If you’re just starting your business, you’ll need some working capital to ensure it can grow. Learn more about how to calculate your working capital needs as you get started.

What is working capital?

It’s important to understand the definition of working capital. From an accounting standpoint, working capital = current assets – current liabilities.

Current assets are short term in nature and can be converted quickly to cash, primarily accounts receivable and inventory. Current liabilities are obligations that come due within one year, primarily accounts payable and short term debt.

Working capital can be viewed as the business’ “equity” in its current assets. This assumes short term loans are only used for short term needs (financing the growth of accounts receivable and/or inventory) and long term loans are used for the financing of fixed assets.

The term “working capital” is often used incorrectly when talking about the financing needs of a business, especially for a start up business. For example, if a start up business is looking to finance typical operating expenses like an advertising budget and salaries for new employees, what it really needs is “long term capital” or equity. If a business is unable to support the expenses for advertising and salaries then most likely it is under-capitalized. If the company is projecting losses for the first year then most likely “equity” is what is needed, not “working capital.”

When is working capital financing needed?

The most common needs for true working capital occurs when a business is just starting out or for an existing business that is growing its customer base/revenues.

When starting a business, you’ll need funds to cover your inventory and accounts receivable balances until you start the collection of your receivables.

The first source of funds is your accounts payable, which represent the credit terms you have negotiated with your trade vendors for purchases. Any additional funds to cover working capital will come from outside sources. For a newly formed small business, this will most likely be in the form of start up equity from your own personal funds or from family, friends and/or other unrelated investors.

Your business may also be short on working capital if there are changes to how quickly your inventory and accounts receivables are turned into cash. For example, during a slow season, inventory and accounts receivables turn to cash at a slower rate than the cash needed to pay vendors. These are working capital needs due to timing.

How much working capital is needed to start a business?

To answer this question, you need to understand how money will flow through your business – in other words, you need to understand your “working capital cycle.” The flow or cycle consists of (1) how quickly current assets (e.g. accounts receivables & inventory) are turned into cash and (2) how quickly that cash is used to pay current liabilities (e.g. accounts payable). The working capital cycle is also referred to as the “turnover rates” for accounts receivables, inventory, and accounts payable.

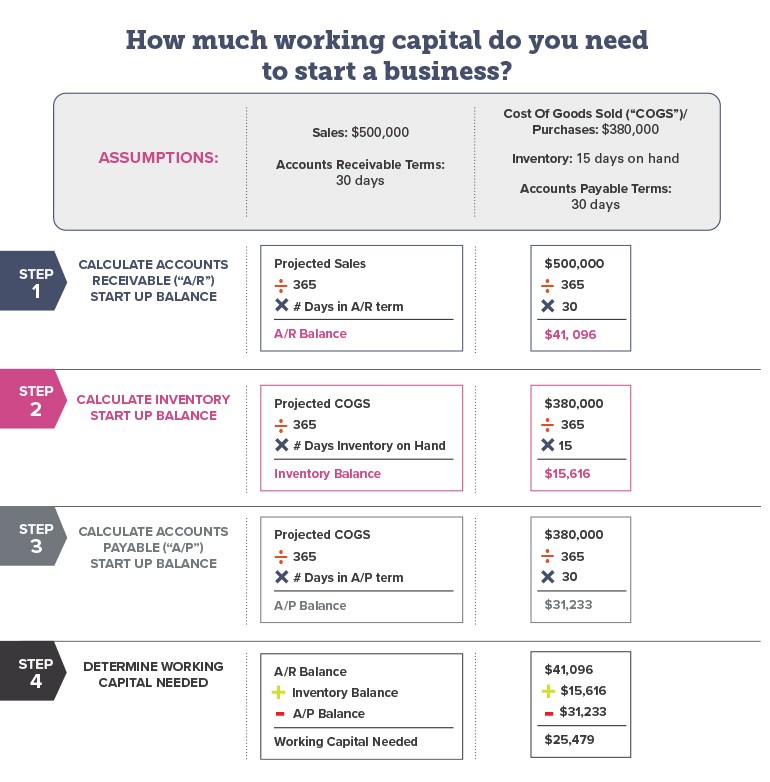

Turnover rates. When starting a business, you will have created projections for key items such as sales, cost of goods sold and other expenses. You also need assumptions on the following: How many days of inventory do you need to keep on hand (“inventory turnover”)? How many days will you give customers to pay you (accounts receivable terms)? How many days will your vendors give you to pay them (accounts payable terms)?

Armed with this information, you can calculate how much working capital is needed to start your business. See the example below.

As you can see from the above example, funds to cover your initial Accounts Receivable ($41,096) and inventory ($15,616) comes from first from Accounts Payable ($31,233). The remaining balance ($25,479) is what you need in Working Capital. To fund that amount, you must either contribute your own equity or find outside sources for funding, or a combination of both.

How to fund working capital needs

Generally speaking, startups find it difficult to obtain working capital financing from traditional banking sources. Some small business owners might be able to cover the funds needed from the equity they have raised. Others might be tempted to turn to non-bank lending sources such as factoring, merchant cash advance, and online lenders. You should know that these sources of working capital financing charge annual percentage rates (“APR”) of 50% or more! We encourage you to calculate the APR of factoring, merchant cash advance, and a typical online loan to uncover the true cost of each loan type.

For small businesses who have been in operation and generating profits, you will most likely reinvest some of the profits back into the business (“retained earnings”). You reinvest your profits into your inventory, use the profits to carry increased levels of receivables or you use the profits to pay down your trade suppliers. In essence, the retention of these profits increases the working capital that you have to continue to grow.

What are alternative sources of working capital financing?

Small business owners, including start-ups, who need to finance inventory and accounts receivables may be eligible for financing from community lenders, such as Community Development Financial Institutions (“CDFIs”). CDFIs are nonprofit, private financial institutions that provide affordable lending to small business owners who are not being served by the banking community. In addition to their own loan programs, many CDFIs also participate in U.S. Small Business Administration (SBA) loan programs. The APR on CDFI and SBA financing is significantly lower than the APR on factoring, merchant cash advance, and your typical online loan!

Conclusion

When you start a small business, you will need working capital financing to invest in inventory and accounts receivable. How much money you need for working capital can be estimated by using a formula that uses assumptions on “Turnover Rates” for inventory, accounts receivable, and accounts payable as shown in the example above. If you are a small business owner in need of working capital financing, avoid the high cost associated with financing products such as factoring, merchant cash advance, and peer-to-peer online lending by exploring alternative, lower-cost financing options available through your local CDFI. You can start by learning more about Pursuit’s SmartLoan, which offers loans up to $100,000 with affordable monthly payments.