Illinois Small Business Loans

For nearly 70 years Pursuit has empowered small businesses through affordable financing and resources. As we enter Illinois, we’re working hard to ensure all entrepreneurs have a path to success.

Your New Go-To Resource for Small Business Financing in Illinois

Pursuit is excited to now offer Illinois small businesses flexible, affordable, innovative financing solutions and resources. When you work with us, you’re tapping into seven decades of small business lending expertise and a team of dedicated employees who want to see you succeed.

With 1.2 million small businesses throughout Illinois, it’s no wonder why so many entrepreneurs are calling the Prairie State home. You’ve got access to major cities like Chicago with easy access to anywhere in the midwest, plus a large, skilled workforce that’s ready to grow the economy. We can’t wait to work with you to achieve your small business dreams!

Pursuit is approved to offer SBA loan products in Illinois under SBA’s Preferred Lenders Program & SBA Express Program.

Empowering Businesses in Illinois

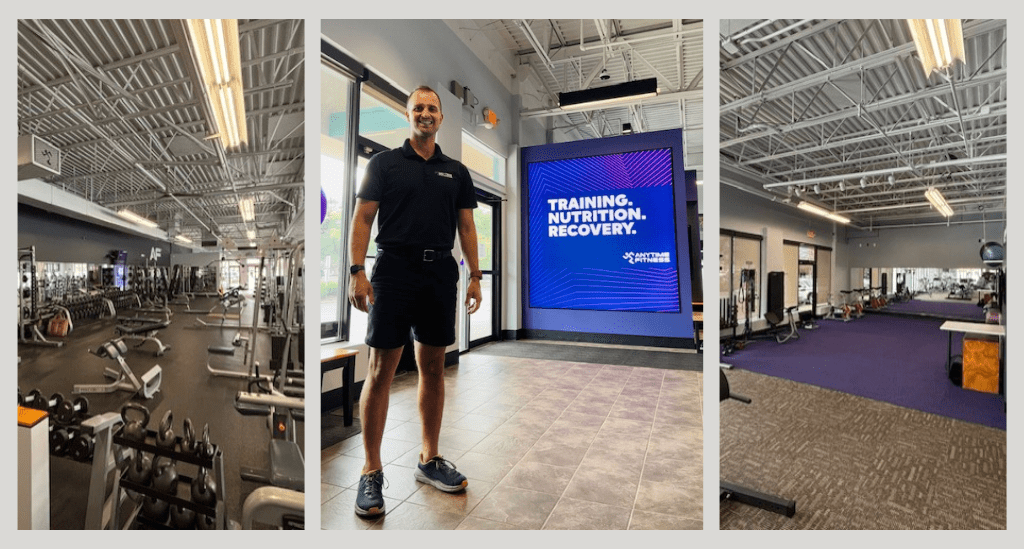

- "It’s really amazing how committed Pursuit is to business owners and our success."

- "My Pursuit team was so helpful. Anytime I needed help, they were ready."

- "Since I was new to small business loans, the process felt complex, but Anthony and Pursuit helped me through."

Business Loan Programs in Illinois

Frequently Asked Questions

There’s a wide variety of business loans available in Illinois from banks and alternative lenders like Pursuit. You can start by speaking with your business bank to find out what they offer and if you qualify. If you need more flexible terms and requirements, you can talk with Pursuit to learn more about your options. We offer SBA 7(a) loans as well as financing through Advantage Illinois and the Entrepreneurs of Color Fund.

Interest rates vary by program. For the SBA 7(a) loan program, the rate is calculated using the Prime Rate. Our community lending programs have interest rates between 7 – 11.9% depending on the program that best fits your needs. Talk to us today to learn more!

Yes! The Advantage Illinois program gives Illinois businesses access to low-rate term loan financing to grow, expand, and create new jobs in the state. The Entrepreneurs of Color Fund has been supporting business owners in Chicago since 2018 with a special focus on the West Side, Austin, and South Shore neighborhoods. Reach out to your business bank, Small Business Development Center (SBDC), or chamber of commerce for more information on programs specifically for Illinois businesses.