For Danielle Sepsy and her team at The Hungry Gnome, building a successful business is about more than creating great baked goods. “It’s our goal to infuse joy into everything we do,” Danielle says. Here’s how she’s achieving current goals and planning for continued growth with an SBA 7(a) loan and a line of credit from Pursuit.

Business offers opportunities, baking creates joy

Danielle began baking when she was young, learning from her grandmother, Rosemarie.

“Later in her life, when she couldn’t bake anymore, being able to bake for her and to carry on her legacy for friends and family meant everything to me,” Danielle explains. “That’s when I really began to understand how baking creates joy.”

When the time came to decide on a path for college, Danielle’s parents supported her passion but also gave her great advice. “They suggested that if I wanted to eventually own a bakery, then I should study business first and follow up with a culinary program,” she says. “It was a really wise perspective that I appreciate now.”

She studied hospitality at Penn State University’s School of Hospitality Management and spent years as a manager in some of the world’s finest hotels and restaurants, including The Peninsula Hotel, The Plaza Hotel, and the Waldorf Astoria. While working full time, she also attended the International Culinary Center’s Professional Culinary Arts program in the evenings.

Danielle showcased her innovative-but-nostalgic recipes by starting a side business catering to Manhattan’s elite and was also baking scones, biscuits, banana bread and delivering them by foot all over the big city. Then, shortly before the pandemic, she was laid off – an event that shifted her life’s work as she took the leap to full-time baker and business owner.

Growing out of a shared kitchen

Within days of establishing her business – and through a combination of experience, ingenuity, and scrumptious samples – Danielle landed her first wholesale client.

“My first account, Joe Coffee, had about two-dozen locations then, so I pulled together a team of colleagues from my previous roles and The Hungry Gnome took off,” Danielle says.

For three years, they worked long days baking and filling orders from a shared kitchen. While it was initially a great place to launch, The Hungry Gnome quickly outgrew it – before long, the space ultimately held her business back by costing more in time, process inefficiencies, and financial expense than it was worth.

A significant project leads to an SBA 7(a) loan and a Pursuit line of credit

Danielle found the ideal building for The Hungry Gnome in Long Island City, NY, about a year before she was ready to move forward – and to her delight, it was still available when the time was right. What would become her bakery and distribution center, however, needed a significant build-out to make it perfect, a process that included securing financing.

“The business was profitable from the start, so I hadn’t looked into small business loans before,” Danielle says. “But outfitting a large-scale commercial kitchen is an enormous expense and it wouldn’t have been feasible without financing.”

She learned about Pursuit through business contacts, including her father – a real estate attorney familiar with the SBA loans that Pursuit offers. Danielle reached out and soon, Pursuit Loan Officer Luke Mancini helped her secure the financing needed for The Hungry Gnome’s new home.

“After Luke explained the different financing options, I knew that the SBA 7(a) was the right fit for renovating and outfitting the bakery,” Danielle says. The SBA 7(a) program includes loans from $50,000 to $5 million for startups and growing businesses in any qualified industry.

A complex project like setting up a large-scale commercial bakery is time-consuming as well as expensive, and Danielle says that her Pursuit team was supportive throughout the process.

“It can be overwhelming when you’re running a business, planning for a huge move, and securing financing at the same time,” she admits. “But Luke and my Pursuit team kept things moving forward and always offered help, guidance, and support when I needed it.”

The flexibility of SBA financing was key

Although she had only been in business for a couple of years, Danielle’s reputation as a baker led to tremendous opportunities, including appearing on several local and national television shows. Among them, she appeared in the HBO Max special, “The Big Brunch,” which led to exponential demand for her baked goods – she experienced a 5,000% increase in online sales after it aired. It also introduced her to industry leaders who were eager to help her succeed.

“I had the opportunity to acquire used equipment through people I’d met in the industry,” Danielle explains. “And it was essential that I could use the SBA 7(a) funds for the equipment, because the cost of new equipment at this scale would have been out of reach.”

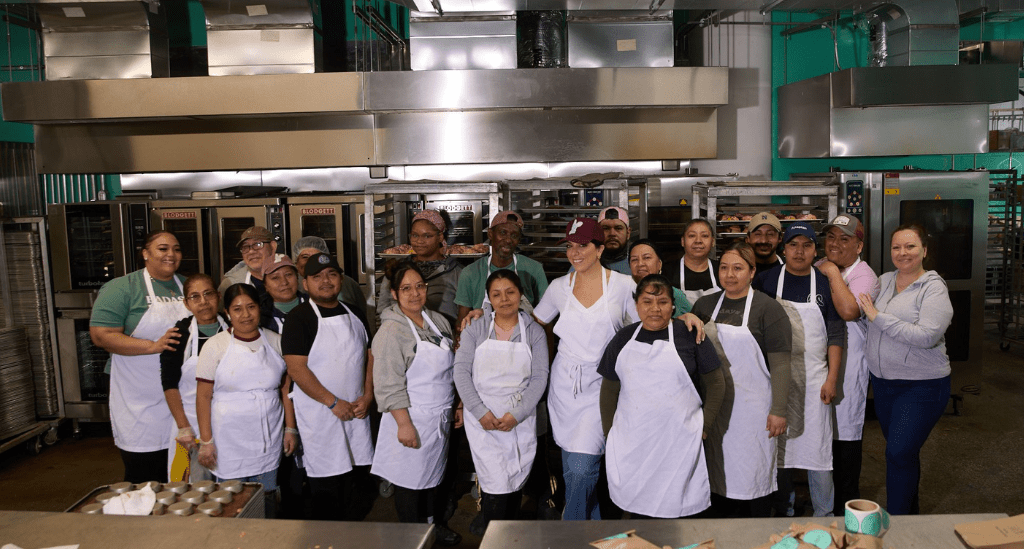

She adds, “We also secured a line of credit from Pursuit, which was great. It gives me the flexibility to leverage new opportunities when they come up, rather than having to find additional financing down the road.” With her new, 5,000-square-foot bakery up-and-running and a line of credit ready when she needs it, Danielle can focus on the next phase of growth for The Hungry Gnome and its stellar team of nearly two-dozen people.

The future looks big, bright, and delicious

“We have about 300 wholesale accounts now and the capacity for more, so I’d like to expand our geographic footprint beyond the Tri-State area,” Danielle says. “We’ve also added an online store and branded merchandise, and sales have been great. And there’s so much more that we can achieve. We have an outstanding team and now, we have the space to really thrive.”

For the success she’s created with her dynamic company, her commitment to excellence, and the joy she brings to her business and the community, Pursuit is pleased to be Danielle’s financing partner – and to nominate her for the 2024 SBA Women-Owned Small Business Person of the Year Award for the Metro New York District.

Driven by joy, with help from Pursuit

Asked to share insight with other entrepreneurs, Danielle says, “Whatever industry you’re in, I believe that when you care deeply about the products and services you offer, your team, and the customers you serve at every point in the process, you’ll create something great and success will follow.”

When you need financing to bring your dreams to their potential, Pursuit is ready to help, with loans and a line of credit available from $10,000 to $5.5 million for businesses in New York, New Jersey, Pennsylvania, Connecticut, Nevada, Illinois, and Washington.

Contact us to learn more.