = Current Assets – Current Liabilities

It can also be calculated and expressed as a ratio:

Working Capital Ratio = Current Assets / Current Liabilities

To make your working capital calculation even more actionable, you can determine how much working capital you have down to the number of days. To do so, divide your working capital by your daily operating expenses.

How much working capital do I need?

While there’s no magic number for working capital, It’s ideal to have a working capital ratio between 1.5 and 2.0. Find a happy medium that works for your business. You should be able to run your business comfortably, even during an unexpected event—without having too much extra working capital.

Having too much working capital shows that your business has more money than it needs to operate. These idle funds could be used to generate more revenue for your business or other growth opportunities.

How much working capital do I need to start a business?

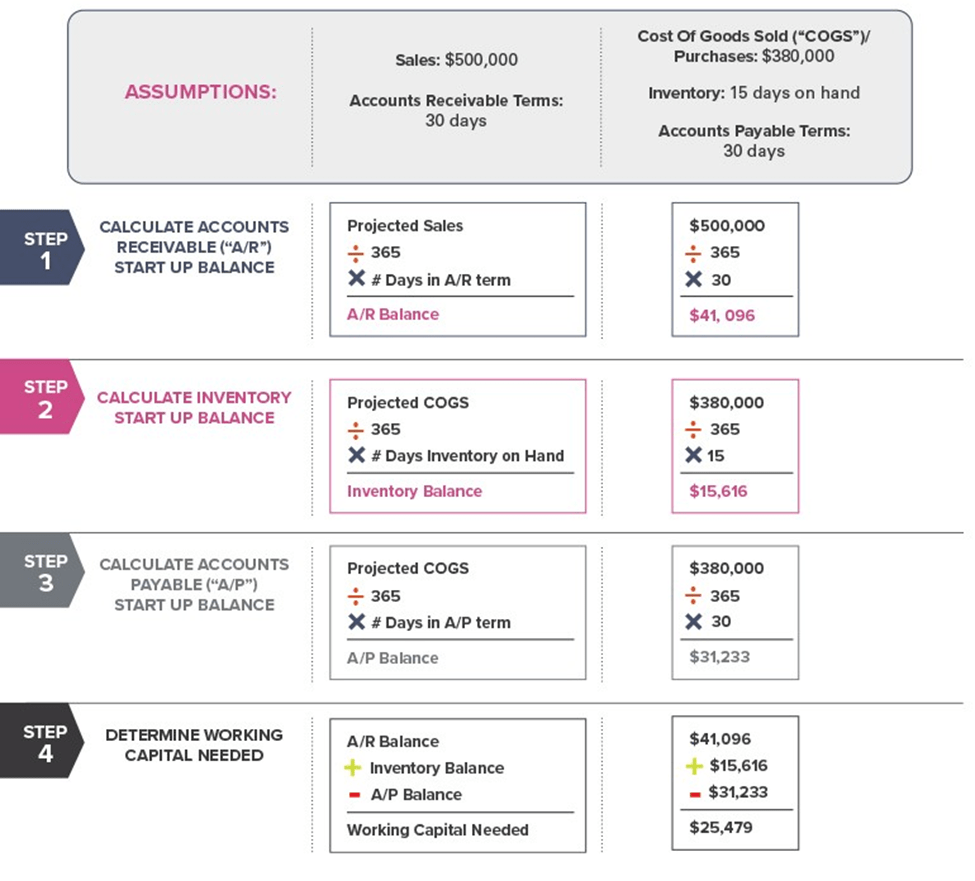

Is your business relatively new? Or are you looking to start a new business altogether? Let’s look at an example of how to calculate working capital for a new business.

From the above example, funds to cover your initial Accounts Receivable ($41,096) and inventory ($15,616) first come from Accounts Payable ($31,233). The remaining balance ($25,479) needs to be covered by working capital. To fund that amount, you can contribute your own equity, find outside sources for funding, or a combination of both.

Working capital varies by business and industry

As you probably know, working capital needs are based on how money flows through your business, which varies by industry. Some of the most common determining factors include:

Sales: Is your company profitable? If so, additional revenue will likely generate more working capital.

Length of operating cycle: How many days pass between paying suppliers and receiving cash from sales? The longer your operating cycle, the more working capital you’ll need to maintain your operations.

Inventory turnover: Faster inventory turnover means you can expect revenue to arrive reasonably quickly with each batch of inventory. This can reduce your working capital requirements, or even enable you to use your existing working capital in other areas.

Nature of your business: Some industries require more time turning raw materials into finished goods. Naturally, this will influence how you manage your debt, and how much working capital your business needs to support it.

Working capital: a potential revenue driver—and safety net

Since working capital directly affects your daily operations, it has strong implications for your business’s future. Suppose that you have low working capital, where the ratio between your assets and liabilities is less than one. If left unchecked, you can lose your ability to make longer-term investments in your business.

Are you looking to upgrade your equipment or planning to expand your operations? If you don’t have breathing room in your working capital, it’ll be very difficult to make or meet your long-term business goals. In certain situations, it may even put your business’s future at risk.

It pays to have a financial cushion for your business

Like having emergency savings for your personal finances, having sufficient working capital can be a lifeline for your business. Most of the time, your daily operations can be reasonably anticipated, but expenses can rapidly increase if an unexpected event takes place.

Imagine you run your own restaurant. During the pandemic, you’re required to immediately purchase personal protective equipment, thermometers, and make other changes to your business. Without working capital, this whirlwind of extra costs would require you to potentially take on high-cost debt to cover it.

Having ample working capital will enable you to pivot around emergency situations like this successfully. Otherwise, your only option is to sell assets or borrow to meet your inventory needs.

Common working capital mistakes

Remember, working capital needs vary by industry, business type, personal preferences, and more. However, it’s still important to avoid these common working capital pitfalls.

Too little working capital

Not having enough working capital can be a risky proposition. As we learned with the pandemic—or any unanticipated event—having enough capital to cover your day-to-day activities plus a little extra is a great foundation for your business’s future projects and goals.

Too much working capital

On the other hand, having too much working capital can also be problematic. If your working capital ratio is more than two, you have unused, excess capital. This is money that is just sitting idle and isn’t adding value to your profits, production, or generating investment returns.

Failure to think long-term

Without a reasonably solid foundation of working capital, your long-term planning ability is severely limited. A plan without working capital is just a business wish list.

Keys to consistent business growth

Now that you have an actionable understanding of the benefits of working capital, you can head into any business situation with confidence. Here are a few simple steps to keep in mind:

Take a second look at your business plan and financials

It’s a good idea to regularly take time to reassess your business plan and financials to ensure that they’re still aligned with your goals. Regular check-ins also make it easier to plan for the future.

Identify what works and what doesn’t

What is your working capital ratio? Are you comfortable with your rotation of debt payments, inventory costs, production costs, and other billables? Would adding more working capital put your mind at ease?

If you don’t believe your working capital calculations are sufficient, consider restructuring some of your debt payments, or taking on a working capital loan.

Think about your business’s future

Your goals can spearhead your best next steps. If you’re looking to expand your business, pay down your debt, or simply level-set after the pandemic, you can adjust your working capital accordingly. Working capital can have many uses, so it’s important to be very clear about how you’ll use your capital and how it will benefit your business.

Secure the working capital you need to reach your goals

As you think about your business’s future, remember that there are business loans available to meet your needs. Working capital loans are a great way to fuel your long-term growth. These loans can give you the capital needed to boost your revenue by launching a new product line or stepping up your marketing.

Many businesses have worked with Pursuit to meet their working capital needs. An affordable loan can be just what your business needs to reach the next level. Reach out to Pursuit today and see how we can help.

Key takeaways

- Working capital is the total amount of capital invested in your daily operations. It’s typically used for short-term obligations but can apply to long-term obligations as well.

- Working capital can be used to pursue new opportunities and protect your business from adverse events.

- Working capital varies depending on your business, industry, and a variety of other factors.

- A basic calculation of working capital is current assets divided by current liabilities.

- There’s no magic number for working capital, but a ratio between 1.5 and 2.0 can be a good starting point.

- A working capital loan has many uses and can be the lift your business needs.