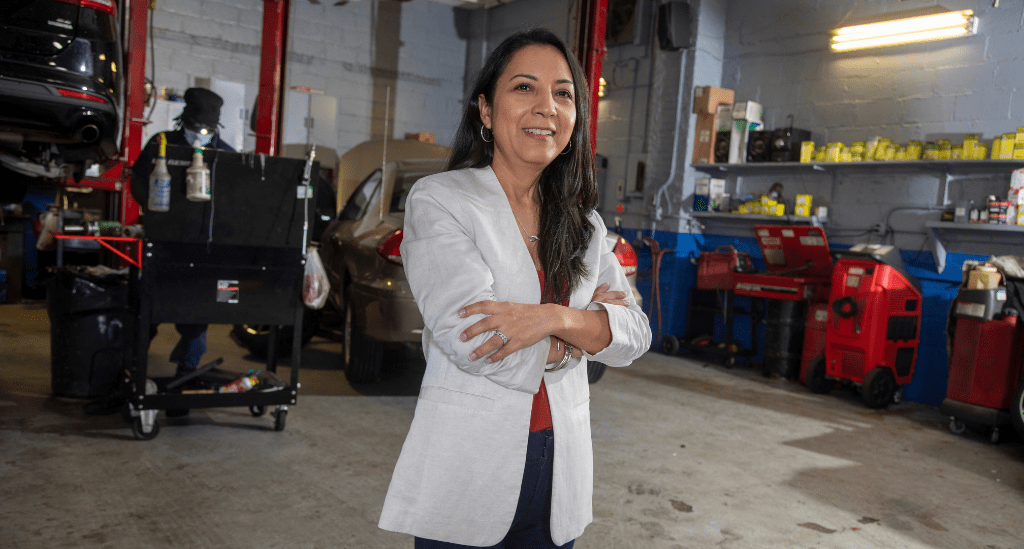

Hilda Mera, co-owner of S&A Auto Center, says, “We didn’t intend to become business owners, but when the opportunity to purchase an auto-repair shop arose, we knew it could change our lives.”

Here’s how she and her husband and co-owner, Jose Masache, acquired their first location in Newark, NJ, in 2013 and expanded to a second in Kearny, NJ, in 2022, as well as how an SBA Microloan from Pursuit has helped strengthen the business’s finances.

Business ownership means challenges and opportunities

“Jose is an auto technician and we were looking for a garage to rent so that he could work on cars for our friends and family,” Hilda explains about the first S&A Auto Center location. “It was a mess when we found it, but we bought it anyway. We made improvements and bought more equipment.”

Hilda admits that she and Jose didn’t know anything about owning a business back then, but they were confident that she could learn the management side while he grew the auto-repair operations.

“There was a lot of risk involved, especially since we had young children to support,” she says. “But it’s up to each of us to create our success. We wanted to build something for our children and to be positive role models for our community.”

An opportunity for growth leads to a need for financing

Born and raised in Ecuador, Hilda moved to the U.S. when she was 20 years old and in her experience as a minority- and woman-owned enterprise, she admits that there have been real and perceived challenges. For example, she says that until the opportunity to open a second location came around, she and Jose had self-funded the business – primarily because she didn’t think they’d meet the approval criteria for conventional financing from banks. It’s a common challenge for small businesses and one that initially came true.

“We had the chance to buy the second shop, which was a great opportunity to grow, but we couldn’t get a loan because banks have set criteria and we didn’t meet all of them,” Hilda says. “Instead, we used all of our savings and maxed out our credit cards.”

Fortunately, Rafael Mata from NJSBDC (New Jersey Small Business Development Center) referred Hilda and Jose to Pursuit.

Soon, they were in touch with Business Development Officer Orlando Callegari and together, they reviewed loan options.

“Orlando was great,” Hilda says. “With his help, we applied for an SBA Microloan and within 2-3 weeks, we had funds in the bank. We couldn’t believe it. Working with Pursuit was the easiest thing we’ve ever done for the business!” In addition to simple applications and fast decisions, SBA Microloans also offer flexible uses and competitive terms. Hilda and Jose used the funds to help offset expenses for the second shop.

Looking ahead, Hilda says, “Eventually, we’d like to franchise S&A so that other people can take what we’ve developed and enjoy business ownership, too, especially women and people from diverse backgrounds. And I’ve already talked to Orlando about franchise financing through Pursuit – it’s great to know that there are options available.”

Empowering women and diverse communities

In addition to running their growing business, Hilda, Jose, and their team of nine employees enjoy helping people in their communities. This includes hosting auto-maintenance and repair workshops, including some targeted to women and youth. They’re also learning to tailor their services to different needs and expectations.

“Our clients come primarily from the geographic areas around the shops,” Hilda says, “and they’re demographically and culturally different. We’re sensitive to that and we do our best to educate everyone about what we need to do, why we need to do it, and what they can expect.”

Engaging and educating their clients and treating all with respect has led to local and statewide recognition, as well as many outstanding testimonials. “Recommendations from happy customers tend to be our best marketing,” Hilda says.

Pursuit helps small businesses achieve their potential

Every day, Pursuit helps business owners discover how the right financing from the right lender supports success. We offer more than 15 small business loans and a line of credit for small businesses throughout New York, New Jersey, Pennsylvania, and Connecticut.

Contact us to learn more about how we can help you, too.