In 1928, Martin Rosol launched his New Britain, CT-based business in a converted garage with eight employees and recipes he perfected before emigrating to the U.S. from Poland. Today, four generations and nearly a century later, Martin Rosol’s Inc. continues to grow, adding new markets, improving an onsite retail store, and adding an online shop, too.

Here’s how Martin’s great-grandson, Teddy Rosol, and his family secured financing through the Connecticut Small Business Boost Fund and Pursuit, preparing the family business for another century of success.

A proud family legacy built on Martin’s original recipes

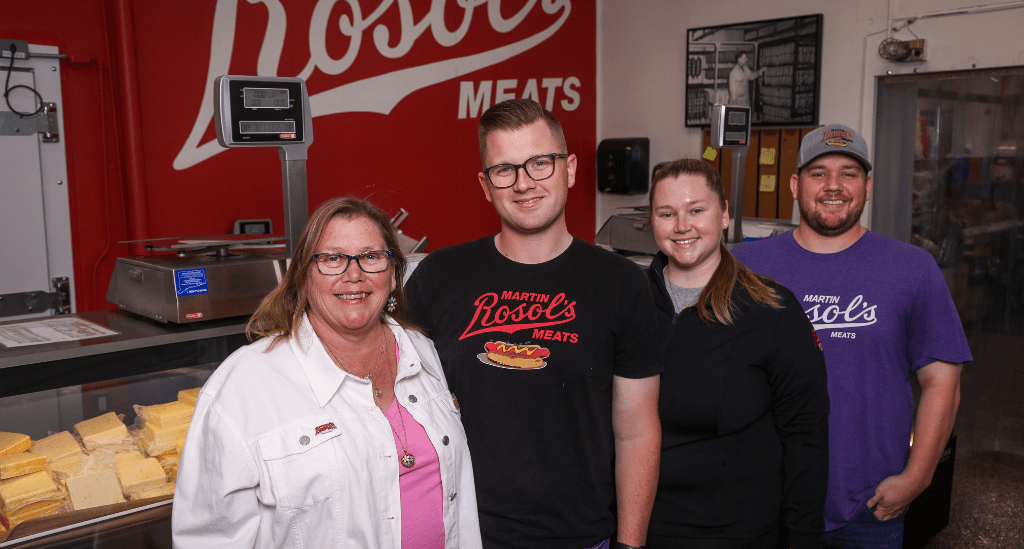

“Our most popular products are our original hot dogs, sausages, and kielbasas,” says Teddy, the business’s general manager. Along with Sarah Rosol – Teddy’s mother and the company’s president – and Teddy’s brother Tim and sister Shawna, the Rosol family legacy is thriving.

With 25 employees and time-tested recipes, the team produces, sells, and distributes their products throughout Connecticut and beyond – initially, to mom-and-pop groceries, hot-dog stands, and delis and, today, to larger grocers, too.

“We’re growing in our home base of Fairfield County and have added customers in Massachusetts, too,” Teddy explains. “We also added ecommerce to the mix and that’s been a great tool to build our brand and national reach.”

Equipment and facility improvements increase production and enable growth

Teddy explains that while the facility is part of the company’s legacy, working with an outdated layout and older production equipment meant that the business wasn’t achieving its full potential.

“Our building was built in 1937 and we love our location and the fact that, for almost 90 years, we’ve accomplished so much in this space,” Teddy says. “But we knew improvements were needed to enable us to do more.”

The leadership team began exploring financing options to purchase new equipment and rework production to improve efficiency and output. Rather than go straight to a bank, though, they approached business-development experts from the State of Connecticut.

“During those initial conversations, the business-development team recommended the Connecticut Small Business Boost Fund and Pursuit,” Teddy says. As strong as the recommendations were, the leadership team at Martin Rosol’s did their due-diligence, exploring other potential loan options and lenders.

“It became clear pretty quickly that the loan terms through the Connecticut Boost Fund and Pursuit were better than any others we’d found,” Teddy says.

Small business financing from CT Boost and Pursuit support major improvements

Teddy explains that the financing process was smooth because the application was straightforward and their Pursuit team, led by Business Development Officer Anthony Booth, was great to work with, providing assistance whenever Teddy and his team needed it.

“The whole process was actually easier than I thought it would be,” Teddy admits. “Both the loans and working with Pursuit were perfect matches for our project. We got all of the financing we needed to purchase state-of-the-art equipment and upgrade the facility.”

They used the financing to renovate packing coolers and to purchase a packaging machine, as well as for a construction project that included updating the roof, replacing refrigerator units with more efficient appliances, and removing walls to increase production space.

“Streamlining our processes has been a huge improvement. Before the renovations, we’d make our products in one area and have to move them to another area for packaging, for example. Now, the order of operations makes so much more sense. It’s better, quicker, and easier for everyone,” Teddy explains.

Improvements help reinvigorate the business

“Clearly, this business is important to our family, but we’ve also got employees who have been with us for decades and this project reinvigorated and reenergized our whole team. We’ve also hired more people for sales and production, due to the increased volume of work. It’s been great for everyone,” Teddy says.

With the renovations to the onsite store, the team held a “Grand Re-Opening” celebration in November and Teddy says that the Easter season – always one of the busiest times of the year – set a new sales record. Their online business has also grown tremendously, too.

“We’re really proud of our legacy and now this feels like a whole new chapter,” Teddy says. “The renovations and new equipment are helping us grow today and we can envision an even stronger future with continued expansion.”

Pursuit has financing options to help small businesses grow

Asked for advice he’d give to other small business owners, Teddy says, “Don’t be afraid to have those initial conversations about what you need for your business. All we did was reach out to start the conversation and from there, everything fell into place. There are great financing options and lenders, like Pursuit, who want to help. And when we’re ready to grow again, we’ll definitely reach out to Pursuit – the financing terms were great for our business, but it was really our Pursuit team that made the experience excellent, from start to finish.”

Whether you’re looking for financing to help you launch or want to grow your business and secure your legacy, Pursuit can help. We offer 15 loan options and a business line of credit for small businesses in Connecticut, New York, New Jersey, and Pennsylvania.

Explore our financing options today, then contact us to learn more about how we can help.