Providing CFO Services that Help Small Businesses Grow: Franco Blueprint

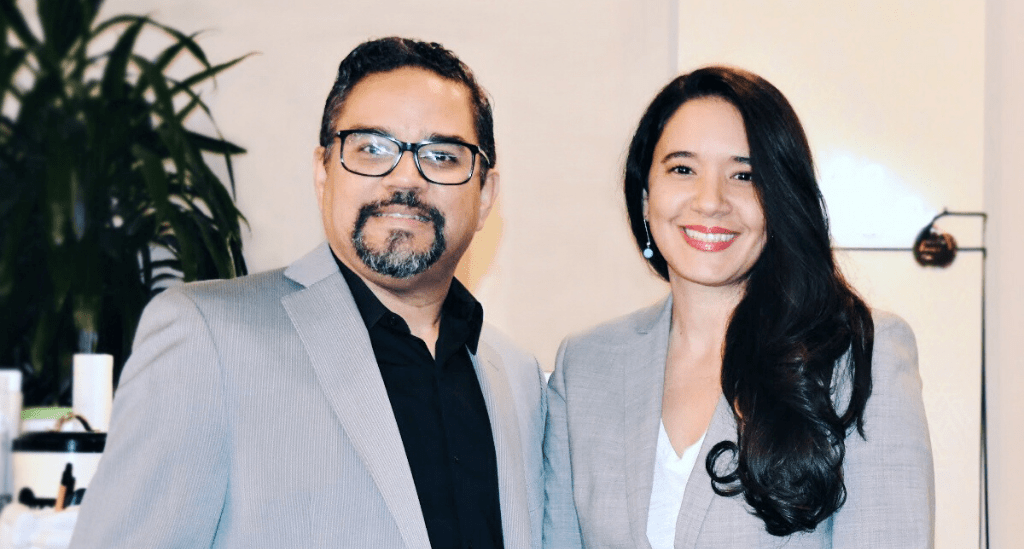

Most small businesses don’t have chief financial officers, or CFOs, on staff and as a result, they often struggle with financial management and growth strategies. Oneida Franco and Rick Diaz, cofounders and owners of Franco Blueprint, developed their niche business to fill that void.

“For businesses that are large enough to need a CFO but who don’t have the financial expertise on hand, we provide an invaluable service. We cover it all, from tax management through long-term growth.”

Through their trademarked approach, Blueprint4Success, Franco Blueprint clients receive the full spectrum of financial services, from diagnosing and resolving accounting and bookkeeping challenges to ensuring that proper controls are in place and that actionable financial strategies are developed that power growth.

Decades of experience and a passion for financial strategy

Oneida and Rick worked in financial services for a combined tenure of five decades before leveraging their identified niche into Franco Blueprint: Accounting, financial consulting, bookkeeping and strategic-growth services for small businesses. Their target clients are businesses that have annual revenues in the range from about $1.5 million to $60 million and in fields that include technology, fashion, law and real estate.

As an expert in construction and real estate development accounting, Rick also provides his services to general contractors and real estate developers across the nation, including major real estate developers with more than $2 billion in projects.

Financial experts fund their business dreams with Pursuit

After a period of rapid growth in late 2017, Oneida and Rick applied for a loan through their commercial bank, to help finance the needs of their growing business. However, even established industry experts with outstanding business plans and financials often fall just short of the traditional lending criteria that banks use to make commercial loans.

Although their bank wasn’t able to finance Franco Blueprint, fortunately, their banker directed them to Pursuit.

They connected with Pursuit Vice President, Paola Garcia. After a quick application and approval process, Franco Blueprint received a $50,000 loan. Oneida and Rick also turned to Pursuit’s consulting services to help them with hiring and other human-resource-related issues, building brand visibility and honing their social media presence to stay front-of-mind for current and potential clients.

With this additional funding, they also expanded their marketing budget, rebranded their business and optimized their website and offerings and set a goal of tripling their clientele within the first full year.

Additional plans included a move to a larger office in Manhattan, as well as to add digital offerings that could potentially scale the business further. They also considered adding employees to help their core business continue to grow. (The Franco Blueprint team outsources non-core business functions, so that their focus is always on their areas of expertise and stellar service to their clients.)

The pandemic puts growth on hold, but loans help their business stay strong

When the pandemic forced business closures, even Franco Blueprint was impacted.

Rick says, “We’re fortunate in that even before the pandemic, we predominantly operated in the cloud, so in that sense, we didn’t have to reduce or change the services that our clients receive.”

“Still,” Oneida adds, “We lost one large client, an events company, who was our largest client and whose operations shut down essentially overnight. Other than that, though, we’ve been able to hold on. We haven’t grown during the pandemic, but we’re doing all right, pretty much status quo.”

They acknowledge that securing funding both before the health crisis hit and taking advantage of pandemic-related business assistance has made these last several months much easier to get through.

“The Pursuit loan gave us a financial foundation that helped. We also secured a Paycheck Protection Program, or PPP, loan,” says Oneida, “and the Economic Injury Disaster Loan. And because we’ve continued our operations, we’ve been available to help our clients get loans, too.”

They also credit their Pursuit team for keeping them informed about opportunities and online events that can help them stay focused and strong.

Asked if they have insight for other business owners who are considering loans, Rick advises that they put together a really good business plan. Also, he says, “Get your finances in order before you apply. A lot of businesses call on us to correct their books when it’s too late.”

Oneida agrees, saying, “Business owners must understand that their financials tell a story – and when you need loans to strengthen and grow your business, that story’s important. Make it easier for potential lenders, like Pursuit, to understand your business and help your loan get approved.”

Franco Blueprint looks forward to growing again

“In spite of everything,” Rick says, “we feel fortunate to be in the position that we’re in, where we’ll come through this from a position of relative strength.”

Oneida adds, “We don’t know what will happen to the client we lost yet, but we hope to help them regain their momentum. And as soon as we move through this, we’ll find ways to help other businesses get the financial management, insight and strategy they need to reposition and grow again, too.”