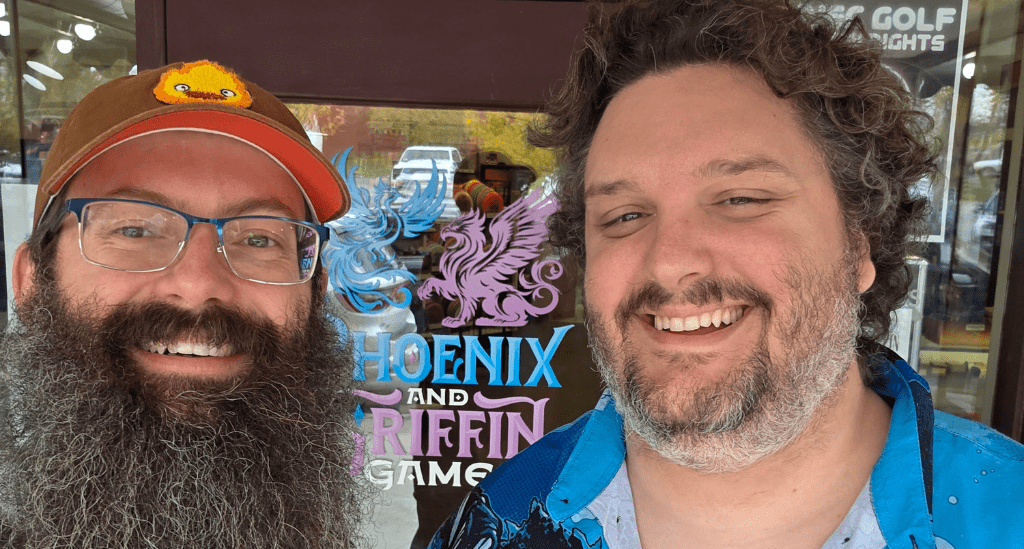

“As avid gamers ourselves, we know how important this business is to our community, both in a business sense and also for the hobbyists and gamers here. We wanted to preserve and build on its potential,” explains Corey Pentoney, co-owner of PG Games LLC, which does business as Phoenix & Griffin Games in Watertown, NY.

Here’s how financing from the Main Street Capital Loan Fund and an SBA Microloan helped Corey and his business partner, Anthony Gebolys, buy an existing business, rebrand it, and build it into something lasting for generations of hobbyists and gamers.

Turning their passion into entrepreneurship

Phoenix & Griffin specializes in trading-card games, or TCGs, including Magic: The Gathering, Pokémon, Yu-Gi-Oh, Flesh & Blood, and Bandai and popular items like Dungeons & Dragons (D&D), Warhammer models and supplies, game accessories, and board games. They also provide space for gamers to play and host multiple events and tournaments every week.

Corey says, “This shop had been in business for years and if the previous owner couldn’t find a buyer and closed instead, it would have left a deep hole for local enthusiasts, like us. There’s a loyal following who come to purchase game- and hobby-related items and gather for hours to hang out with like-minded people who enjoy the competition and camaraderie here.”

When they learned about the owner’s goal of selling the shop, which is housed in the historic Marcy Building in Watertown, Corey and Anthony – who also had an online-only business at the time – jumped at the opportunity.

Their local SBDC helps them plan and prepare for financing

Corey and Anthony met with the North Central Small Business Development Center (SBDC) to create a business plan and financial projections. Initially, they also had conversations with local banks about their plan to acquire and improve the business.

Anthony says, “Although it was an established business and we both had experience within the industry, the terms banks offered were less-than-ideal.” That’s often the case, because even with an established business, new ownership can signal greater risk for banks, which have less flexibility when it comes to lending to small businesses.

Instead, the SBDC recommended that they reach out to Pursuit.

Two loans provide financing with beneficial terms

“We needed financing to purchase inventory from the previous owner, as well as to buy new inventory, update the space, and bring in more furnishings,” Corey explains. “We also wanted to have cash in-hand to complete rebranding and for staff.” Along with three employees, Anthony works full-time at the shop and Corey maintains a part-time role.

They worked with Pursuit AVP and Senior Business Development Officer Keri Pratico on financing to achieve their goals.

After reviewing different loan options, Keri suggested two: The Main Street Capital Loan Fund and an SBA Microloan. The Main Street Capital Loan Fund is a $10-million fund in partnership with Empire State Development that provides loans up to $100,000 for small businesses throughout New York State, including acquisitions, existing businesses, and startups. Borrowers benefit from lower monthly payments, including interest-only payments for the first 12 months.

The SBA Microloan offers loans of $10,000 to $50,000 for a range of uses, including working capital to help businesses start and stay strong.

“The work we did with the SBDC really helped us prepare for the loan process and with the help of Keri and Pursuit, it was pretty seamless overall,” Corey says. “They made sure we got through all the details successfully and within about three months, we had funds in hand.”

Everyone in their area who likes games, hobbies, and gaming fall into their target market – whether that’s board games, video games, card games, or anything else. Friends bring friends, too, so word-of-mouth growth is strong.

“In our industry, there’s no age or ability limit, anyone can learn and join in at any time, and you can play onsite or anywhere,” Anthony says.

Corey adds, “Folks who like to play board and card games are a growing market, too. We reach them through Facebook and Instragram now, as well as local partnerships and outreach to the SUNY Jefferson campus and Fort Drum military base, which are nearby.”

If you want to launch or acquire a business in your community, Pursuit can help

“Building the business is important from a financial standpoint, of course,” Corey says, “but it’s also really important to us that this shop continued because it holds such an important place in our community. I’m not sure we’d be here, though, if we hadn’t worked with our SBDC and Pursuit. Both were key to making this work.”

Whether your goal is to launch a new business or purchase an existing business, Pursuit can help. As a leading small business lender serving businesses across New York, New Jersey, Pennsylvania, Connecticut, and Illinois, we offer loans and a line of credit for working capital, commercial real estate, equipment, and much more. We’ve helped thousands of small business owners get the funding they need to achieve their goals, and we can help you, too.