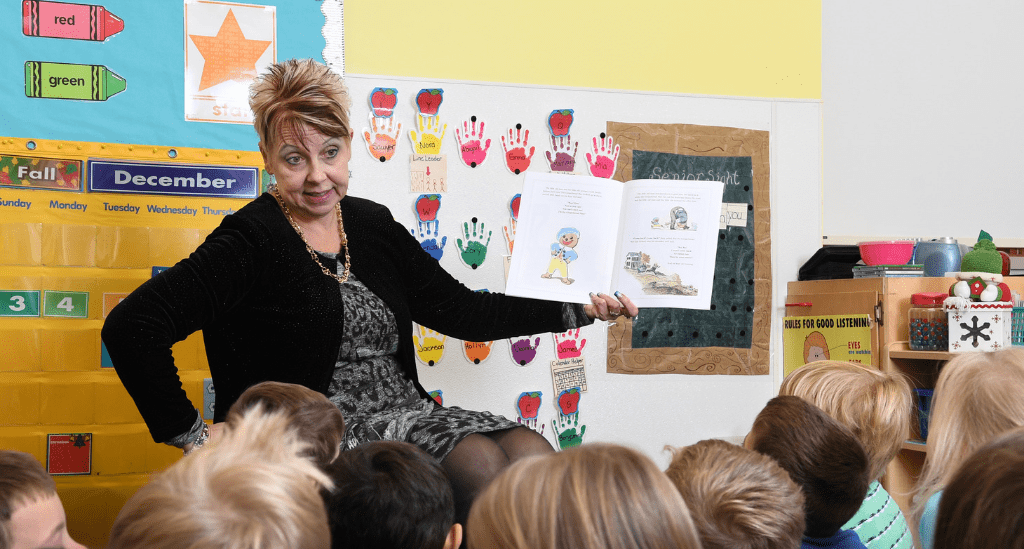

Acquiring an existing company is a great way to become a small business owner, and that’s just what Darlene Bartlett did in 2001, when her mentor and employer of more than five years offered to sell, Children’s Kastle, a child daycare and preschool, in Lancaster, NY, to her. Darlene assumed ownership of the business right away, but negotiated a lease-to-own agreement for the building and land with the original owner.

Darlene worked diligently to grow the business, ultimately opening a second location to offer services to school-aged children. When the time was right to acquire the building, she approached her long-time bank, KeyBank, to fund the real estate acquisition and a number of renovations, including the creation of a new classroom and upgrades to lighting, office space and the staff area. KeyBank was eager to provide a large portion of the loan but preferred to partner with another lender to finance the full project. So, Darlene’s banker pulled in Pursuit.

“One thing I learned is to let funders help you with the challenges,” explains Darlene. Together, KeyBank and Pursuit approved Children’s Kastle for $828,000, including a Capital Access loan for $368,000, enabling Darlene to close on and update the property.

“Sometimes the [loan] process is a little overwhelming,” she continues, “but ultimately, we were funded with terrific rates and terms, which allows us to offer so much more to our parents and children.”

Whether your small business is just getting off the ground, coming through the pandemic, or ready to expand, we have loan options that can help you, too. Contact us today and learn more.