Navigating the Paycheck Protection Program (PPP) can feel overwhelming at times. If you’ve taken a PPP loan through Pursuit, we’re making the process easier by frequently sending out tips and updates by email. You can find these tips here–be sure to check back as we roll out more information. Also be sure to check out our loan forgiveness guide and PPP FAQs for additional information!

Tip 1: The latest on the PPP forgiveness application

Our PPP forgiveness tip earlier this month focused on when to apply for PPP forgiveness and which application to use. As borrowers, we encouraged you to remain patient in applying for PPP forgiveness. This week, our advice remains the same.

We know you’re eager to know for sure that your loan will be forgiven, but there’s good reason to practice patience. We’ve been closely monitoring recent PPP developments. We are very optimistic that the forgiveness process will be made even easier for borrowers—particularly those with smaller PPP loans—within the next couple of weeks.

So, rather than have you complete a more complicated forgiveness application in the short-term, we’re waiting until a final decision has been made on the loan forgiveness process before we begin working with you on forgiveness. This is in line with our goal of helping you obtain maximum forgiveness with the minimum amount of stress on your time and energy.

You may have read that the SBA will begin accepting forgiveness applications from lenders on August 10th. We won’t start accepting forgiveness applications on August 10th for the reasons above.

We know that it hasn’t been easy to navigate the forgiveness process and that information changes rapidly. However, know that all of the changes that have been made by Congress to the program have been meant to make the process easier for you to have your loan forgiven. And remember, that no matter what your PPP loan documents say or when your loan was approved, no payments will be due until after loan forgiveness has been determined.

We will keep you closely posted on the forgiveness rules as they continue to evolve. Please be on the lookout for email updates from us on this topic!

Tip 2: When to apply for PPP forgiveness and which application to use

The most frequent question we receive from PPP borrowers is “when can I submit my loan forgiveness application?” The truthful answer is that, at this time, we don’t have enough information to provide an answer! All PPP lenders, including Pursuit, are awaiting clear information from SBA on how to accept and submit the forgiveness application (to date, SBA has only provided the application forms).

Find out which forgiveness application you’ll use

While it’s not yet possible to apply for forgiveness, you can determine which forgiveness application form you’ll use when the time comes—the SBA 3508EZ (short application) or the SBA 3508 (full application). Reviewing the instructions on the application in advance will increase your knowledge on how forgiveness will be calculated.

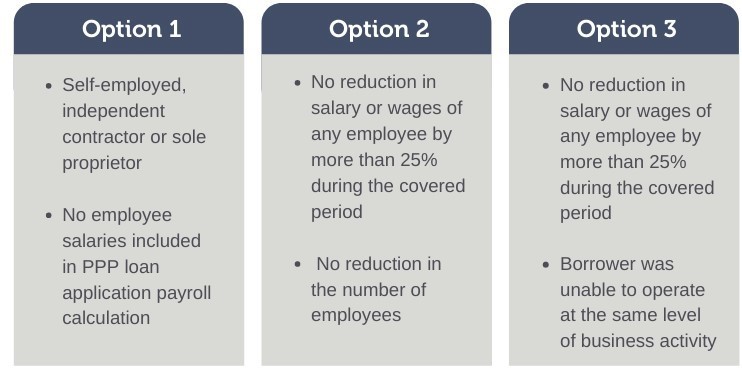

Determining which form you’ll use is simple. If any of the three options below describe your business, you qualify to use SBA form 3508EZ (these options are a summary of the checklist located on the EZ instructions, which you will want to review in full).

We expect that most of our borrowers will qualify for the EZ form. That’s good news, as this form will be significantly easier to fill out and will save you time and energy in documenting your forgiveness.

Once you’ve determined which form you’ll use, access it and its instructions here: