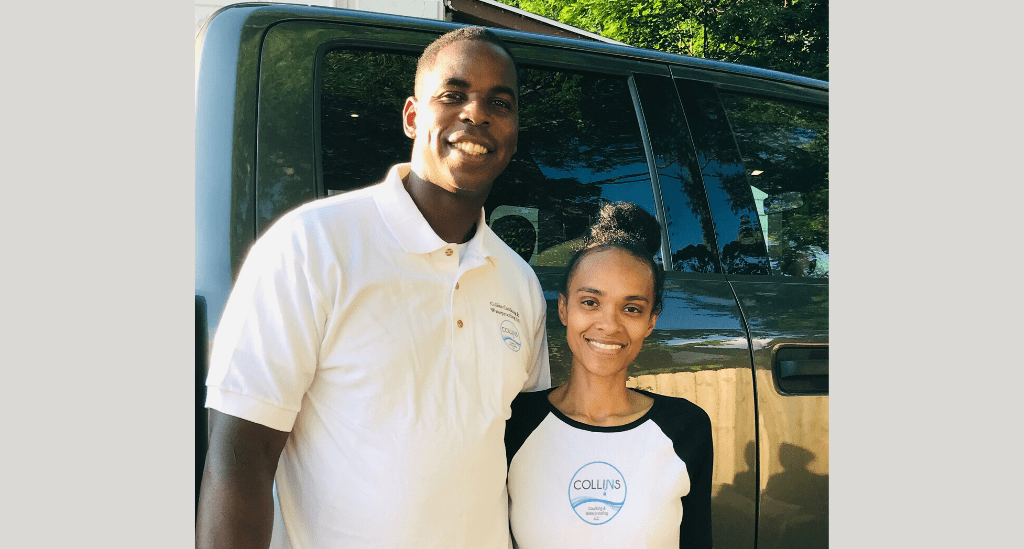

Running a business takes enormous commitment and compromise, especially when you undertake the venture with your spouse. Add raising a family of seven children to the mix and you’re talking about a level of energy, passion and time-management that few couples can even imagine, let alone make their reality. Collins Caulking & Waterproofing proves that it can be done – and that it can be done well, on time, on budget and with professionalism and a smile, always.

Ernest and Shannon Collins established their business four years ago but, as Ernest says, “We really only started to gain traction in the last two years. Our goals for the business include growing it into an enterprise that can provide our family with a comfortable income, as well as to do the same for several of the laborers that work on our team.”

Both Ernest and Shannon had several years of relevant experience behind them: Ernest has more than 20 years in waterproofing, caulking and masonry construction and repair, and Shannon is an experienced business manager. Their company is based in Endicott, NY and provides services in the Southern Tier for residential and commercial clients.

As a New York State-certified minority-business enterprise (MBE), Collins Caulking & Waterproofing is also well-positioned for growth with commercial and government contracts.

Getting funds to grow into a reliable partner

Despite their experience, Shannon and Ernest have encountered many of the challenges that are typical for new and early-stage businesses, including not having sufficient working capital on hand to leverage opportunities and grow their business.

“In our line of work, if you don’t have money on hand, then you can only get small jobs with little profitability,” Ernest explains. “And we couldn’t go after larger jobs if we weren’t certain that we could complete the work. We needed a loan to help us get better equipment and, because commercial construction jobs typically have a 60-day payment period, we needed to have sufficient cash flow available to cover labor costs.”

They learned about Pursuit through their representative, Teri Nelson, at the State Employees Federal Credit Union (SEFCU), who recommended Pursuit as a lender.

“We applied for a loan through Pursuit and it was approved last fall,” says Ernest. “It was such a huge help and we’ve made great advances toward our goals. For example, one goal was to get a truck large enough to haul small excavating equipment. We also got a laser and tamp for sidewalk projects and many hand tools for forming and carpentry projects. These all help us expand what we can offer and through that, we can grow.”

Leveraging new partnerships through the pandemic

As the Covid-19 health crisis took hold throughout the northeastern U.S., Shannon and Ernest strengthened the business’s finances with an SBA Paycheck Protection Program (PPP) loan through their bank, KeyBank.

Collins Caulking & Waterproofing also received a microloan from Pursuit in May of this year, which was particularly helpful during the pandemic because it helped them expand their offerings at a time when other competitors might have scaled back operations.

“Although we had to close for a short time, we reopened in April. And, unlike many businesses, we actually had the opportunity to grow our operations even more during the pandemic, including adding services like commercial roofing,” Ernest explains.

To meet growth opportunities as well as have some additional financial stability, they decided to seek additional funding.

“We applied to our commercial bank and to SEFCU and although they were really supportive of our business goals, we didn’t meet their small business credit criteria and they couldn’t approve loans for us. So, we went back to Pursuit and they came through again,” says Ernest.

He continues, saying, “Our team at Pursuit is perfect for us. Very professional and very personable, too. This was the first time that people really listened to our story and understood that we were in a unique place but needed extra funding to stabilize our business.”

Ernest even describes the application and approval processes as “phenomenal!”

The tools to grow even further

In addition to turning to Pursuit for loans, Shannon and Ernest accepted additional assistance that Pursuit offers.

“We used Pursuit’s financial-management services,” Ernest says. “Our Pursuit contact, Wesley Slyke, was great. Like our whole Pursuit team, he was professional and approachable. He understood our business and saw what we needed to do to continue to expand. He connected us with a bookkeeper and got us started with QuickBooks, which has already helped us immensely.”

Ernest has this insight to offer other business owners, particularly if you need funding to help stabilize and grow your business, as they did. “Pursuit made it possible for us to perform projects that have a greater profit. They’re great to work with, too, and will help you gain the edge you need to grow your business. For us, it meant that we gained exposure to reputable construction and contracting companies and had the funds to perform projects, pay for labor and wait for payment, all of which made us a more professional and viable company.”