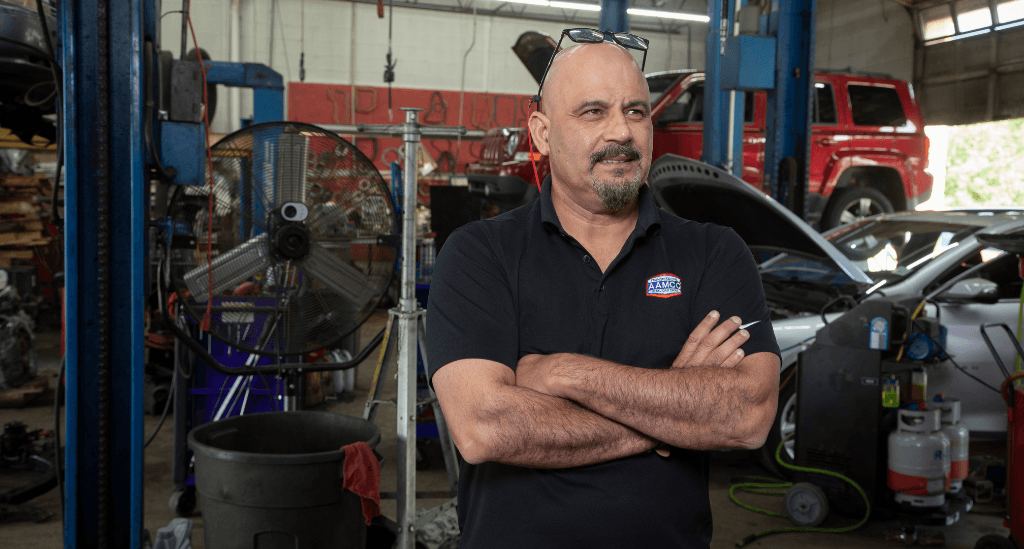

“While planning our move from Australia to the United States in 2017, I made another life-changing decision – instead of getting a job here, I’d find a way to buy and grow a business,” explains Kamran Durrani. Since then, he’s acquired AAMCO Transmissions franchises in New Jersey and Pennsylvania. Here’s how he made his dream come true with support from two Pursuit SmartLoans.

Acquiring an established business and brand

Kamran has over 25 years of managerial experience, team leadership, account management, business development and operations management, including high-level strategy development. He was also responsible for maintaining strong relationships with existing customers and developing new contacts and relationships – all experiences that he wanted to leverage when searching for a franchise to acquire.

“Acquiring a franchise meant that I could buy an established brand, rather than spending years trying to build one, so that was how I focused my research,” Kamran says. The AAMCO Transmissions brand – an auto-repair business focused on transmission-repair services with a 60+year history – offered everything Kamran wanted. As he searched for an established franchise to acquire, it would already have a location, equipment, and employees.

“I found the AAMCO in Delran, New Jersey, and knew it would be a great fit,” Kamran says. “It was an excellent location with an experienced team and I also saw potential for growth.” By June 2017, the AAMCO Delran, NJ, became Kamran’s first AAMCO shop. At that time, it had two technicians and a part-time manager. Today, it has nine employees, offers additional value-added services, and has increased annual revenue from $500,000 to $1.9 million.

Finding the right financing opportunity with Pursuit

By 2020, with an excellent team running the day-to-day operations in Delran, Kamran was ready for another challenge. He began his search for a second AAMCO location and found one about 30 minutes away in Prospect Park Township, Pennsylvania. To finance the acquisition, Kamran shopped around to explore options.

“Before I found Pursuit, the financing options I came across included high interest rates with short repayment terms, just 9-18 months. That makes it really hard to establish a business and repay a loan,” Kamran explains.

He found Pursuit through a Google search and contacted Senior Business Development Officer Orlando Callegari.

“I got in touch with Orlando and from that point on, the whole process was quick and easy. We reviewed the available loans and decided that the SmartLoan was a great option for my business. Within about a week, I had funds in the bank.”

He received a $75,000 Pursuit SmartLoan, which enabled him to acquire the franchise, with monthly payments that were lower than other options he explored – saving him thousands of dollars every month to reinvest in his growing businesses. It also gave him some working capital to cover the slowdown in business that resulted from the COVID-19 pandemic, which took hold just as Kamran was acquiring his second transmission shop.

Soon, both AAMCO shops were busy again and he increased his team at the Prospect Park location from two employees to five and revenue steadily increased to $1.3 million today.

A second Pursuit SmartLoan helps to build profitable add-on services

Kamran wanted to add integrated services and at the Delran location, this meant a tire shop.

“The cost to add a tire business is high because the equipment and inventory are expensive,” Kamran explains, “but I knew it would be a worthwhile investment from both a service perspective and in terms of profitability.” Additional financing would be needed, so he reached out to Orlando and Pursuit again and was quickly approved for another Pursuit SmartLoan. He received the funds in November 2022.

He says, “Again, the whole process only took about a week and thanks to the additional services we offer, we’ve already added two more employees.”

Ready for additional growth and more financing from Pursuit

Kamran’s adding services at the Prospect Park AAMCO location, too, and is exploring the acquisition of a third transmission shop. He says, “My Pursuit team helped me get the financing I needed to acquire my businesses, expand my services, and grow my teams in both locations. I’ve already been in touch with Orlando about my next loan!” He’s exploring financing options that include SBA 7(a) and SBA 504 loans.

Pursuit has more than 15 loan options for small businesses in NJ, NY, PA and CT

Kamran says, “Going into business is inherently risky, but you have to embrace the challenges, and a big part of that is finding the right financing. I did a lot of comparison shopping early on to find the best loan terms, and Pursuit has them. Everything about working with Pursuit has been a great experience.”

Take a look at our small business loan options, from $10,000 to more than $5.5 million. They’re available for most industries and include many uses, too. Then, contact us today to see how we can help you grow your business, too.