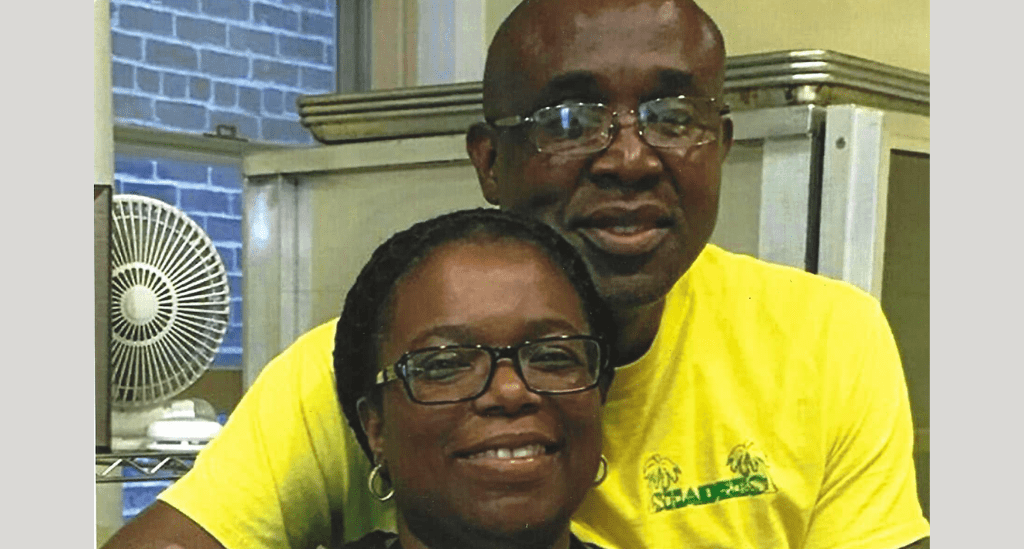

It was 1993 when Dion Mitchell-Hope and her husband and business partner, Shane Hope, first had the idea to open a Jamaican restaurant together. It would be nearly 25 years, though, before they brought their idea to fruition with SHADEES Jamaican Restaurant. Today, it’s a neighborhood favorite in Long Island’s Riverhead community.

This past summer, Dion and Shane hit another milestone when they closed on an SBA 504 loan to buy the building that SHADEES calls home. Here’s how the right timing, Shane’s authentic Jamaican cooking, and SBA funding helped them create their recipe for success.

Jamaican cooking comes to Riverhead

When Shane emigrated to the U.S. from Jamaica in 1990, he missed his island’s flavorful dishes and wanted to recreate them for his Long Island community as well as his family. But, as he and Dion realized in 1993, timing is everything for small business success.

“When we first had the idea to open a restaurant together, it didn’t take long to realize that the timing just wasn’t right yet,” Dion explains about the two-decade wait. Today, Shane shines in the kitchen, delighting faithful customers and newcomers alike with signatures dishes of oxtail stew, jerk chicken, curried goat, and curried chicken.

“The day we opened, we had a line out the door and the community has been supportive ever since, because people love Shane’s cooking,” says Dion.

Shane adds, “Many people in the community have been to Jamaica, so they were excited to have real Jamaican cooking in the neighborhood. And I love cooking for others, so the response has been exciting and appreciated.”

Dion manages the operational aspects and, as a self-described “people person,” she spends a lot of time interacting with customers, too, many of whom are frequent visitors. Family members help fill out the restaurant’s small staff.

Working together on a deal

After renting their restaurant space for a year or so, Dion and Shane realized that purchasing the building would offer multiple benefits: They’d have the assurance of a stable mortgage payment and they’d build equity that would benefit their business and help build their future financial security. Dion says that it was their landlord who introduced them to the idea of getting an SBA 504 loan through their bank and Pursuit.

“We wanted to get an SBA loan in 2018 but our business was too new, since we’d only been open for a year. Our landlord came back to us in early 2020 and encouraged us to try again, and so we did.” That’s when they met Josh Lieber, one of Pursuit’s commercial lending officers.

Partnering with a certified development corporation (CDC) – like Pursuit – on an SBA loan is a great funding solution for banks and borrowers alike. When Pursuit worked with Dime Bank to create a loan package, Dion and Shane purchased their building with a 10% down payment instead of the 30% (or more) that’s required for traditional commercial loans.

As Shane says, “With our SBA loan, we only had to put 10% down – and it’s a gift, really, when you can hold onto your cash for working capital and a cushion. It helps so much.” Their monthly mortgage payment is lower than the rent they paid, too, thanks to their loan’s fixed interest rate and longer repayment term.

About the loan process, Dion says, “Actually, it was pretty amazing! As small business owners, we’d heard that there’s a lot of paperwork, but that’s true any time you buy real estate. And our teams at Pursuit and the bank were great, too, helping us throughout the process. Even when we hit a couple of bumps, they assured us it would work out – and it did.”

Getting through the pandemic stronger and better

Before the pandemic, SHADEES was open seven days a week, for long hours each day, and the restaurant was open for about three years when just about everything closed in New York because of the pandemic.

Shane says, “From the time we opened in 2017, we were takeout only, so we were used to that and we added several delivery apps, which helped us sustain our business and grow. Now, we feel even more a part of our community because we worked through this together.”

Dion and Shane closed the restaurant for about a month, then gradually reopened, starting with three days a week and ending up at five days.

Dion admits that if there was a silver lining to the challenges of the pandemic, “It showed us that our business would be fine if we slowed down a little bit. It gives us a chance to relax and refresh – especially Shane, since he also works at a hospital full time. Having some time to unwind helps us stay motivated when we’re here.”

Looking ahead, as Dion says, “Our community has been so supportive of us and while we could go somewhere else and expand and have more customers, we’re happy here. We’d rather stay and grow in place.”

We can help you, too

Whether you’re ready now or interested in learning about your options for future funding, contact Pursuit today. We can help you get the financing you need to make your small business vision come true, too.