COVID-19 is unlike disasters that the world has faced for generations. While other disasters have caused massive devastation, they had a definite beginning and end. The damage of COVID-19 has only just begun and could have effects on the world long after infections subside. As a business owner you need to:

- Understand how much your business has been affected, and

- Understand how long your business can withstand the effects

In this article, we’ll show you how to measure the impact of a crisis on your business, and determine how to keep it moving forward.

Benchmarking your business

Every business owner needs to benchmark their performance as soon as possible. Benchmarking helps you to precisely determine how well your business was doing before the crisis, how much financial stress your business has suffered, and how much more it can withstand.

The first step in this process is to gather your data. This means making sure that your bookkeeping software is up to date, and if you don’t use bookkeeping software gather these documents:

- Bank and credit card statements.

- Point of sale (POS) system reports.

- Unpaid bills from your vendors.

- Open invoices to your customers.

- List of all your equipment, furniture, and inventory on hand.

Once you’ve pulled this information together:

- Determine your profit and loss in 2019 from the beginning of the year through today’s date last year. Since business is seasonal, the same time last year is the best picture of how your business “should have been doing” this year if there wasn’t a crisis.

- Determine your profit and loss in 2020 from the beginning of the year through today.

- Finally, remove any “one-off” items from the data, like a big one-time sale or one-time cost you incurred.

Once you have these two reports, put them side by side and calculate the percent change in every line item. It will look something like this:

| PROFIT & LOSS 1/1 – 3/24 | |||

| 2019 | % Change | 2020 | |

| Sales | $95,000 | -23% | $73,000 |

| Cost of Goods Sold | $28,000 | -2% | $27,500 |

| Gross Profit | $67,000 | -32% | $45,500 |

| Operating Expenses | |||

| Labor | $28,500 | 0% | $28,500 |

| Rent | $13,000 | 3% | $13,390 |

| Dues & Subscriptions | $2,600 | 3% | $2,678 |

| Bank Charges | $130 | 3% | $134 |

| Utilities | $3,500 | 3% | $3,605 |

| Office Expenses | $4,200 | 3% | $4,326 |

| Total Operating Expenses | $51,930 | 1% | $52,633 |

| Operating Profit | $15,070 | -147% | $(7,133) |

With this information you can now see not only the amount by which your business has been affected, but the degree. This is actionable information that you can use to cut expenses along the lines of controllable and non-controllable costs to make a budget to see how long your business can last, and to set your recovery goals.

Gather external information:

The next step in figuring out how much this crisis has affected you involves looking outside your company at your customers and your vendors.

If your business sells directly to individual customers, check the weekly jobless claims report from the US Department of Labor. Jobless claims are directly tied to all discretionary (meaning not necessary to survive) purchases. If you’re selling discretionary goods and services, you can expect your sales to drop by about the same rate as the increase in unemployment.

If your business sells to other businesses, you’ll still be affected by changes in consumer income, but the effect won’t be as immediate. This is the time to contact your clients, ask them how much they’ve seen their sales drop, and work together to help even out the rapid change in demand. This information and the financials you put together will help you build a more accurate budget to ensure that your business can last.

Build a budget:

Your budget will be the key to knowing how long you can last and, more importantly, how you’re going to be able to do it. Since this is strictly a management tool, it doesn’t need to be detailed like the projections you might make for investors or a lender.

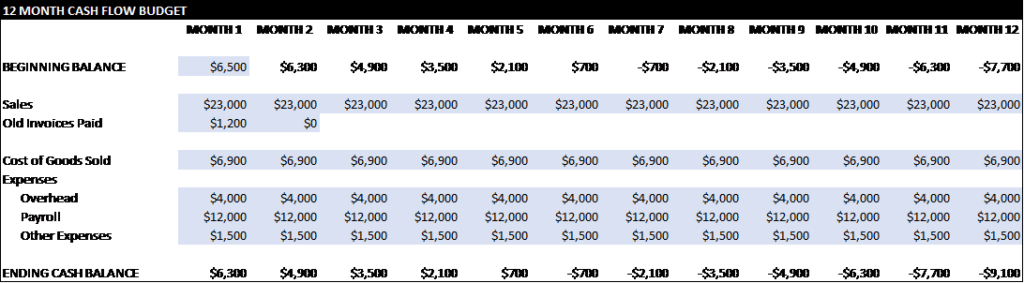

Now that you know how much you’re making and spending, and with your external data have a better idea of how much your sales will change in the near future, you can construct a 12-month cash flow budget.

This budget can help you to determine precisely how long you can last and then ways to extend the life of your business.

- Beginning Balance: enter how much cash your business has now, in all accounts.

- Sales: enter an estimate of your monthly sales that takes into account how your business is doing now and how much more you expect it to decline. For simplicity, just assume this will be your sales volume for the next twelve months.

- Old Invoices Paid: enter any payments you expect in the next two months from your customers that owe you money.

- Cost of Goods Sold: Enter your monthly cost of goods. For simplicity, estimate it as a percent of your sales.

- Expenses: enter your overhead (things like rent, utilities, and general administration costs), payroll, and any other regularly-occurring costs.

Once you’ve filled in all the blue spaces in the template, review the ending cash balance line. This tells you what you estimate your cash resources will be at the end of each month. The month that this number dips into negative territory is your projection of when your cash resources will run out.

Having this information can help you plan ahead – if you need to apply for government programs and other type of relief, try to set aside a few months leading up to this date to complete your application and get funded before you run out.

With this budget completed, you can also use it do what-if analysis. Try taking a look at the budget after cutting some of your controllable costs and see how much longer your cash will last.

Contact us for support

You’ll find up-to-date resources and information on what’s available in our COVID-19 Resource Center. If you need additional assistance, contact us. Together, we can work through the challenges of this crisis and keep moving forward.