If you’re considering launching or growing your business and haven’t created a sound business plan, then this guide can help! You’ll learn the concept of the lean business plan: a simpler, more flexible approach to business planning that makes it easier to develop and use a business plan for many kinds of startup and early-stage businesses.

What is a lean business plan?

With a traditional business plan, a business owner creates a comprehensive plan that looks at important factors, from the mission, vision, and goals to the management team, comprehensive financial projections, marketing and sales plans, and more.

A lean business plan contains these components, but it’s simpler, actionable, and user-friendly while still including key information about the business and its path to success.

Should your business use a lean business plan?

All businesses need a plan – without one, it’s hard to focus your resources and make wise short- and long-term decisions. However, not every business needs all the elements of a traditional business plan.

For many startups, early-stage businesses, and specific niches, a lean business plan can give you essential information as a simple roadmap in a fraction of the time it takes to create a traditional plan. For example, if you were a solo website designer, you could benefit from a lean plan because many elements in a traditional plan aren’t relevant or essential for the business to launch.

Businesses that are complex from the start, such as full-scale restaurants or small manufacturers, usually benefit from the traditional model. This model ensures that you thoroughly consider all aspects of your business’s revenue, expenses, competition, market analysis, needs, and potential profitability before launching – all of which are essential for success and presentation to potential lenders and investors.

What is the business model canvas?

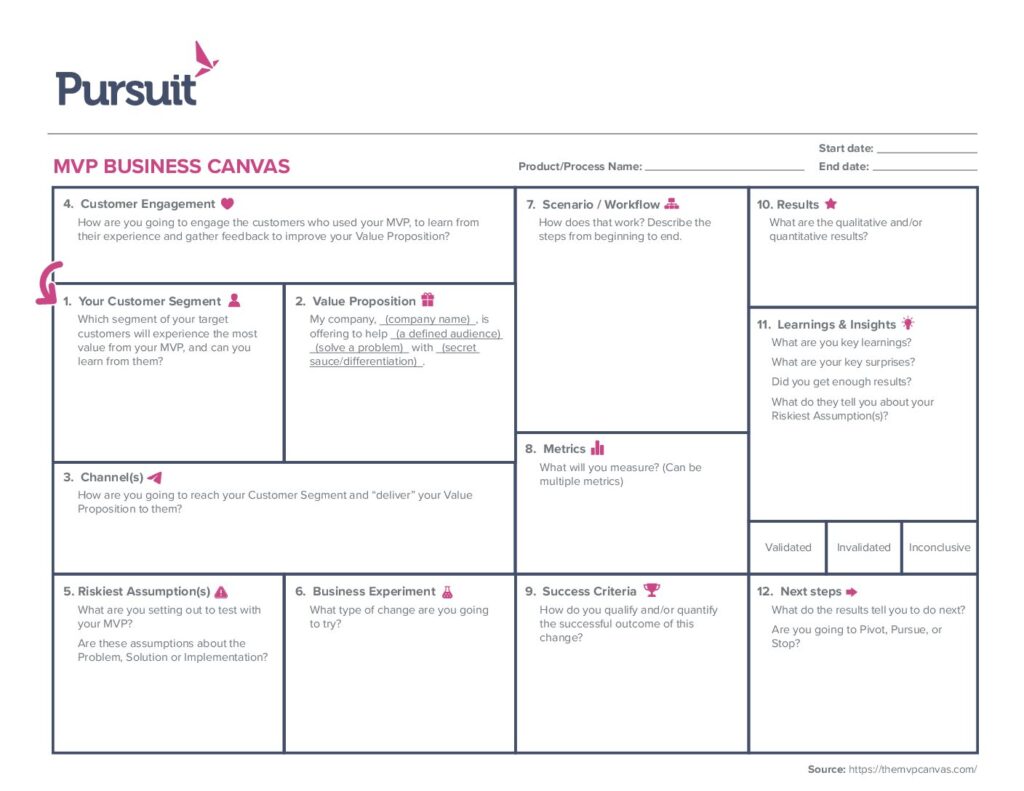

In addition to traditional and lean plans, you may have heard about another tool, the business model canvas. This single-page visual breakdown can help you map out time-bound action steps and assessment metrics for marketing, sales, operations, and more. By completing the steps in order, you will create a step-by-step road plan to implement and test your profitability and effectiveness. Here is a business model canvas you can follow:

What’s the difference between a lean business model, a traditional model, and the business model canvas?

Here are the key aspects of the three models:

- Lean: This model uses a streamlined document, usually about 3-5 pages, but could be just a single page that’s relatively quick to create. It’s primarily for internal use to guide early-stage operations and prioritize resources. It’s focused on essential elements like vision, goals, target demographics, short-term financials, and key metrics that can be updated as you launch and learn more about your business.

A key benefit is its flexibility. It’s designed to be revisited and updated regularly based on business performance and market feedback. - Traditional: This model has a more formal document, often 20-40+ pages, with detailed sections including an executive summary, product or service overviews, competitive analysis, sales plans, market research, an operation plan, financial forecasts, management, ownership, and staffing background and plans.

The format works well for presentation to external audiences like investors, banks, or other lenders because it provides in-depth details to demonstrate viability over the long term. However, it can be time-consuming and overwhelming for small businesses, especially when some elements may be irrelevant in the startup phase. - Canvas: A single-page visual tool with value propositions, customer segments, channels, and revenue streams. This helps with brainstorming and visualizing your business at a high level to map out ideas, test assumptions, or identify risks, but it typically lacks actionable steps.

The differences between these tools also demonstrate how each can play a role in the life of your business:

- A lean business plan lets you organize operations and resources to launch, with enough insight to focus your time and work while providing flexibility to learn about operations, target markets, revenue streams, and more.

- After several years in business, a traditional business plan’s comprehensive format can analyze considerations that weren’t essential in the early stages but are key as you prepare for growth and increased financing.

- A business model canvas can help you and your team better understand and strategize potential opportunities and challenges throughout the life of your business.

In the end, the best business model is the one that makes you understand your business more thoroughly, provides a roadmap for your time and resources, and allows you to focus on goals.

How to create your lean business plan

While a lean business plan will look a bit different for every business, you can use templates and this guide to identify the most relevant aspects of your business.

1. Outline your business vision and goals

Start with a brief mission or vision statement – why you’re starting your business. Explain what you’ll bring to the market, how it’s different or better than what’s available, and how you plan to make money from your idea.

2. Create 2-3 SMART goals

Creating specific, measurable, achievable, relevant, and time-bound (SMART) goals helps you focus on how you’ll spend your time and resources, which is especially critical in the early stages.

3. Define your target audience and approach

Use customer personas or short bullet points to describe your ideal customer. Then, plan how you’ll engage with them and how your product or service can solve their needs.

4. Identify key activities, resources, and partners

Here, highlight what you’ll need to achieve your goals, such as inventory, technology, staff, or key partnerships.

5. Create simple financial projections

Focus on break-even points, top-line revenue goals, and basic cost analysis to create simple income-and-expense projections.

6. Review and update regularly

A business plan is only as good as the time you spend using, reviewing, and updating it. For the first six months of operations, review your plan weekly or bi-weekly to ensure you’re on track with goals and benchmarks, add new opportunities as you identify them, or re-evaluate offerings that aren’t performing as anticipated.

Tips for completing your lean business plan

Just as a lean business plan is designed to be easy to create, it’s also intended to be simple to implement:

- Keep it actionable: If your plan doesn’t drive decision-making or daily activities, revisit and refine it.

- Leverage technology: While you may not need technology to track performance in the lean plan phase, tools like LivePlan, Bizplan, and templates in Google Docs and from the Small Business Administration (SBA) can help.

- Include your team: If you have employees, ensure everyone understands the plan’s key points and how their roles support it.

- Adapt to market feedback: Treat your lean plan as a living document and update it based on sales data, customer feedback, and market trends.

- Seek the right advisors: You can gain key insight from the right advisors, such as SCORE volunteers, SBDC centers, or potential lenders.

As you develop and implement your lean business plan, you may find that you need additional information to communicate and use it confidently – and that’s fine! It’s common for business plans to fall somewhere between the lean and traditional models. The most important aspect of your business plan is that it’s useful and relevant to you.

Pursuit can support your lean business plan goals

Pursuit can help you launch, achieve your goals, and grow your business. We’re a leading small business lender serving businesses across New York, New Jersey, Pennsylvania, Connecticut, Nevada, Illinois, and Washington. We have loans and a line of credit for working capital, commercial real estate, equipment, and much more.

We’ve helped thousands of small business owners get the funding they need and continued support through business advisory services to achieve their dreams and we can help you, too.

Contact us today to learn more.