When you want a business loan, you’re likely researching the current interest rates offered and how they’ll impact your loan repayment. Once you’ve been approved, your loan is funded, and you enter the repayment period, the interest rate goes into effect, but you may still be left asking, “How does interest work on a business loan?”

In this overview, you’ll learn everything you need to know about how your interest rate affects your business loan, including what your interest rate options are and how the interest changes as you pay down your loan.

What is interest?

In simple terms, interest is the cost of borrowing money. Interest is a part of short-term loans like credit cards and lines of credit, as well as longer-term loans like for purchasing commercial real estate. You could also be collecting interest on your savings and investment accounts.

The interest collected over the life of your loan, along with any fees you pay, helps lenders cover the costs of providing loans. In the case of for-profit lenders, such as banks, interest also serves as a source of profit from the money they lend.

Interest rates vary from loan to loan and are determined by many different factors. Your lender will consider your credit score, your industry, and more when determining your interest rate. It’s a good idea to compare loans based on the annual percentage rate (APR). This calculation considers the interest rate, loan amount, term, repayment, fees, and more to give you a more comprehensive comparison between loan products.

What’s the difference between a fixed interest rate and a variable interest rate?

Loans can either have fixed or variable interest rates that will impact your cost of borrowing over time.

Fixed interest rates

If you have a fixed-rate loan, the interest rate stays the same throughout the life of the loan, regardless of how interest rates change outside of the loan. This can be beneficial when the rates are lower because you’ll lock in your loan at a lower rate until the loan is paid in full.

If you are looking for a more predictable option, a fixed-rate loan can give you just that. Your interest rate won’t change during the life of your loan and your monthly payment amount will be the same each month.

Variable interest rates

With variable-rate loans, the interest rate can change throughout the life of the loan, including changes due to economic conditions. Variable rates have a rate interval set by your lender to determine when your interest rate is recalculated, such as monthly, quarterly, or annually.

In either case, if interest rates fall you can always try to refinance your debt into a lower-cost loan.

How does interest work on a loan?

While lenders can set different terms for every loan, most loans have similar repayment structures. If you have a monthly payment, then the interest on your loan builds up over the number of business days in a month. Since some months have more business days than others, your interest amount will vary a bit from month to month.

Let’s look at this example:

- You have a loan for $200,000, and the current balance is $150,000. The amount of interest charged for this month is calculated on the outstanding balance of $150,000 over the number of business days in the month, and not on the original loan amount of $200,000.

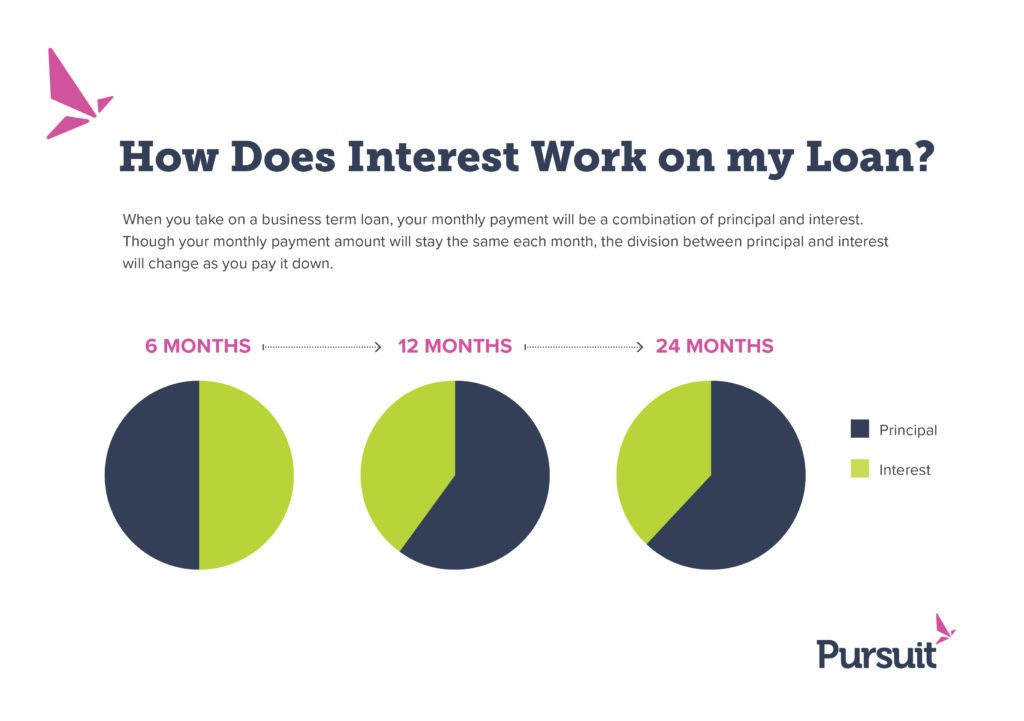

As you review your monthly statements, you’ll notice a change in the division between principal and interest. Over time, even though your monthly payment amount stays the same, you’ll see that the outstanding balance and the interest portion of your monthly payment will decrease. This is because, with every payment you make, more of it will go toward paying the original amount, and the interest owed will be a little less each month.

For some loans, you can make extra payments in between your scheduled payments that goes straight toward your principal. With that, you’ll see your interest decrease even more over time as there’s less principal left to calculate the interest.

How often will you pay your loan?

It depends! Your loan-repayment schedule is set up by your lender. For most loans, payments are usually due once a month.

There are some lenders with more aggressive repayment requirements who take automatic payments weekly and even daily. Often, these are considered predatory lenders because the repayment terms are extremely hard for small business owners to manage.

How often do you pay interest?

Unfortunately, interest isn’t a one-time fee. It’s something that you’ll pay as long as there’s an outstanding balance on your loan. Each payment you make goes toward your interest and the principal, which is the original amount of the loan.

Still, many lenders do have one-time fees that are paid when you apply for a loan, when you close, or both. Some of the fees can be financed into your loan, so you’ll pay them off over time. Your lender should outline these fees for you upfront, but don’t be afraid to ask about the fees if you need more information.

You can use an amortization schedule to see each of your monthly loan payments and breaks down how much will go toward interest and how much will go toward your principal.

Pursuit doesn’t provide amortization schedules, which are charts that show how much will go toward interest and how much will go toward your principal. The schedule may not exactly match the interest that actually collected because the number of business days in each month varies. Given this, you may not know the exact amount of interest you paid in a month until after the payment is made and you review the next month’s statement.

What’s an interest-only period and how does it work?

A loan can include an interest-only period to give you a financial cushion to support your business during a start-up period, seasonal change, or construction and renovation phase. During this transitional period, rather than making full principal and interest payments, you’ll make interest-only payments, and the interest paid each month is only on the amounts already distributed. After the pre-determined interest-only period ends, you’ll begin to make full principal and interest payments.

Do you have the right interest rate?

The easiest way to determine if your loan is a good fit for your business is to talk to your loan officer. They can review your loan and learn about your financial goals for your business. They can take a look at your financials to see if there’s a better loan option to refinance your current loan, or if there’s another option to give you a boost.

Staying in touch with your lender keeps them updated on your goals and progress, and keeps you updated on any new products or services that can benefit your business.

How can you reduce your interest payments?

There are two ways to reduce the interest that you pay each month:

- You can refinance your current loan with a lower interest rate loan. Make sure that you don’t have to pay prepayment penalties on the original loan because the penalties may offset the benefits of refinancing.

Some lenders will let you refinance a current Small Business Administration (SBA) loan with new SBA loan. Your lender may give you this option if the interest rate is lower and will help free up your working capital to continue building your business.

- If you make additional payments to the principal, you’ll reduce the interest that builds up each month. That’s because the amount of interest is based on the amount of your outstanding principal. Even a one-time extra payment toward the principal will give you a lasting reduction in the interest you pay from that point on.

Pursuit can help

When you need financing, you want to work with a lender that’s dedicated to your success. That’s Pursuit! We offer more than 15 small business loan programs, insightful resources, and business advisory services to support businesses across New York, New Jersey, Pennsylvania, Connecticut, Nevada, Illinois, and Washington.

We’ve helped thousands of small business owners get the funding and support they need to achieve their goals and dreams, and we can help you, too.

Contact us today to learn more about how we can help.